ABB – Q3 2025 results

Ad hoc Announcement pursuant to Art. 53 Listing Rules of SIX Swiss Exchange

Q3 2025 results

High order and revenue growth, improved margin and strong free cash flow

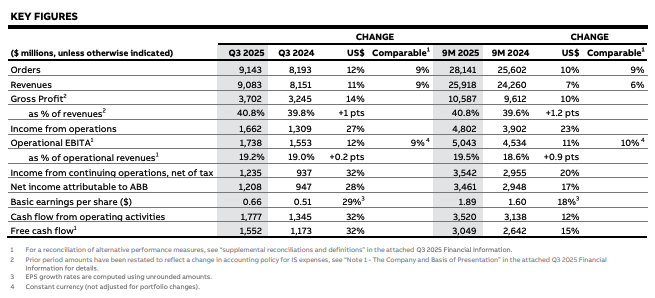

- Orders $9,143million, +12%; comparable1 +9%

- Revenues $9,083 million, +11%; comparable1 +9%

- Income from operations $1,662 million; margin 18.3%

- Operational EBITA1 $1,738 million; margin1 19.2%

- Basic EPS $0.66; +29%3

- Cash flow from operating activities $1,777 million; +32%

- Return on Capital Employed 23.3%

I am proud of ABB achieving good order growth, further improving operational performance and delivering a strong cash flow in the third quarter. We continue to invest to support robust long-term demand for our electrification and automation technologies.

Morten Wierod, CEO

CEO summary

In the third quarter 2025, I was pleased to see a robust overall market situation as customers continue to invest behind electrical power and automation. We achieved a positive book-to-bill of 1.01, supported by three out of four business areas, with Robotics & Discrete Automation still hampered by a challenging discrete automation market. Our operational results were even a bit better than originally expected with a strong revenue growth of 11% (9% comparable), a 20 basis points margin improvement to 19.2% and a strong free cash flow of $1.6 billion. All combined, we are on a good path towards our ambition of delivering another record year for ABB.

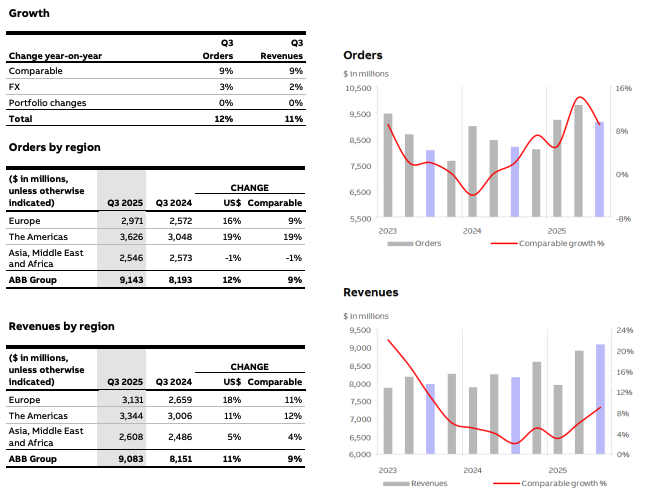

We improved orders by 12% (9% comparable) to $9.1 billion, with a positive development in all four business areas. Demand was particularly strong in the data center segment which improved orders at a double-digit rate. Positive development was seen in the electrification areas of infrastructure and commercial buildings. Orders in the machine builder segment increased significantly, but this relates more to last year’s low comparable as the general market conditions remain muted. Customer activity in the energy segment is robust. Similar to recent quarters, demand was muted in the process industry-related areas of pulp & paper, chemicals and mining; and with weakness in automotive and residential buildings.

US tariff-related market uncertainties remain, but so far we have not seen any material impact on demand or profitability. We continue to focus on what we can control: serving our customers and taking action to improve our market position and profitability.

Our long-standing local-for-local footprint serves us well, and we continue to invest in increasing localization levels. During the quarter we announced combined investments of $210 million in North America to expand the Electrification business area’s local R&D and manufacturing capabilities in the United States and Canada. These investments will support the long-term demand from the surging power needs of AI in data centers, grid modernization and resilience and customers improving energy efficiency and up-time to reduce their costs.

It was good to see the Motion Drive Products division further strengthening their customer value proposition by launching the next-gen machinery drive. This new drive is engineered specifically for performance and connectivity in industrial machinery applications with stringent cybersecurity requirements, while offering customers reduced complexity and installation time. Well done by the team.

