Avnet – Avnet reports first quarter 2026 financial results

- First quarter sales of $5.9 billion and diluted EPS of $0.61

- Adjusted diluted EPS of $0.84

- Return to year-over-year sales growth in the Americas

PHOENIX–(BUSINESS WIRE)– Avnet, Inc. (Nasdaq: AVT) today announced results for its first quarter ended September 27, 2025.

“In the first quarter, our sales and earnings exceeded our expectations, led by double-digit year-over-year sales growth in Farnell and Asia,” said Avnet Chief Executive Officer Phil Gallagher. “While uncertainty continues to impact the market, we remain optimistic about the increasingly positive signs of recovery. Our durable business model, coupled with our strong, diverse supplier line card and customer base, position Avnet to create long-term value for all our stakeholders.”

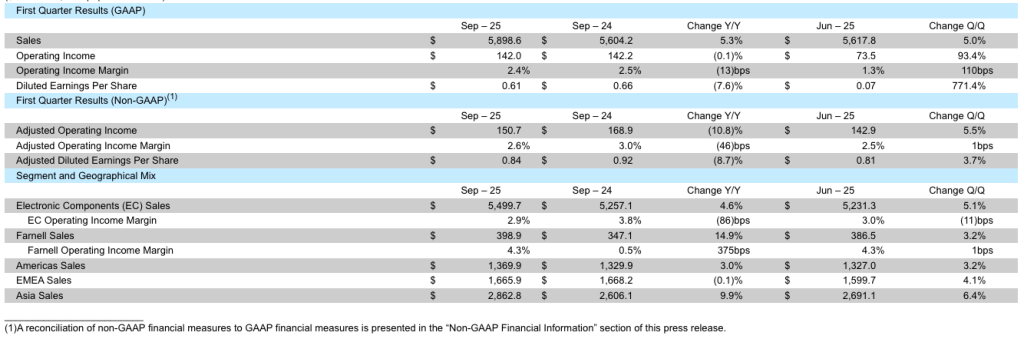

Fiscal First Quarter Key Financial Highlights:

- Sales of $5.9 billion

- Fifth consecutive quarter of year-over-year sales growth in Asia

- Second consecutive quarter of year-over-year growth at Farnell

- Diluted earnings per share of $0.61

- Adjusted diluted earnings per share of $0.84

- Operating income margin of 2.4%

- Adjusted operating income margin of 2.6%

- Returned $138 million to shareholders from share repurchases, representing 3.2% of shares outstanding

- Repurchased approximately 8% of outstanding shares over past four quarters

- Returned $28 million to shareholders in dividends

- Increased quarterly dividend by 6% compared to fiscal 2025

Key Financial Metrics

($ in millions, except per share data)

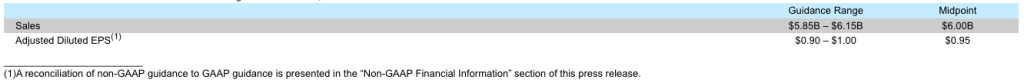

Outlook for the Second Quarter of Fiscal 2026 Ending on December 27, 2025

The above guidance implies sequential sales growth of approximately 2% at the midpoint and assumes sequential sales growth in the Americas and Asia and flat sales in Europe.

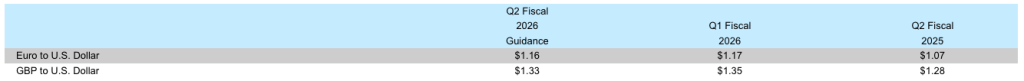

The above guidance also excludes restructuring, integration and other expenses, foreign currency gains and losses, and certain income tax adjustments. The above guidance assumes similar interest expense to the first quarter of fiscal 2026 and an adjusted effective tax rate of between 21% and 25%. The above guidance assumes 83 million average diluted shares outstanding and average currency exchange rates as shown in the table below:

Today’s Conference Call and Webcast Details

Avnet will host a conference call and webcast today at 9:00 a.m. PT / Noon ET to discuss its financial results, provide a business update and answer questions.

