Rexel – Q3 2025 sales

Same-day sales up +3.0%, increasing sequentially for sixth consecutive quarter ; Growth driven by solid North America, slightly improving trends in Europe ; FY 25 targets confirmed

→ Q3 25 sales of €4,758m, up +3.0% on a same-day basis

- North America up +7.4% on a same-day basis

- High-growth verticals (datacenters and broadband infrastructure) contributing to more than 50% of the growth in the US

- Continued investment to accelerate penetration in those verticals: new datacenter-focused distribution center in Reno (NV), expansion of Talley in Canada

- Good pass-through of tariff-related price increases in a competitive US market

- Europe decreased by (0.5)% on a same-day basis; a sequential improvement in a soft market

- Sequential improvement in France, Benelux & DACH with some positive macroeconomic green shoots (housing starts, transactions)

- Market-share gains in key markets

- Asia-Pacific decreased by (0.5)% on a same-day basis, sequentially improving

- Pricing contributing for +140bps to sales growth, consistent with Q2 25

→ Continued implementation of our Axelerate 2028 strategy

- Digital penetration progressing by +136bps over the quarter

- Accelerated initiatives to harness the power of AI tools in our operations for the benefit of our customers

- Active capital allocation strategy, with the completion of the disposal of Finland activities in September, the issuance of a €400m Senior note due 2030, and €50m dedicated to share buybacks since the beginning of the year

→ FY25 sales growth is now seen as “slightly positive” vs 2024 (narrowed from “stable to slightly positive”).

Full-year profitability and cash flow guidance are also confirmed in an environment that remains competitive.

Q3 was in line with the trends observed since the beginning of the year, with growth improving steadily in both North America and Europe. We are happy that our past strategic initiatives are paying off – for example in the North American datacenter and in datacom infrastructure market. The sequential improvement seen in Europe and Asia-Pacific demonstrates the strength, resilience and agility of the new Rexel in persistently soft conditions. As we continue to execute our Axelerate 2028 roadmap, we are delivering on our commitments, combining disciplined portfolio management, operational excellence and strategic investments in high-growth areas. This reinforces our confidence in achieving our full-year objectives and our mid-term ambitions.

Guillaume Texier

Chief Executive Officer

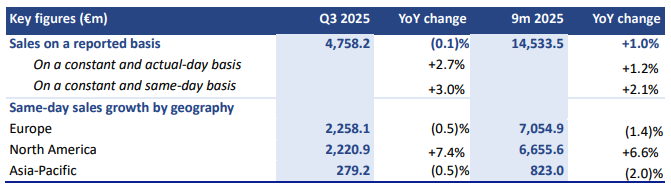

Main Q3 25 figures

Sales review for the period ended September 30, 2025

- Unless otherwise stated, all comments are on a constant and adjusted basis and, reflect sales adjusted for a constant number of working days

