Mersen – Nine-month 2025 sales of €895 million in a contrasting global market environment

- Quarterly sales of €285 million, bringing total nine-month sales to €895 million (down 4.1% on an organic basis)

- Organic growth in the third quarter in line with the first half of the year, down 4.3%:

- accelerated growth in the Electrical Power segment, thanks to power electronics and electrical distribution projects in North America

- downturn in Advanced Materials, with a particularly low level of sales in the solar and SiC semiconductor markets, partially offset by continued momentum in transportation markets and a recovery in sales of silicon semiconductors

- For full-year 2025, the Group now expects:

- organic sales growth of between -5% and -3% (compared with between -5% and 0% previously);

- EBITDA margin before non-recurring items of around 16% (compared with between 16% and 16.5% previously);

- operating margin before non-recurring items confirmed between 9% and 9.5%;

- capital expenditure revised downwards significantly, to between €140 million and €150 million (compared with between €160 million and €170 million previously).

The Group is holding a webcast and conference call in French with simultaneous translation into English today at 6:00 p.m. CET (details on the last page).

PARIS, OCTOBER 23, 2025 – Mersen (Euronext FR0000039620 – MRN), a global expert in electrical power and advanced materials, today reported consolidated sales of €895 million for the first nine months of 2025, representing a contraction of 4.1% on an organic basis.

Luc Themelin, Mersen’s Chief Executive Officer, said: “In a contrasting environment, Mersen’s performance demonstrates the strength of its diversified business model, with good momentum in the aeronautics, rail, power electronics and electrical distribution markets partly offsetting the lackluster solar and SiC semiconductor segments. We do not expect any recovery in the solar market between now and the end of the year, which is why our sales forecasts have been revised to the lower end of the range initially forecasted. We remain focused on market opportunities and cash flow generation to support the Group’s sustainable performance and to achieve our medium-term objectives.”

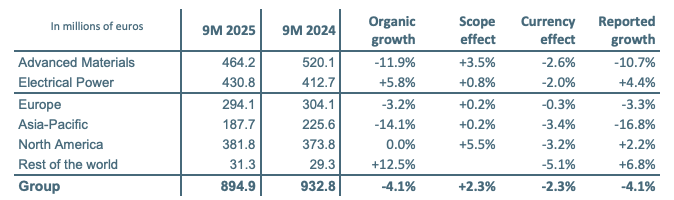

NINE-MONTH 2025 SALES

Mersen’s consolidated sales for the first nine months of 2025 totaled €895 million, down 4.1% on an organic basis versus the same period in 2024. Prices increased by around 1% over the period.

The unfavorable currency effect represented around €22 million, and was mainly due to the depreciation of the Chinese renminbi and the US and Canadian dollars. The scope effect reflects the contribution of acquisitions made in 2024 in the United States

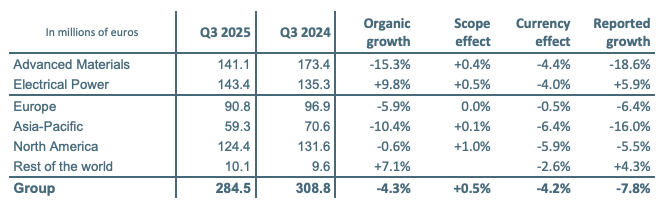

THIRD-QUARTER 2025 SALES

Mersen reported consolidated sales of €285 million for the third quarter of 2025, representing a contraction of 4.3% on an organic basis.

The most significant exchange rate fluctuations during the period concerned the depreciation of the US and Canadian dollars, and the Chinese renminbi. The scope effect corresponds to acquisitions made in the second half of 2024.

PERFORMANCE BY SEGMENT

Advanced Materials sales totaled €141 million, down 15.3% on an organic basis versus the prior-year period. This trend mainly reflects an ongoing downturn in the solar and SiC semiconductor markets, partly offset by a gradual recovery in silicon semiconductors and good momentum in the rail and aeronautics markets. Deliveries for the chemicals and process industries markets were down, in line with expectations.

Electrical Power sales amounted to €143 million, representing organic growth of 9.8% versus the same period in 2024. This significant increase reflects consistently strong demand in the rail and wind power markets and several power electronics projects, as well as healthy business activity in electrical distribution, particularly in the United States.

PERFORMANCE BY REGION

Sales in Europe saw a moderate decline, with a decline in SiC semiconductors and the energy market, offset by growth in the transportation markets. Business remained resilient in France, while Germany saw a decline.

In Asia, Group sales declined 10.4% on an organic basis compared with last year, as a result of a sharp slowdown in the solar market in China and fewer deliveries in the chemicals market. India confirmed its strong growth, driven in particular by the rail market.

In North America, business remained robust, despite a year-on-year decline in SiC semiconductor sales. The market for electrical distribution is dynamic, particularly in the data center and energy grid segments.