- Live conference call: 877-407-8112 (domestic) or 201-689-8840 (international)

- Live webcast along with slides can be accessed via Avnet’s Investor Relations website at https://ir.avnet.com

- An audio replay of the webcast will be available after the completion of the call and archived on the website for one year

Forward-Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations, and business of the Company. You can find many of these statements by looking for words like “believes,” “projected,” “plans,” “expects,” “anticipates,” “should,” “will,” “may,” “estimates,” or similar expressions. These forward-looking statements are subject to numerous assumptions, risks, and uncertainties. The following important factors, in addition to those discussed elsewhere in the Company’s Annual Report on Form 10-K for the fiscal year ended June 28, 2025 and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, could affect the Company’s future results of operations, and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements: geopolitical events and military conflicts; pandemics and other health-related crises; competitive pressures among distributors of electronic components; an industry down-cycle in semiconductors; relationships with key suppliers and allocations of products by suppliers; accounts receivable defaults; risks relating to the Company’s international sales and operations, including risks relating to repatriating cash, foreign currency fluctuations, inflation, duties and taxes, tariffs, sanctions and trade restrictions, and compliance with international and U.S. laws; risks relating to acquisitions, divestitures, and investments; adverse effects on the Company’s supply chain, operations of its distribution centers, shipping costs, third-party service providers, customers, and suppliers, including as a result of issues caused by military conflicts, terrorist attacks, natural and weather-related disasters, pandemics and health related crises, warehouse modernization, and relocation efforts; risks related to cyber security attacks, other privacy and security incidents, and information systems failures, including related to current or future implementations, integrations, and upgrades; general economic and business conditions (domestic, foreign, and global) affecting the Company’s operations and financial performance and, indirectly, the Company’s credit ratings, debt covenant compliance, liquidity, and access to financing; constraints on employee retention and hiring; and legislative or regulatory changes.

Any forward-looking statement speaks only as of the date on which that statement is made. Except as required by law, the Company assumes no obligation to update any forward-looking statement to reflect events or circumstances that occur after the date on which the statement is made.

