Siemens Energy – Earnings Release Q2 FY 2025

Munich, Germany, May 8, 2025 – Siemens Energy today announced its results for the second quarter of fiscal year 2025 that ended March 31,

Outlook raised after strong first half year results, especially in the second quarter – focus on profitable growth

“The rising demand for electricity led to an exceptionally strong quarter and first half of the fiscal year for our business. The improved outlook reflects our confidence in the ongoing market opportunities and our excellent project execution. Even in light of the uncertain macroeconomic factors, our focus remains on profitable growth”, says Christian Bruch, President and CEO of Siemens Energy AG.

- After the strong start to the fiscal year, Siemens Energy’s positive development continued in the recent quarter. Favorable market trends have led to a broad-based increase in demand for our products. In addition, Siemens Energy demonstrated strong project execution and operational performance in the quarter, to which all segments contributed. Overall, Siemens Energy achieved one of the strongest quarters ever.

- Siemens Energy’s orders amounted to €14.4bn. This was 52.3% higher than in the prior-year quarter on a comparable basis (excluding currency translation and portfolio effects). In addition to sharp growth at Grid Technologies, the upturn was primarily due to Gas Services, which recorded the highest orders in a quarter to date. Book-to-bill ratio (ratio of orders to revenue) was again strong with 1.45, leading to a new record level of €133bn in the order backlog.

- Revenue increased double-digit in all segments. Overall, revenue grew by 20.7% on a comparable basis to €10.0bn.

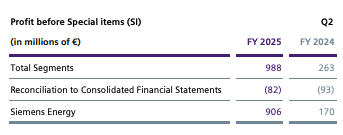

- Siemens Energy’s Profit before Special items amounted to €906m, reflecting a margin of 9.1%. All segments contributed to the increase year-over-year (Q2 FY 2024: €170m). Special items were negative €291m (Q2 FY 2024: positive €331m) primarily relating to the sale of the Indian wind business. Siemens Energy’s Profit came in at €615m (Q2 FY 2024: €501m).

- Net income was €501m (Q2 FY 2024: €108m). The corresponding basic earnings per share amounted to €0.50 (Q2 FY 2024: €0.08).

- Free cash flow pre tax amounted to €1,390m, sharply increased compared to the prior-year’s figure (Q2 FY 2024: €483m). Almost all segments contributed to this improvement. In addition to the profit development, this was primarily due to customer payments including reservation fees.

- Due to the positive business development, Siemens Energy updates the outlook for fiscal year 2025. Siemens Energy now expects for the Group to achieve comparable revenue growth in fiscal year 2025 in a range of 13% to 15% and a Profit margin before Special items between 4% and 6%. Siemens Energy expects a Net income of up to €1bn excluding assumed positive Special items subsequent to the demerger of the energy business from Siemens Limited, India. The outlook for Free cash flow pre tax for the fiscal year 2025 is updated to around €4bn.

- In April 2025, the government of the USA, among others, announced tariffs on imports from various countries. Siemens Energy is closely monitoring developments and continuously analysing their potential impact on its net assets, financial position and results of operations. For the second half of the fiscal year 2025, a limited direct impact on Siemens Energy’s Profit of up to a high double-digit million € amount, after mitigation measures, is currently expected.

Siemens Energy

- Orders increased by more than half compared to prior-year quarter, due to the considerable growth at Gas Services and Grid Technologies. The improvement was primarily due to the new units business and supported by a substantial rise in the service business. On a geographic basis, growth was broad-based. All reporting regions recorded sharp increases.

- Book-to-bill ratio was 1.45. Order backlog once again exceeded the previous record level and increased to €133bn.

- Revenue rose significantly while new units and service business share overall remained unchanged.

- Profit before Special items and the corresponding margin were up, with all segments improving sharply. This was due to the increased volume and corresponding degression effects as well as processing of orders with higher margins. In addition, Grid Technologies benefited from positive timing effects of around €100m.