SALES

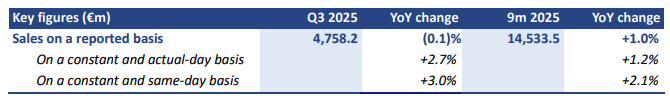

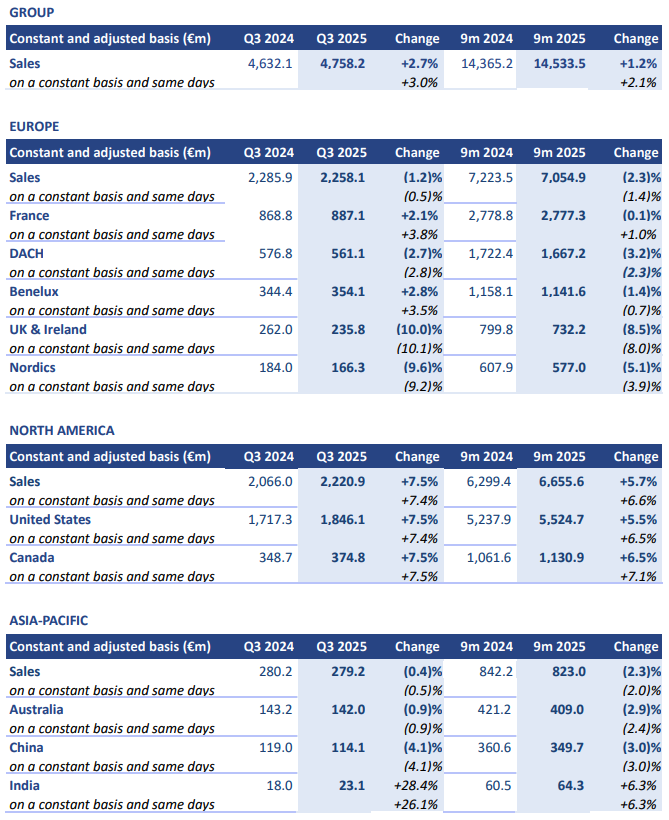

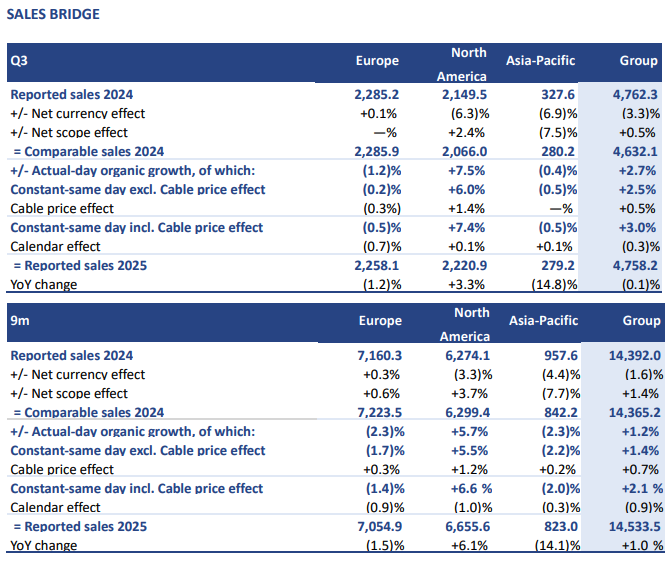

Q3 sales broadly stable at (0.1)% year-on-year on a reported basis and up +3.0% on a constant and same-day basis

In Q3 2025, Rexel posted sales of €4,758m, broadly stable at (0.1)% on a reported basis with positive organic and M&A contributions offset by negative forex impacts. This includes:

- Constant and same-day sales growth of +3.0%, with a volume growth acceleration (+1.6% contribution), and a similar pricing contribution compared to Q2 25 (+0.9% positive selling-price effect on non-cable products and +0.5% on cable products)

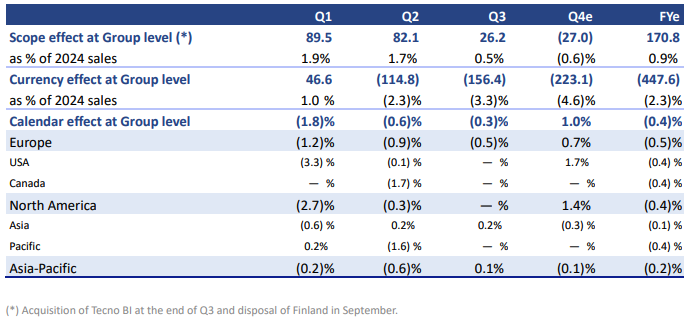

- A negative calendar effect of (0.3)%

- A positive net scope effect of +0.5%, resulting from:

- The acquisitions of Warshauer, Itesa, Schwing, Jacmar and Tecno Bi

- The disposal of Rexel’s operations in New Zealand & Finland

- In September, Rexel completed the disposal of its Finnish operations to Ahlsell, a Nordic regional distributor of installation products, tools and supplies. As a result, Finland was deconsolidated as of September 1st, 2025.

- A negative currency effect of (3.3)%, mainly due to the depreciation of the US and Canadian dollars, and to a lesser extend the Australian dollar and renminbi, against the euro

Sales were up +3.0% on a constant and same-day basis. More specifically:

- North America remains the growth engine for the quarter, confirming our ability to capture the potential of high-growth segments in the region

- The sales growth acceleration in Q3 25 (vs Q2 25) was supported by improving trends in Europe and APAC

- Digital sales in Q3 25 increased by +136bps to represent 33% of Group sales

- Digital accounted for 44% of sales in Europe, up +100bps; 23% in North America, an increase of +280bps; and 26% in Asia-Pacific, stable vs Q3 24

9m sales up +1.0% year-on-year on a reported basis, +2.1% on a constant and same-day basis

In 9m 2025, Rexel posted sales of €14,533.5m, up +1.0% on a reported basis, supported by the positive organic contribution and M&A strategy. This includes:

- Constant and same-day sales growth of +2.1%, reflecting contributions of +0.9% from volume, +0.6% from non-cable selling prices and +0.7% from cable product selling prices

- A negative calendar effect of (0.9)%

- A positive net scope effect of +1.4%, mainly resulting from acquisitions of Talley, Itesa, Schwing, Warshauer, Electrical Supplies Inc, Jacmar and Tecno Bi, net of the New Zealand and Finland disposals • A negative currency effect of (1.6)%, mainly due to the depreciation of the US and Canadian dollars, and to a lesser extend the Australian dollar and renminbi, against the euro

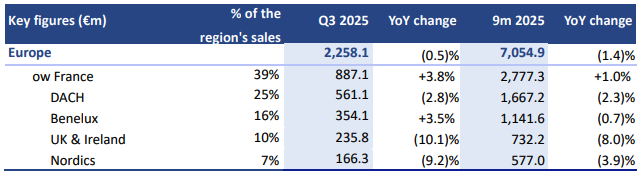

Europe (47% of Group sales): Revenues decreased by (0.5)% in Q3, (1.4)% in 9m on a constant and same-day basis

In Q3 25, sales in Europe stood at (1.2)% on a reported basis, including:

- A constant and same-day sales decline of (0.5)%

- A negative calendar effect of (0.7)%

- A stable net scope impact, with the acquisitions of Itesa in France and Tecno Bi in Italy offset by Finland disposal

- A broadly stable currency effect of +0.1%

- Europe decreased by (0.5)% on a same-day basis year-on-year, while improving sequentially in a soft environment marked by political and macro uncertainties in several countries. More specifically:

- Same-day sales growth was positive excluding solar, up +0.6%

- We saw signs of improvement in the residential segment (ex Solar) in Sweden, France, the Netherlands, Austria & Germany

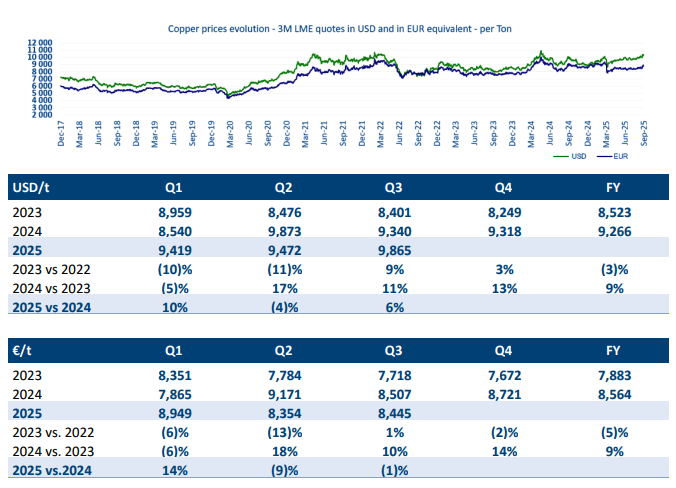

The price effect in non-cable was very similar to Q2 25, and the contribution from cable pricing slightly decreased, reflecting lower copper prices in euro terms.

Trends by country and cluster (same-day basis):

- Further progression in France up +3.8% in a challenging environment, driven by high demand from small contractors (fueled by air conditioning segment), favorable base effect and market share gains

- DACH region (Germany, Austria, Switzerland) declined by (2.8)%, remaining negative but showing resilience with a sequential improvement, thanks to Switzerland and Austria. Germany remains soft in a challenging environment

- Benelux increased by +3.5% with all countries returning to positive territory, and particularly boosted by growth in air conditioning in the Netherlands and Solar activity in Belgium

- UK & Ireland sales declined by (10.1)%, with the UK still impacted by a challenging market, ongoing business selectivity and branch closures

- Nordics (Sweden and Finland) sales decreased by (9.2)% but delivered broadly stable growth excluding Solar and September 2024 one-off

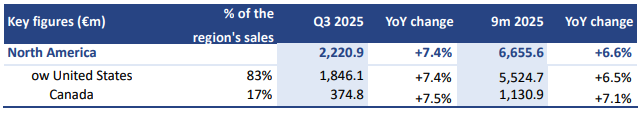

North America (47% of Group sales): Strong sales growth of +7.4% in Q3 and +6.6% in 9m on a constant and same-day basis

In Q3 25, North America sales were up by +3.3% on a reported basis, including:

- Strong constant and same-day sales growth of +7.4% • Broadly stable calendar effect of +0.1%

- Positive scope effect of +2.4%, resulting from the acquisitions of Warshauer and Schwing in the US, and Jacmar in Canada

- Negative currency effect of (6.3)%, mainly due to the depreciation of the US dollar against the euro

Sales were up +7.4% on a same-day basis, with positive trends confirmed in high-growth-segments (datacenter, broadband infrastructure, datacom). Backlogs remain solid at the end of September, representing 2.6 months of sales, similar to their level in June 2025.