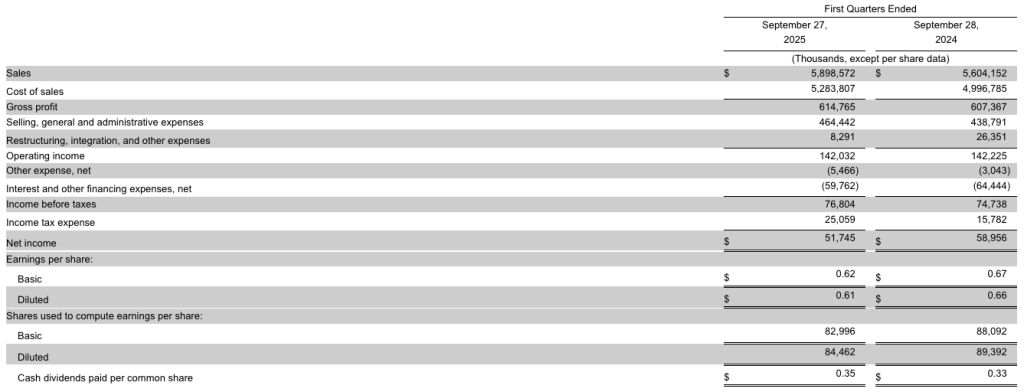

AVNET, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

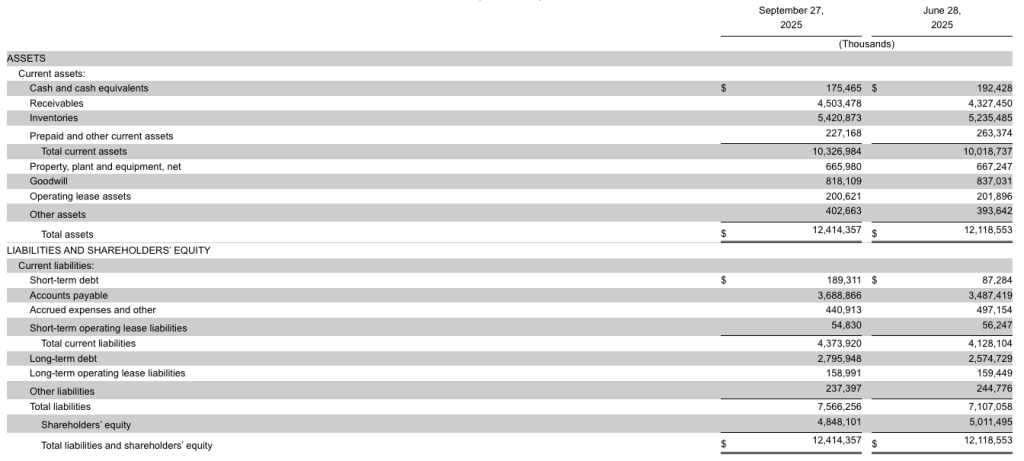

AVNET, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

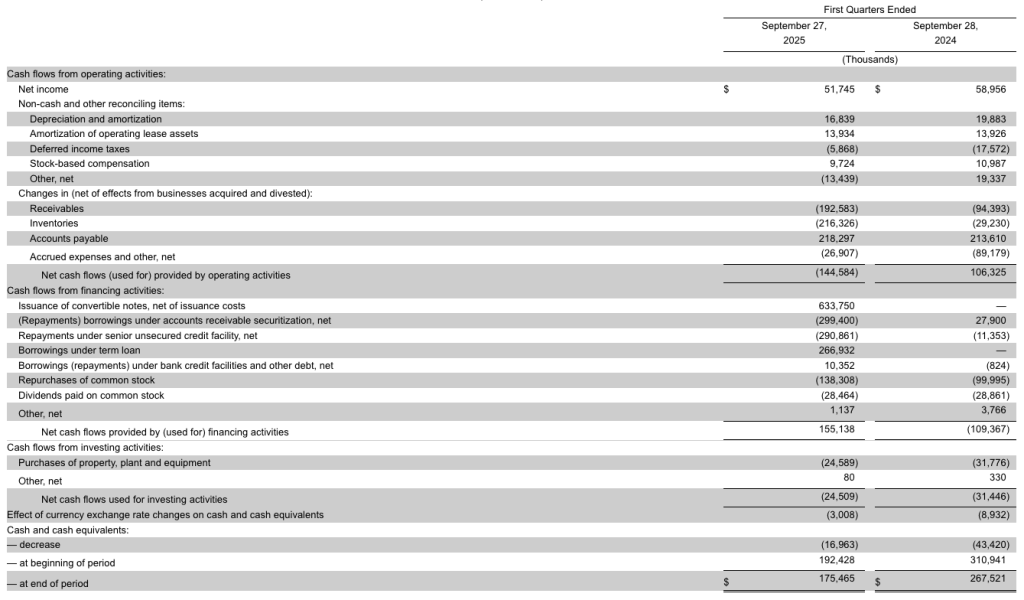

AVNET, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

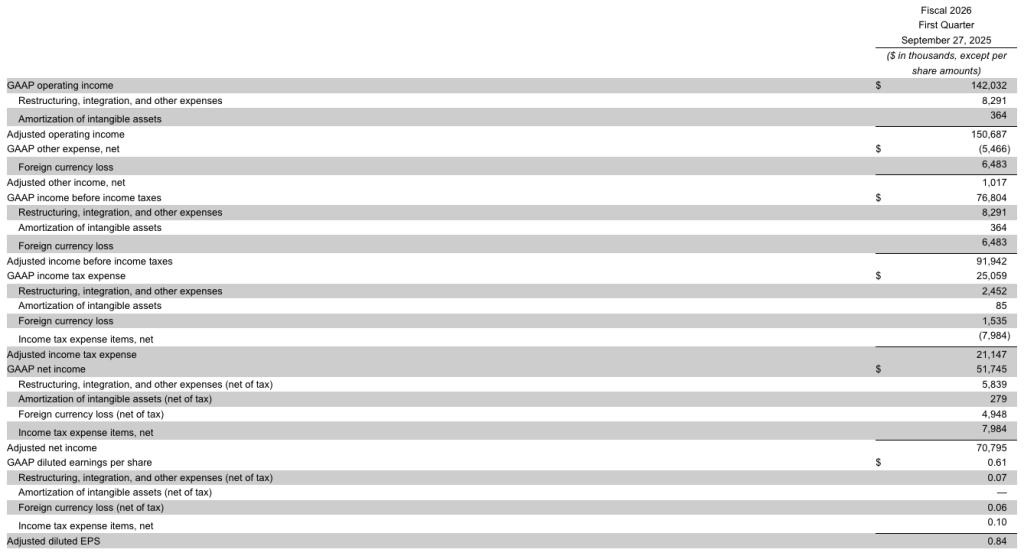

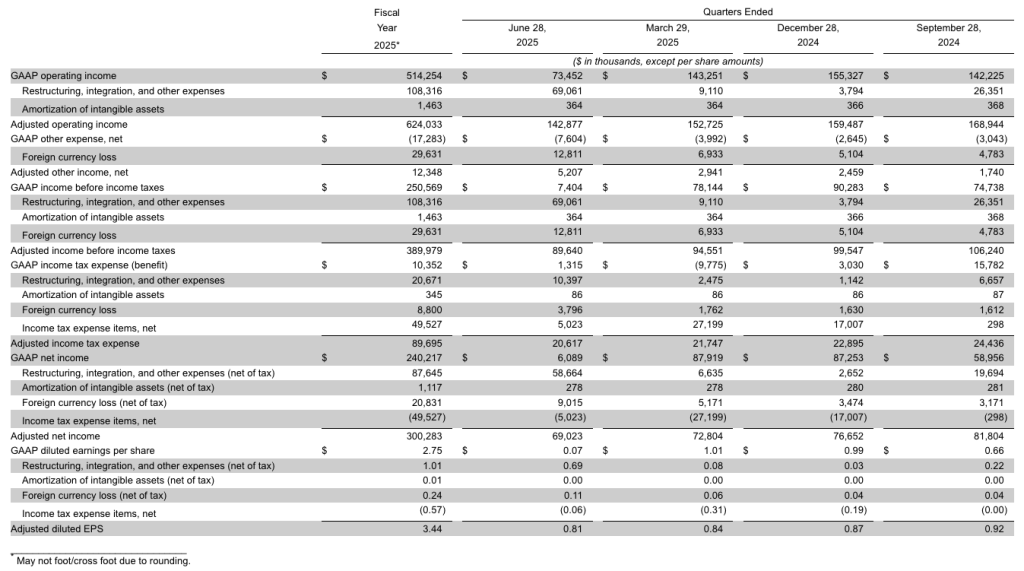

Non-GAAP Financial Information

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also discloses certain non-GAAP financial information including (i) adjusted operating income, (ii) adjusted other income (expense), (iii) adjusted income before income taxes, (iv) adjusted income tax expense (benefit), and (v) adjusted diluted earnings per share.

There are also references to the impact of foreign currency in the discussion of the Company’s results of operations. When the U.S. Dollar strengthens and the stronger exchange rates of the current year are used to translate the results of operations of Avnet’s subsidiaries denominated in foreign currencies, the resulting impact is a decrease in U.S. Dollars of reported results. Conversely, when the U.S. Dollar weakens and the weaker exchange rates of the current year are used to translate the results of operations of Avnet’s subsidiaries denominated in foreign currencies, the resulting impact is an increase in U.S. Dollars of reported results. In the discussion of the Company’s results of operations, results excluding this impact are referred to as “constant currency.” Management believes sales in constant currency is a useful measure for evaluating current period performance as compared with prior periods and for understanding underlying trends. In order to determine the translation impact of changes in foreign currency exchange rates on sales, income or expense items for subsidiaries reporting in currencies other than the U.S. Dollar, the Company adjusts the average exchange rates used in current periods to be consistent with the average exchange rates in effect during the comparative period.