MARKET TRENDS FOR THE FOURTH QUARTER

In the fourth quarter, Mersen expects:

- continued good momentum in wind power while the solar power market is expected to remain at a low level of sales;

- a continued recovery in Si semiconductors and a sequential improvement in the SiC semiconductor market, which will however remain subdued; ongoing projects in power conversion for electricity transmission (HVDC);

- continued positive trends in transportation markets, thanks to numerous projects in rail and aeronautics and the ramp-up of deliveries for ACC for EV batteries;

- a decline in the chemicals market, in line with expectations;

- process industries that will evolve in line with global macroeconomic trends.

2025 GUIDANCE

Based on the results for the first nine months of the year, and in particular the low level of sales expected for the solar market, the Group now expects for the full-year 2025:

- organic sales growth of between -5% and -3% (compared with between -5% and 0% previously);

- EBITDA margin before non-recurring items of around 16% (compared with between 16% and 16.5% previously);

- operating margin before non-recurring items confirmed between 9% and 9.5%;

- capital expenditure revised downwards, to between €140 million and €150 million (compared with between €160 million and €170 million previously).

Given the changes in the main exchange rates since the end of the first quarter, in particular the depreciation of the Chinese renminbi and the US and Canadian dollars, the Group’s reported sales target is no longer suitable.

The Group confirms its 2029 targets.

GLOSSARY

Organic growth: Calculated by comparing sales for the year with sales for the previous year, restated at the current year’s exchange rate, excluding the impact of acquisitions and disposals.

Scope effect: Contribution from companies acquired in the year, less the contribution from companies sold in the previous year, in relation to sales for the previous year, restated at the exchange rate for the current year and for disposals.

Currency effect: Calculated by comparing sales for the previous year at the exchange rate of the previous year with sales for the previous year at the exchange rate of the current year.

WEBCAST

The Group is holding a webcast on October 23, 2025 at 6:00 p.m.: ACCESS LINK (in English)

You can ask your questions via chat or by joining the conference call.

To join the conference call in English, please register by clicking on this link.

FINANCIAL CALENDAR:

Full-year 2025 sales: January 28, 2026, after the markets close

SourceMersen

EMR Analysis

More information on Mersen: See the full profile on EMR Executive Services

More information on Luc Themelin (Chief Executive Officer, Mersen until Annual General Meeting in May 2026 + Nominated Non-Executive Chairman of the Board, Mersen at Annual General Meeting in May 2026): See the full profile on EMR Executive Services

More information on Salvador Lamas (Chief Operating Officer, Mersen + Designated Chief Executive Officer, Mersen until Annual General Meeting in May 2026 + Chief Executive Officer, Mersen as from after the Annual General Meeting in May 2026): See the full profile on EMR Executive Services

More information on Thomas Baumgartner (Chief Financial Officer, Mersen): See the full profile on EMR Executive Services

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The Mersen Q3 2025 Sales Presentation can be found here: https://www.mersen.com/sites/default/files/medias/financial_results/2025-10/2025-10-ps-en-presentation-Sales-Q3-2025-mersen.pdf

- The Mersen Q2 and HY 2025 Sales Presentation can be found here: https://www.mersen.com/sites/default/files/medias/financial_results/2025-07/2025-07-ps-en-presentation-H1-2025-mersen.pdf

- The Mersen 2025 First-Half Financial Report can be found here: https://www.mersen.com/sites/default/files/medias/financial_results/2025-07/2025-07-rs-en-H1-financial-report-mersen.pdf

- The Mersen 2024 Universal Registration Document can be found here: https://files.webdisclosure.com/1326981/202503MERSEN_URD_2024_VA.pdf

- The Mersen 2024 Annual Results Presentation can be found here: https://www.mersen.com/sites/default/files/medias/financial_results/2025-03/2025-03-ps-en-mersen-annual-results-presentation.pdf

- The Mersen 2023 Universal Registration Document can be found here: https://www.mersen.com/sites/default/files/publications-media/2024-03-urd-en-universal-registration-document-2023-mersen.pdf

- The Mersen FY 2023 Sales Presentation can be found here: https://www.mersen.com/sites/default/files/publications-media/2024-01-ps-en-mersen-2023-sales.pdf

- The Mersen December 2023 Investor Presentation can be found here: https://www.mersen.com/sites/default/files/publications-media/23-11-ps-en-mersen-investors.pdf

- The Mersen 2022 Universal Registration Document can be found here: https://www.mersen.com/sites/default/files/publications-media/2023-03-fr-mersen-deu-2022.pdf

- The Mersen 2022 Full-Year Results Presentation can be found here: https://www.mersen.com/sites/default/files/publications-media/23-03-15-ps-en-mersen.pdf

- The Mersen 2023 investor Presentation can be found here: https://www.mersen.com/sites/default/files/pdf/2023-01-ps-en-presentation-mersen.pdf