- US same-day sales were up by +7.4% in Q3 2025

- Datacenter & broadband infrastructure (c.12.5% of US sales) contributing for more than half of Q3 sales growth in the country

- Q3 25 was driven by the proximity segment, that grew faster than projects

- By market, the growth was mainly driven by the non-residential. The residential also contributed to the growth in the country notably thanks to Northwest, California and Southeast regions. Industrial automation was slightly positive for the second quarter thanks to Water Waste Water and panel builders.

- Good pass-through of tariff-related price increases in a competitive market environment

More specifically, on our datacenter activity that represented 5% of US sales

- Activity launched three years ago through Mayer acquisition and creation of national sales account team

- Unique Rexel value proposition, leveraging scale national presence, product availability and expertise

- Recently invested in logistics capacity in Atlanta and Reno to boost customer service and support further growth

- We are mainly active in the gray space/power distribution, selling full range of products: cable, busbar, gears, conduits…

- This is a fast growing segment

- Up more than 50% in the first 9 months of 2025

- Our sales grew sequentially at a double-digit pace in Q3 25 vs Q2 25

- Demand growth initially driven by eastern US, now spreading to Texas & California

- In Canada, sales were up +7.5% on a same-day basis, driven by market share gains notably in project activities in non-residential and industrial end markets.

- Growth accelerated in the datacom business, boosted by commercial initiatives.

- We also expand Talley into the Canadian market. This complements Rexel Canada’s existing North American footprint by integrating Talley’s expertise and product offerings with Rexel’s connected and electrified solutions.

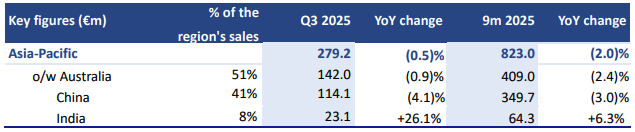

Asia-Pacific (6% of Group sales): Sales decreased by (0.5)% in Q3 and (2.0)% in 9m on a constant and same-day basis

In Q3 25, Asia-Pacific sales decreased by (14.8)% on a reported basis, including:

- Constant and same-day sales decline of (0.5)%

- Broadly stable calendar effect of +0.1%

- Negative scope effect of (7.5)%, resulting from the disposal of Rexel’s New Zealand activities

- Negative currency effect of (6.9)%, mainly due to the depreciation of the Australian dollar and the renminbi against the euro

In Asia-Pacific, sales decreased by (0.5)% on a constant and same-day basis

Asia-Pacific trends by country (same-day basis):

- In Australia, sales still in negative territory but improving compared to Q2 25, thanks to residential and non-residential markets, boosted by Solar activity (introduction of subsidies on batteries)

- In China, sales decreased by (4.1)%, in a challenging industrial market environment, with export activities facing headwinds following the introduction of US tariffs. The sequential improvement (vs Q2 25) is supported by volume

- In India, sales increased by +26.1% in the quarter driven by strong growth in our industrial automation activity

Outlook confirmed

Rexel’s expectations for full-year 2025 are as follows:

- Slightly positive same-day sales growth (narrowed from “stable to slightly positive”)

- Current adjusted EBITA margin1 at c. 6%

- Free cash flow conversion2 at c. 65%, excluding the €124m fine imposed by the French Competition Authority and paid in April 2025

At the Rexel Expo in Paris, our management teams will take the opportunity to host a Strategic Update on October 16th, when they will demonstrate how Rexel’s action plans are being implemented in the service of mid-term objectives.

1 Excluding (i) amortization of PPA and (ii) the non-recurring effect related to changes in copper-based cable prices.

2 FCF Before interest and tax/EBITDAaL

NB: The estimated impacts per quarter of (i) calendar effects by geography, (ii) changes in the consolidation scope and (iii) currency fluctuations (based on assumptions of average rates over the rest of the year for the Group’s main currencies) are detailed in appendix 6

CALENDAR

February 12, 2026 – Q4 2025 sales and FY 2025 results

FINANCIAL INFORMATION

A slideshow of the third-quarter sales is also available on the Group’s website.