Management believes that operating income adjusted for restructuring, integration and other expenses, and amortization of acquired intangible assets, is a useful measure to help investors better assess and understand the Company’s operating performance. This is especially the case when comparing results with previous periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of Avnet’s normal operating results or non-cash in nature. Management analyzes operating income without the impact of these items as an indicator of ongoing margin performance and underlying trends in the business. Management also uses these non-GAAP measures to establish operational goals and, in most cases, for measuring performance for compensation purposes. Management measures operating income for its reportable segments excluding restructuring, integration and other expenses, and amortization of acquired intangible assets.

Management also believes income tax expense (benefit), net income and diluted earnings per share adjusted for the impact of the items described above, foreign currency gains and losses and certain items impacting income tax expense (benefit) are useful to investors because they provide a measure of the Company’s net profitability on a more comparable basis to historical periods and provide a more meaningful basis for forecasting future performance. Adjustments to income tax expense (benefit) and the effective income tax rate include the effect of changes in tax laws, certain changes in valuation allowances and unrecognized tax benefits, income tax audit settlements and adjustments to the effective tax rate based upon the expected long-term adjusted effective tax rate. Additionally, because of management’s focus on generating shareholder value, of which net profitability is a primary driver, management believes net income and diluted earnings per share excluding the impact of these items provides an important measure of the Company’s net profitability for the investing public.

Additional non-GAAP metrics management uses are adjusted operating income margin, which is defined as adjusted operating income divided by sales and the adjusted effective income tax rate, which is defined as adjusted income tax expense divided by adjusted income before income taxes.

Any analysis of results and outlook on a non-GAAP basis should be used as a complement to, and in conjunction with, results presented in accordance with GAAP.

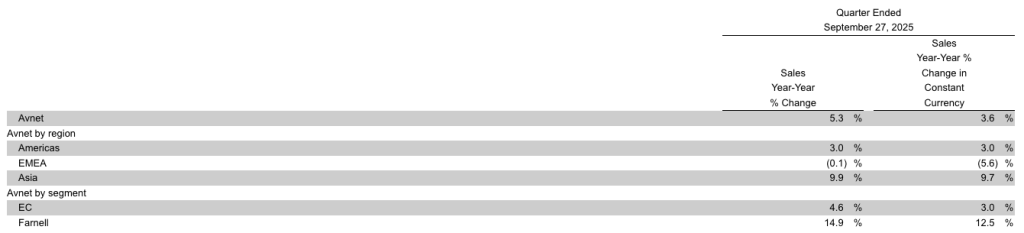

Sales in Constant Currency

The following table presents the percentage change in sales and the percentage change in sales in constant currency for the first quarter of fiscal year 2026 compared to the first quarter of fiscal year 2025.