- Special items in both fiscal years primarily related to disposals.

- Development of Free cash flow pre tax was driven by improvements in all segments, except for Transformation of Industry, where Free cash flow pre tax was nearly unchanged. In addition to the profit development, this was mainly due to advance payments, reservation fees, and early payments from customers.

Gas Services

- Continued strong customer demand led to orders more than doubling year-over-year. This was driven by large orders in the new units business, although orders in the service business also increased sharply. On a geographic basis, all reporting regions experienced sharp growth. The largest increases came from Saudi Arabia, Canada and Taiwan.

- Book-to-bill ratio was 2.22. As a result, the order backlog increased to €52bn.

- Significant increase in revenue was mainly due to the service business.

- Profit before Special items rose sharply, and the corresponding margin was also significantly higher than in the prior year. Main drivers were higher volume in the service business and margin quality of the processed order backlog.

Grid Technologies

- Orders at Grid Technologies also increased sharply. This was mainly driven by growth in the solutions business, primarily due to increased volume from large orders, particularly in Europe.

- Book-to-bill ratio was 1.82, and the order backlog rose to €38bn.

- Substantial revenue growth was driven by increases in both the product and solutions businesses.

- Profit before Special items more than doubled year-over-year, and the corresponding margin improved sharply. Both were driven by continued strong operational performance, higher volume including corresponding degression effects, and a higher margin of the processed order backlog year-over-year. In addition, the quarter was positively impacted by timing effects of around €100m.

- Special items in the prior-year quarter included the pre-tax gain from the disposal of an investment accounted for using the equity method.

Transformation of Industry

- Positive market environment drove orders almost on prior-year quarter’s level, which included an exceptionally high large order in the Compression business in the Middle East.

- Book-to-bill ratio was 1.11. Order backlog at the end of the quarter was €8bn.

- All businesses led by Compression contributed to a clear revenue increase.

- Profit before Special items almost doubled, with the corresponding margin reaching double-digits. This was mainly due to sustained volume growth, particularly in the service business, and improved margin quality of the processed order backlog.

Siemens Gamesa

- Orders were nearly on prior-year quarter’s level. There were no large orders in the offshore business and onshore orders continued to be affected by the follow-on effects or continuation of the temporary interruption of sales activities for the 4.X and 5.X turbines.

- Book-to-bill ratio was 0.32. Order backlog decreased to €36bn at the end of the quarter.

- Revenue increased significantly, driven by the new units business in offshore, mainly due to the ramp-up of its activities.

- Profit before Special items remained negative but improved sharply compared to the prior-year quarter. This was primarily driven by continued growth in the offshore business, which led to corresponding degression effects as well as due to positive project effects. Profit continued to be impacted by follow-on effects of cost increases related to the ramp-up of offshore activities as well as the quality issues in the onshore area.

- Negative Special items related to the disposal of the Indian wind business.

Reconciliation to Consolidated Financial Statements

- Reconciliation to Consolidated Financial Statements includes items, which management does not consider to be indicative of the segments’ performance – mainly group management costs (management and corporate functions) and other central items, Treasury activities as well as eliminations. Other central items include Siemens brand fees, corporate services (e.g. management of the Group’s real estate portfolio), corporate projects, centrally held equity interests and other items.

Outlook

Due to the positive business development in the first half-year and the strong market demand, Siemens Energy updates the outlook for fiscal year 2025. The change in the outlook is driven by stronger than expected performances at Gas Services, Grid Technologies and Transformation of Industry. Regarding Free cash flow pre tax, the higher outlook is particularly attributable to Gas Services and Grid Technologies, which both experience strong cash inflows driven by customer payments related to strong order momentum. At Siemens Gamesa we continue to work on the measures to reach break-even in fiscal year 2026. We still expect sales activities for the 5.X onshore turbine to resume during fiscal year 2025.