After the close of the third quarter, we announced the changed plans for the ABB Robotics division. Instead of doing a spin-off, as communicated earlier this year, we have signed an agreement to divest the business to SoftBank Group for an enterprise value of $5.375 billion. In our view, the bid reflects the long-term strengths of ABB Robotics, which will benefit from combining its leading technology and deep industry expertise with SoftBank’s state-of-theart capabilities in AI, robotics and next-generation computing. Upon closing of the deal, anticipated for midto-late 2026, we will use the proceeds from the transaction in accordance with our capital allocation priorities. As a result of the signing of the agreement, ABB will move to three business areas as from the fourth quarter 2025. The Robotics division will be reported as Discontinued operations and the Machine Automation division will become a part of the Process Automation business area.

We have also announced that CFO, Timo Ihamuotila, will step down from the Executive Committee effective February 1, 2026, as he has decided to focus on nonoperational roles. Timo will be succeeded by the internal candidate Christian Nilsson who joined ABB in 2017 as CFO of the Electrification business area.

Morten Wierod

CEO

Outlook

Guidance based on new reporting structure effective as from fourth quarter 2025

In the fourth quarter of 2025, we anticipate comparable revenue growth to be in the mid-single digit range, and the Operational EBITA margin to sequentially soften from the third quarter by approximately -150 basis points, in line with historical pattern; however acknowledging the uncertainty for the global business environment.

In full-year 2025, we expect a positive book-to-bill, comparable revenue growth in the mid-single digit range and an Operational EBITA margin broadly at the higher end of the long-term target range of 16%-19%, however acknowledging the uncertainty for the global business environment.

Orders and revenues

In the third quarter, demand for electrical power infrastructure and automation continued its strong trend. Uncertainties from potential impacts related to US imposed tariffs remain, similar to the previous quarter, but have not materially impacted business activity. With the majority of ABB’s manufacturing set up on a local-for-local basis, tariff-related cost inflation has so far been limited, and mitigating pricing activities have been implemented. Order intake amounted to $9,143 million and improved by 12% (9% comparable) year-on-year, supported by a positive development in all four business areas.

Orders in the Americas were up by 19% (19% comparable), with the mid-single digit growth in base orders further fueled by large bookings. Orders in Europe were up by 16% (9% comparable). Asia, Middle East and Africa declined by 1% (1% comparable) with China being down by 3% (4% comparable).

In transport & infrastructure, the trading environment and pipeline remains strong in marine and ports, although quarterly order intake remained stable yearon-year. The rail segment remains robust and orders increased sharply. The segment for land transport infrastructure benefited from upgrades of electrical equipment for such as airports, tunnels etc.

In the industrial areas, the utilities segment remains generally very strong, although with a modest order improvement in this quarter. The market sentiment in data centers was very strong and orders increased by double-digits.

The buildings segment improved overall, with a stable to positive development in both Europe and the United States more than offsetting the general weakness in China.

In the robotics business, weakness in the automotive and general industry segments was offset by a positive development in areas like consumer electronics and logistics. Orders in the machine builder segment increased sharply from a low comparable, however the absolute level remains subdued in a continued challenging market.

Orders in the oil & gas segment improved. There was increased activity among nuclear customers, however slower demand in renewables. Declines were noted in mining, pulp & paper and chemicals.

Revenues improved in all business areas and amounted to $9,083 million, up by 11% (9% comparable). This was supported by backlog execution as well as positive developments in the short-cycle and service businesses. Higher volumes was the main driver of the revenue growth, with some added support from positive pricing.