GLOSSARY

- CURRENT EBITA (Earnings Before Interest, Taxes and Amortization) is defined as operating income before amortization of intangible assets recognized upon purchase price allocation and before other income and other expenses.

- CURRENT ADJUSTED EBITA is defined as current EBITA excluding the estimated non-recurring net impact from changes in copper-based cable prices

- EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is defined as operating income before depreciation and amortization and before other income and other expenses.

- EBITDAaL is defined as EBITDA after deduction of lease payment following the adoption of IFRS16.

- RECURRING NET INCOME is defined as net income restated for non-recurring copper effect, other expenses and income, non-recurring financial expenses, net of tax effect associated with the above items.

- FREE CASH FLOW is defined as cash from operating activities minus net capital expenditure.

- NET DEBT is defined as financial debt less cash and cash equivalents. Net debt includes debt hedge derivatives.

APPENDIX

Appendix 1: Segment reporting – Constant and adjusted basis*

* Constant and adjusted = at comparable scope of consolidation and exchange rates, excluding the non-recurring effect related to changes in copper-based cable prices and before amortization of purchase price allocation.

The non-recurring effect related to changes in copper-based cable prices was, at the EBITA level:

Appendix 2: Calendar, scope and currency effects on sales

Based on the assumption, that exchange rates (as of October 3rd) remain unchanged until year end:

and based on acquisitions/divestments to date, 2024 sales should take into account the following estimated impacts to be comparable to 2025:

Appendix 3: Analysis of change in revenues (€m)

Appendix 4: Historical copper price evolution

DISCLAIMER

The Group is exposed to fluctuations in copper prices in connection with its distribution of cable products. Cables accounted for approximately 16% of the Group’s sales and copper accounts for approximately 60% of the composition of cables. This exposure is indirect since cable prices also reflect copper suppliers’ commercial policies and the competitive environment in the Group’s markets. Changes in copper prices have an estimated so-called “recurring” effect and an estimated so called “non-recurring” effect on the Group’s performance assessed as part of the monthly internal reporting process of the Rexel Group: i) the recurring effect related to the change in copper-based cable prices corresponds to the change in value of the copper part included in the sales price of cables from one period to another. This effect mainly relates to the Group’s sales; ii) the non-recurring effect related to the change in copper-based cable prices corresponds to the effect of copper price variations on the sales price of cables between the time they are purchased and the time they are sold, until all such inventory has been sold (direct effect on gross profit). Practically, the non-recurring effect on gross profit is determined by comparing the historical purchase price for copper-based cable and the supplier price effective at the date of the sale of the cables by the Rexel Group. Additionally, the non-recurring effect on current EBITA corresponds to the non-recurring effect on gross profit, which may be offset, when appropriate, by the non-recurring portion of changes in the distribution and administrative expenses.

The impact of these two effects is assessed for as much of the Group’s total cable sales as possible, over each period. Group procedures require that entities that do not have the information systems capable of such exhaustive calculations to estimate these effects based on a sample representing at least 70% of the sales in the period. The results are then extrapolated to all cables sold during the period for that entity. Considering the sales covered. the Rexel Group considers such estimates of the impact of the two effects to be reasonable

This document may contain statements of future expectations and other forward-looking statements. By their nature, they are subject to numerous risks and uncertainties, including those described in the Universal Registration Document registered with the French Autorité des Marchés Financiers (AMF) on March 10, 2025 under number D.25-0084. These forward-looking statements are not guarantees of Rexel’s future performance, Rexel’s actual results of operations, financial condition and liquidity as well as development of the industry in which Rexel operates may differ materially from those made in or suggested by the forward-looking statements contained in this release. The forward-looking statements contained in this communication speak only as of the date of this communication and Rexel does not undertake, unless required by law or regulation, to update any of the forward-looking statements after this date to conform such statements to actual results to reflect the occurrence of anticipated results or otherwise.

The market and industry data and forecasts included in this document were obtained from internal surveys, estimates, experts and studies, where appropriate, as well as external market research, publicly available information and industry publications. Rexel, its affiliates, directors, officers, advisors and employees have not independently verified the accuracy of any such market and industry data and forecasts and make no representations or warranties in relation thereto. Such data and forecasts are included herein for information purposes only.

This document includes only summary information and must be read in conjunction with Rexel’s Universal Registration Document registered with the AMF on March 10, 2025 under number D.25-0084, as well as the financial statements and consolidated result and activity report for the 2024 fiscal year which may be obtained from Rexel’s website (www.rexel.com).