Siemens Energy now expects for the Group to achieve comparable revenue growth (excluding currency translation and portfolio effects) in fiscal year 2025 in a range of 13% to 15% (before 8% and 10%) and a Profit margin before Special items between 4% and 6% (before between 3% and 5%). Siemens Energy expects a Net income of up to €1bn (before around break-even) excluding assumed positive Special items subsequent to the demerger of the energy business from Siemens Limited, India. The outlook for Free cash flow pre tax for the 2025 fiscal year is updated to around €4bn (before to exceed the original guidance of up to €1bn).

The outlook for Siemens Energy does not include charges related to any future legal and regulatory matters.

Amended overall assumptions per business area

- Gas Services assumes a comparable revenue growth of 11% to 13% (before 7% to 9%) and a Profit margin before Special items of 11% to 13% (before 10% to 12%).

- Grid Technologies plans to achieve a comparable revenue growth of 24% to 26% (before 23% to 25%) and a Profit margin before Special items between 14% and 16% (before between 10% and 12%).

- Transformation of Industry expects a comparable revenue growth of 13% to 15% (before 11% to 13%) and a Profit margin before Special items of 9% to 11% (before 8% to 10%).

- Siemens Gamesa assumes a comparable revenue growth of 0% to 2% (before negative 9% to negative 5%) and a negative Profit before Special items of around €1.3bn (unchanged).

Notes and forward-looking statements

The press conference call on Siemens Energy’s financial results of the the second quarter of fiscal year 2025 will be broadcasted live for journalists at https://www.siemens-energy.com/pressconference starting at 8:30 a.m. CEST today.

You can also follow the conference call for analysts and investors live at www.siemens-energy.com/analystcall starting at 10:30 a.m. CEST today.

Recordings of both conference calls will be made available afterwards.

The financial publications can be downloaded at: https://www.siemens-energy.com/q2-fy2025.

This document contains statements related to our future business and financial performance, and future events or developments involving Siemens Energy that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project,” or words of similar meaning. We may also make forward-looking statements in other reports, prospectuses, in presentations, in material delivered to shareholders, and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Siemens Energy´s management, of which many are beyond Siemens Energy´s control. These are subject to a number of risks, uncertainties, and other factors, including, but not limited to, those described in disclosures, in particular in the chapter “Report on expected developments and associated material opportunities and risks” in the Annual Report and the Half-year Financial Report, which should be read in conjunction with the Annual Report. Should one or more of these risks or uncertainties materialize, should acts of force majeure, such as pandemics, occur, or should underlying expectations including future events occur at a later date or not at all, or should assumptions not be met, Siemens Energy´s actual results, performance, or achievements may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. Siemens Energy neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated. This document includes supplemental financial measures – that are not clearly defined in the applicable financial reporting framework – and that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Siemens Energy´s net assets and financial position or results of operations as presented in accordance with the applicable financial reporting framework in its consolidated financial statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently. Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Financial Results

Second quarter of fiscal year 2025

Key figures

(in millions of €, except where otherwise stated)

Consolidated Statements of Income

Consolidated Statements of Comprehensive Income

Consolidated Statements of Financial Position

Consolidated Statements of Cash Flows

Overview of Segment figures

EBITDA Reconciliation

Orders & Revenue by region (location of customer)

Disaggregation of external revenue of segments

SourceSiemens Energy

EMR Analysis

More information on Siemens Energy: See the full profile on EMR Executive Services

More information on Dr. -Ing. Christian Bruch (President, Chief Executive Officer and Chief Sustainability Officer, Siemens Energy AG + President and Chief Executive Officer of Siemens Energy Management GmbH, Siemens Energy AG): See the full profile on EMR Executive Services

More information on Maria Ferraro (Chief Financial Officer, Siemens Energy AG): See the full profile on EMR Executive Services

More information on Siemens Gamesa Renewable Energy, S.A. (SGRE) by Siemens Energy AG: https://www.siemensgamesa.com/en-int + At Siemens Gamesa, when the wind blows, we see infinite possibilities. 40 years ago, we saw the potential to blend nature and engineering. We envisioned the possibility of powering factories and lighting up cities, all whilst cleaning the air we breathe. Today, we’ve made that vision a reality by producing clean energy to power our homes, schools, and hospitals to keeping us moving all over the world – from the largest cities to the most remote corners of the planet.