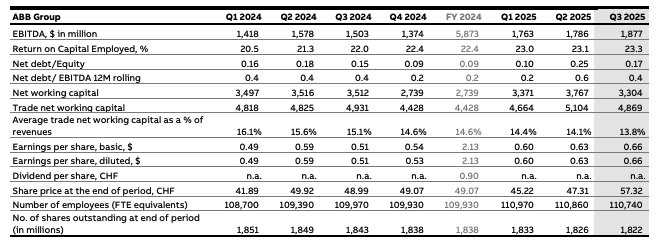

Earnings

Gross profit

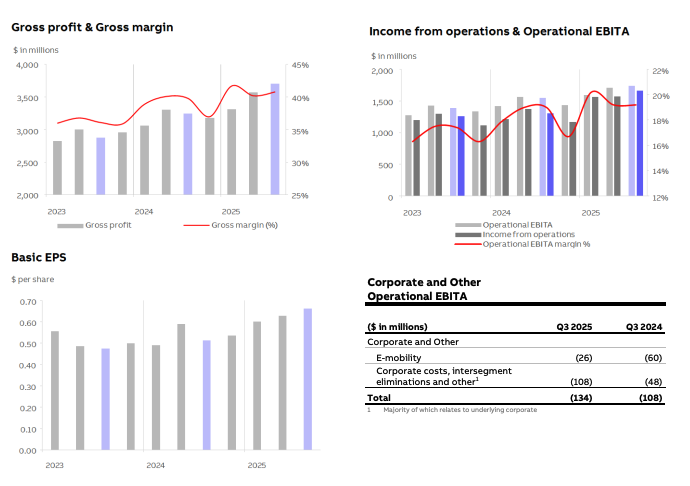

Gross profit increased by 14% (11% constant currency) year-on-year to $3,702 million, reflecting a gross margin of 40.8%, up 100 basis points. Gross margin remained stable or improved in all business areas.

Income from operations

Income from operations amounted to $1,662 million and increased by 27% year-on-year. This was mainly driven by improved operational business performance with additional support from Certain other fair value changes as well as the positive contribution from Foreign exchange timing differences. These combined positive effects more than offset somewhat higher Acquisition and divestment-related expenses. The Income from operations margin was 18.3% and improved by 220 basis points.

Operational EBITA

Operational EBITA increased by 12% year-on-year to $1,738 million, resulting in a 20 basis points margin improvement to 19.2%. Higher results were supported by improved performance in the businesses, which more than offset increased Corporate expenses. The positive business impacts from higher volumes, slightly positive pricing and improved efficiency more than compensated for the increase in expenses related to Research and Development (R&D) as well as Sales, General & Administrative (SG&A). SG&A increased only slightly in relation to revenues to 19.1% from last year’s 19.0%. Operational EBITA in Corporate and Other amounted to -$134 million compared with last year’s -$108 million. Underlying corporate costs were $108 million while the E-mobility business reported a somewhat lower than anticipated loss at $26 million.

Finance net

Net finance income contributed to results with a positive $13 million, representing a higher income compared with last year’s $2 million.

Income tax

Income tax expense was $452 million, and the effective tax rate was 26.8%.

Net income and earnings per share

Net income attributable to ABB was $1,208 million, representing an increase of 28% year-on-year, mainly helped by the impact of improved business performance, with some additional support from improved Net finance income and a lower tax rate year-on-year. Basic earnings per share increased by 29% to $0.66, up from $0.51 in the previous year period.

Balance sheet & Cash flow

Trade net working capital1

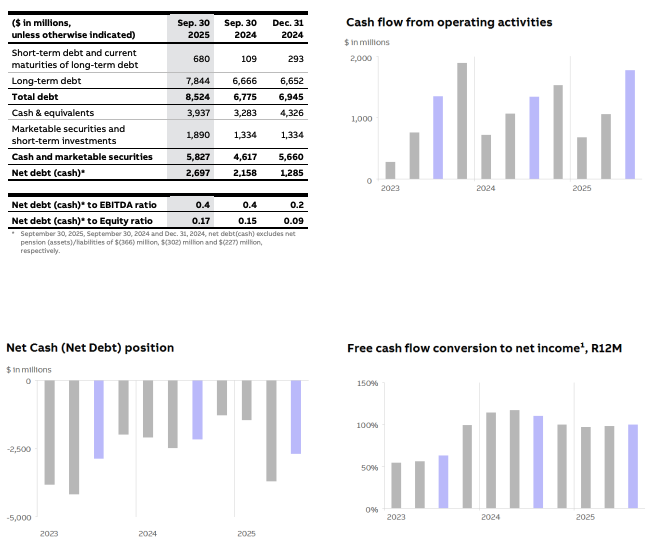

Trade net working capital amounted to $4,869 million, decreasing slightly year-on-year from $4,931 million, as the increase in receivables was mostly offset by higher customer advances and payables. The average trade net working capital as a percentage of revenues1 was 13.8% which declined from 15.1% one year ago.

Capital expenditures

Purchases of property, plant and equipment and intangible assets during the third quarter amounted to $229 million, higher than last year’s $196 million.