SourceRexel

EMR Analysis

More information on Rexel: See the full profile on EMR Executive Services

More information on Guillaume Texier (Chief Executive Officer, Rexel): See the full profile on EMR Executive Services

More information on Laurent Delabarre (Group Chief Financial Officer, Leading China-India Cluster, Rexel): See the full profile on EMR Executive Services

More information on Axelerate 2028 Plan by Rexel: See the full profile on EMR Executive Services

More information on Warshauer Electric Supply by Rexel USA by Rexel: See the full profile on EMR Executive Services

More information on Jim Warshauer (President, Warshauer Electric Supply, Rexel USA, Rexel): See the full profile on EMR Executive Services

More information on Itesa by Rexel: See the full profile on EMR Executive Services

More information on Olivier Pages (President, Itesa, Rexel): See the full profile on EMR Executive Services

More information on Schwing Electrical Supply Corp. by Rexel USA by Rexel: See the full profile on EMR Executive Services

More information on Jacmar Automation by Rexel Canada by Rexel: See the full profile on EMR Executive Services

More information on Martin Gagnon (President, Jacmar Automation, Rexel Canada, Rexel): See the full profile on EMR Executive Services

More information on Tecno-Bi s.r.l. by Rexel Italy by Rexel: See the full profile on EMR Executive Services

More information on Valter Costi (Managing Director, Tecno-Bi, Rexel Italy, Rexel): See the full profile on EMR Executive Services

More information on Talley Inc. by Rexel USA Inc. by Rexel: See the full profile on EMR Executive Services

More information on Mark Talley (President and Chief Executive Officer, Talley Inc., Rexel USA, Rexel): See the full profile on EMR Executive Services

More information on Mayer Electric by Rexel USA Inc. by Rexel: See the full profile on EMR Executive Services

More information on Patrick Daley (Senior Vice President, President, Mayer Electric Supply, Rexel USA, Rexel): See the full profile on EMR Executive Services

More information on Electrical Supplies Inc. (ESI) by Mayer Electric by Rexel USA Inc. by Rexel: See the full profile on EMR Executive Services

More information on James Segal (President, Electrical Supplies Inc. (ESI), Mayer Electric Supply, Rexel USA, Rexel): See the full profile on EMR Executive Services

More information on Ahlsell: See the full profile on EMR Executive Services

More information on Claes Seldeby (President and Chief Executive Officer, Ahlsell Group): See the full profile on EMR Executive Services

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents like the Universal Registration Document.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The Rexel Q3 sales 2025 Results Presentation can be found here: Not yet available

- The Rexel Q2 sales & H1 2025 Results Presentation can be found here: https://www.rexel.com/en/finance/documentation/

- The Rexel 2024 Universal Registration Document can be found here: https://www.rexel.com/en/finance/documentation/?oo_filter_category=60&oo_filter_year=Year+of+publication&oo_filter=investors-publications

- The Rexel Fourth Quarter Sales & FY 2024 Results can be found here: https://www.rexel.com/en/finance/documentation/

- The Rexel Capital Market Days Presentation from the 7th of June 2024 can be found here: https://assets.main.pro2.maf.media-server.com/d23b5b2ba2184959bd5a6965dd3fd1b5/20240607_-_Powering_Up_Rexel_to_the_next_level.pdf

- The Rexel 2023 Universal Registration Document can be found here: https://www.rexel.com/en/finance/documentation/?oo_filter_category=60&oo_filter_year=Year+of+publication&oo_filter=investors-publications

- The Rexel Q4 2023 and Full-Year 2023 Results Presentation can be found here: https://www.rexel.com/en/finance/documentation/

- The Rexel 2022 Universal Registration Document can be found here: https://www.rexel.com/en/finance/documentation/?oo_filter_category=60&oo_filter_year=Year+of+publication&oo_filter=investors-publications

- The Rexel FY 2022 Financial Statements and Consolidated Results can be found here: https://www.rexel.com/en/finance/documentation/

- The Rexel 2022 Capital Markets Presentation can be found here: https://www.rexel.com/en/medias/events/fourth-quarter-sales-and-full-year-2022-results/

- The Rexel 2021 Universal Registration Document can be found here: https://www.rexel.com/en/finance/documentation/?oo_filter_category=60&oo_filter_year=Year+of+publication&oo_filter=investors-publications