We are a team of 28,150 individuals from over 100 nationalities, all motivated to tackle the greatest challenge of our generation – the climate crisis. We’re inspired by the prospect of working in a continuously evolving industry alongside expert colleagues, pushing the boundaries of possibility.

More information on Vinod Philip (Member of the Executive Board for Wind Power, Siemens Energy AG + Member of the Executive Board of Siemens Energy Management GmbH, Siemens Energy AG + Chief Executive Officer, Siemens Gamesa Renewable Energy, Siemens Energy AG): See the full profile on EMR Executive Services

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents like the Universal Registration Document.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- Siemens Energy Q2 FY 2025 Earnings Release and Financial Results: https://p3.aprimocdn.net/siemensenergy/f41da104-6818-4eb5-aa0e-b2d7003f58b2/Siemens_Energy_Earnings_Release_Q2-pdf_Original%20file.pdf

- Siemens Energy Q2 FY 2025 Earnings Presentation: https://p3.aprimocdn.net/siemensenergy/9a6e1a2f-af3b-4282-98ac-b2d700440986/2025-05-08_Q2_Analyst-presentation_final-pdf_Original%20file.pdf

- Siemens Energy Half-year Financial Report 2025: https://p3.aprimocdn.net/siemensenergy/f0db533a-9051-4ee4-bc60-b2d700441395/2025-05-08-Half-year-financial-report-2025-pdf_Original%20file.pdf

- Siemens Energy Annual Report 2024: https://p3.aprimocdn.net/siemensenergy/6974f976-432a-4ed9-ba61-b24301167dc8/A-Siemens-Energy-Annual-Report-2024-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2024 Earnings Release and Financial Results: https://p3.aprimocdn.net/siemensenergy/ed099e7a-c429-46b9-8e57-b2260127e834/Earnings-Release-Q4_EN_final-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2024 Earnings Presentation: https://p3.aprimocdn.net/siemensenergy/d516ea4c-b219-4259-94f3-b2260132e5cd/2024-11-13_Q4_Analyst-presentation_final-pdf_Original%20file.pdf

- Siemens Energy Annual Report 2023: https://p3.aprimocdn.net/siemensenergy/41a02640-9d16-4610-af08-b0ce00e67556/2023-12-06-Siemens-Energy-AG-Annual-Report-2023-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2023 Earnings Release and Financial Results: https://p3.aprimocdn.net/siemensenergy/e0872591-2bff-46a9-833f-b0ba015a476c/2023-11-15-Earnings-Release-Q4-FY23-EN-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2023 Presentation Analyst Call: https://p3.aprimocdn.net/siemensenergy/e0c4db0b-48d4-49fc-b421-b0bb0057e5a1/2023-11-15-Analyst-Presentation-Q4-FY23-EN-pdf_Original%20file.pdf

- Siemens Energy Annual Report 2022: https://assets.siemens-energy.com/siemens/assets/api/uuid:2c6beb5b-85ef-4200-a361-6a4550a31b9b/2022-12-12-siemens-energy-ag-annual-report-2022.pdf

- Siemens Energy Comparable key Figures FY2022: https://assets.siemens-energy.com/siemens/assets/api/uuid:76569361-381b-40d7-9542-d6216f6f1482/2023-02-07-siemens-energy-comparable-key-figures-fy2022.pdf?ste_sid=81e549b0261e3412a9eecb9842be8982

- Siemens Energy Annual Report 2021: https://assets.siemens-energy.com/siemens/assets/api/uuid:a400bf27-8ce4-4f48-8f2b-e89a9bd44b64/2021-12-07-siemens-energy-ag-annual-report-2021.pdf