Net debt

Net debt1 amounted to $2,697 million at the end of the quarter and increased from $2,158 million year-on-year. The sequential decrease from $3,701 million in the second quarter was mainly due to the very strong cash generation in the third quarter, partially offset by purchases of treasury shares

Cash flows

Cash flow from operating activities during the third quarter was $1,777 million, an increase of 32% from last year’s $1,345 million. Contribution to the strong cash flow derived from stronger earnings as well as a reduction in Net Working Capital, mainly linked to contribution from contract assets and liabilities and timing of accrued expenses. Free cash flow amounted to $1,552 million, and improved materially from last year’s $1,173 million, despite the higher capex spend.

Share buyback program

A share buyback program of up to $1.5 billion was launched on February 10, 2025. During the third quarter, ABB repurchased a total of 5,262,688 shares for a total amount of approximately $344 million. As at the end of the third quarter, ABB’s total number of issued shares, including shares held in treasury, amounts to 1,843,899,204.

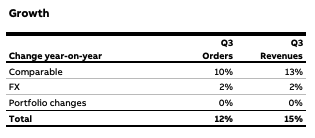

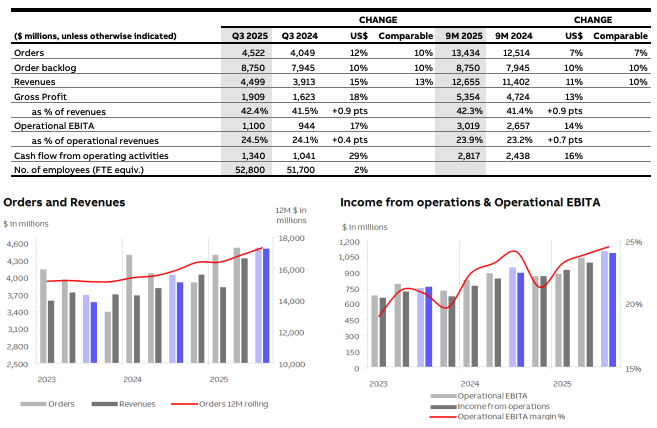

Electrification

Orders and revenues

In a buoyant business environment, orders increased by 12% (10% comparable) to $4,522 million as customers continue to invest behind electrical power. Revenues were record-high, yet book-to-bill was positive at 1.01.

- All customer segments had stable to positive order development. Growth was particularly strong in data centers which improved at a double-digit rate. Buildings was overall positive, with the US and Europe improving within the commercial area and remaining broadly stable for residential. The buildings market in China remains weak overall. Utilities remain strong, although orders were broadly stable on a high comparable. Another area for high customer activity was land transport infrastructure, such as airports, rail, tunnels.

- The Americas increased by 17% (18% comparable) with a very strong development of 23% (23% comparable) in the United States. Europe was up by 22% (15% comparable). Asia, Middle East and Africa declined by 5% (6% comparable) with China being down by 10% (12% comparable).

- Revenues improved strongly in virtually all divisions and was even a bit better than originally expected with a strong ending to the quarter. Revenues amounted to $4,499 million and higher volumes was the main driver to the 15% (13% comparable) increase, reflecting high deliveries linked to the order backlog for the medium voltage and power protection offering, as well as improved short-cycle demand. Additional support derived from a slightly positive price development.

Profit

Most divisions improved earnings and margin, supporting the total increase of 17% in Operational EBITA to $1,100 million, reflecting a margin of 24.5%, up 40 basis points from last year.

- The improved result was driven by the impacts from operational leverage on higher volumes which more than offset higher spend on R&D and SG&A, year-on-year. While R&D increased slightly as a percentage of revenues, the SG&A percentage declined.

- Tariff-related cost impact was not material and was offset by productivity measures and pricing.