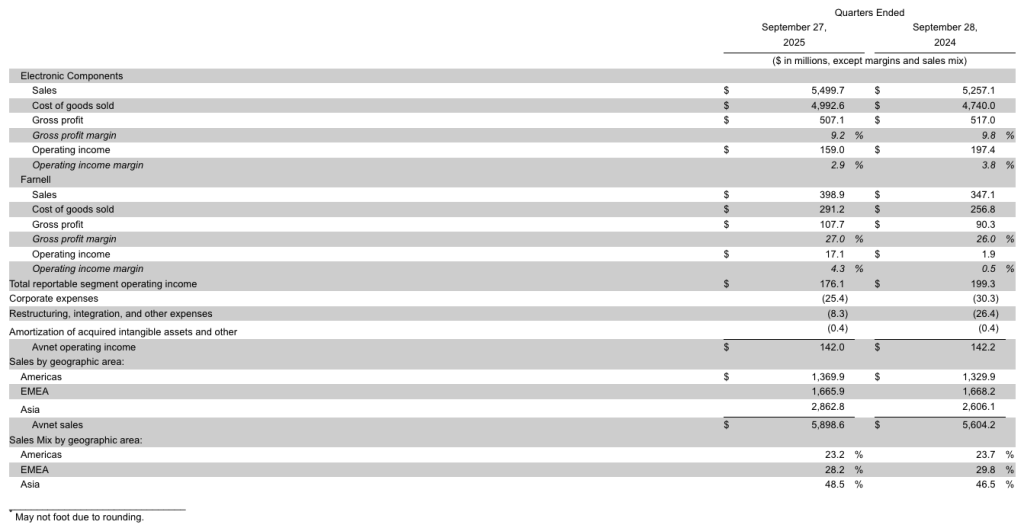

Segment Financial Information*

Guidance Reconciliation

The following table presents the reconciliation of non-GAAP adjusted diluted earnings per share guidance to the expected GAAP diluted earnings per share guidance for the second quarter of fiscal 2026.

SourceAvnet

EMR Analysis

More information on Avnet: See the full profile on EMR Executive Services

More information on Phil Gallagher (Chief Executive Officer, Avnet): See the full profile on EMR Executive Services

More information on Ken Jacobson (Chief Financial Officer, Avnet): See the full profile on EMR Executive Services

More information on Joe Burke (Vice President, Treasury & Investor Relations, Avnet): See the full profile on EMR Executive Services

More information on Multicomp Pro by Avnet: See the full profile on EMR Executive Services

More information on Farnell (Farnell, Newark, element14): See the full profile on EMR Executive Services

More information on Rebeca Obregon-Jimenez (President, Farnell, Avnet): See the full profile on EMR Executive Services

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The Avnet First Quarter 2026 Presentation can be found here: https://ir.avnet.com/static-files/1b54f8fa-34ec-4f0a-86c4-0adae508ec21

- The Avnet Annual Report 2025 (Form 10-K) can be found here: https://ir.avnet.com/static-files/438048be-53d7-4311-96e9-e276d329e73c

- The Avnet Fourth Quarter and Fiscal Year 2025 Presentation can be found here: https://ir.avnet.com/static-files/e1886a6b-862b-4fe1-9c45-90edeb0b0595

- The Avnet Annual Report 2024 (Form 10-K) can be found here: https://ir.avnet.com/static-files/15e09ee4-0111-4d5e-9ff1-2adfdeaae8d0

- The Avnet Fourth Quarter 2024 Presentation can be found here: https://ir.avnet.com/static-files/46596881-303b-45aa-a1b5-cf91f182344f

- The Avnet Annual Report 2023 can be found here: https://ir.avnet.com/static-files/04387c10-3a4d-4776-a9df-fa5f16c828f9

- The Avnet Fourth Quarter and Fiscal Year 2023 Presentation can be found here: https://ir.avnet.com/static-files/b3bc3476-ac71-4d08-9cb9-a3ad491cad6f

- The Avnet Annual Report 2022 can be found here: https://ir.avnet.com/static-files/04ad22e7-96f4-4079-8351-475e9f800d56