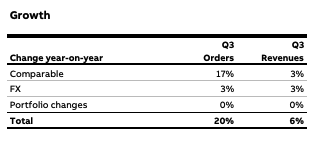

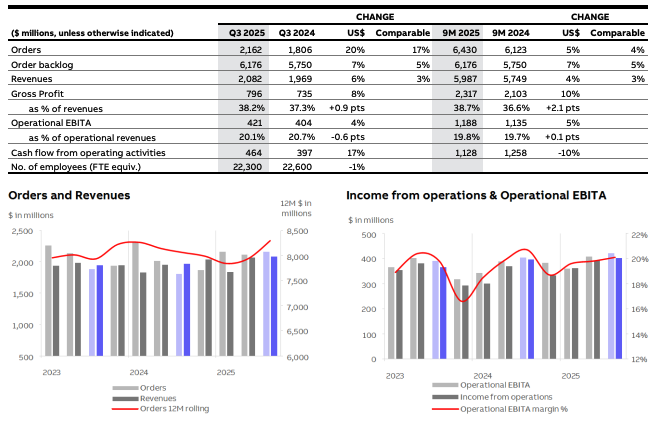

Motion

Orders and revenues

Order intake was high at $2,162 million and improved by 20% (17% comparable). A positive development in both the project and short-cycle businesses supported the book-to-bill of 1.04.

- Orders increased in the segments of HVAC for commercial buildings, water & wastewater, oil & gas, power generation and food & beverage. Similar to previous quarters, weakness was seen in the processrelated segments of chemicals, pulp & paper and metals. The pipeline for rail is robust, and orders improved sharply.

- Orders improved in all regions. The Americas was up by 35% (33% comparable), with the strong improvement of 43% (40% comparable) in the United States positively impacted by timing of large orders booked. The comparable was fairly low for both Europe, which was up by 15% (8% comparable) and Asia, Middle East and Africa up by 8% (8% comparable), with China improving 3% (2% comparable).

- Revenues amounted to $2,082 million and improved by 6% (3% comparable). Higher short-cycle volumes and a positive development in the service business was the somewhat larger driver to comparable revenue growth, with further support from positive price impacts. Deliveries from the project and systemrelated business were somewhat lower than anticipated.

Profit

Operational EBITA improved by 4%, however the margin of 20.1% softened by 60 basis points from last year’s alltime-high level.

- The positive impact on margin from operational leverage on higher volumes and positive price was more than offset mainly by higher SG&A and R&D.

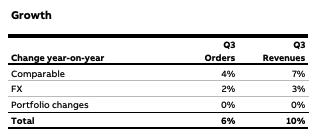

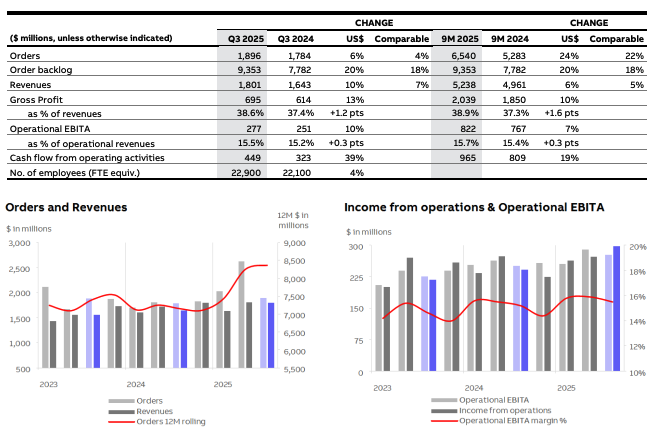

Process Automation

Orders and revenues

At 1.05, this was the 20th consecutive quarter with Process Automation achieving a positive book-to-bill. Order intake of $1,896 million was up by 6% (4% comparable) and improved despite a lower level of large bookings, as customers continue to invest in safe and efficient uptime solutions through automation, electrification and digitalization.

- The strongest order improvement was seen in the energy-related segments of oil & gas and conventional power generation. There was also an increased activity among nuclear customers, however slower for renewables, such as solar and wind. The market for marine and port automation and electrification remains strong, although order intake was stable in the quarter. A decline was recorded in the process industry-related areas of chemical, pulp & paper and mining.

- Revenues amounted to $1,801 million, up 10% (7% comparable) with the broad-based support from execution of the order backlog, strong growth in the service business and improvement in the short-cycle product business. Higher deliveries was the key driver to comparable revenue growth, with additional support from price and mix impacts.

Profit

Operational EBITA increased by 10% to $277 million with margin somewhat better than expected at 15.5%, up 30 basis points from last year.

- The margin improvement was mainly supported by the impacts from higher volume and positive pricing. These combined positive effects more than offset increased spend for R&D as well as slightly higher SG&A.

As from the fourth quarter 2025, the Process Automation business area will also contain the Machine Automation division, currently part of the Robotics & Discrete Automation business area.

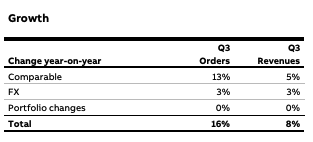

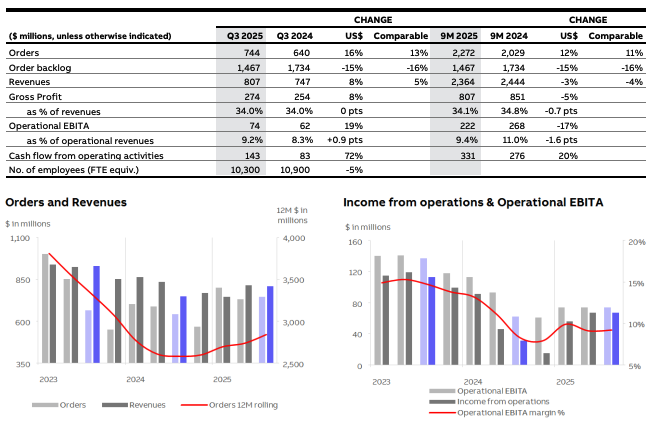

Robotics & Discrete Automation

Orders and revenues

As expected, there was a slight sequential order increase, reflecting a year-on-year, improvement of 16% (13% comparable).

- Orders in the Robotics division remained broadly stable year-on-year as weakness in the automotive and general industry segments was offset by a positive development in areas like consumer electronics and logistics.

- Orders in the Machine Automation division increased sharply from a low level, however the absolute order level remains subdued in a continued challenging market.

- Revenues amounted to $807 million for the business area, up by 8% (5% comparable). Both divisions improved from last year’s low comparable, supported mainly by backlog execution triggering higher volumes, with some additional support from price.

Profit

Both earnings and margin improved materially from last year’s low level, and remained broadly stable sequentially with the Operational EBITA at $74 million and margin at 9.2%.

- In Robotics, both earnings and margin improved yearon-year as the division continued to deliver a doubledigit profitability level, supported by higher volumes and stable pricing.

- Machine Automation delivered earnings at a breakeven level as savings from cost measures did not offset the adverse impacts from low utilization rates in production.

As from the fourth quarter 2025, the business area will be dissolved as a consequence of the signed agreement to divest the Robotics division, which will be reported in Discontinued operations. The Machine Automation division will become part of the Process Automation business area.

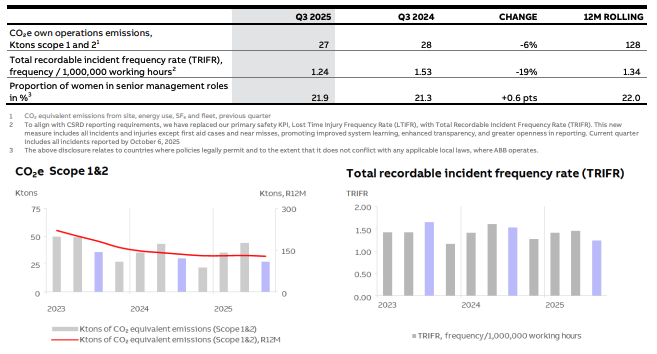

Sustainability

Events from the Quarter

- ABB has opened a new $35 million manufacturing and R&D facility in Nottingham, U.K., to expand research and development and production of its Furse® earthing and lightning solutions. These advanced products help safeguard critical infrastructure against lightning strikes and electrical surges, preventing costly damage and disruption. The investment will enable ABB to meet growing demand from customers who want to protect critical industries, driven by increased frequency and intensity of severe weather events, along with urbanization, and more stringent building and data center safety requirements. The site integrates the latest technologies for sustainable operations, bringing together ABB’s digital and renewable energy solutions to increase energy efficiency and reduce emissions.

- During the quarter, ABB has also expanded its IE5 SynRM motor portfolio with three smaller frame sizes. This gives customers the broadest range of magnetand rare earth-free motors to boost efficiency, reliability, and sustainability across even more applications. With the expanded SynRM range, the company is ensuring that every motor, no matter the size, plays its part in helping boost productivity for our customers while cutting emissions. ABB’s IE5 SynRM motors cut energy losses by up to 40% compared to IE3 motors. For example, a single 90 kW motor can save €79,800 and reduce CO₂ emissions by 95,760 kg over 20 years. Industrial sites typically operate dozens or even hundreds of smaller motors alongside larger ones, multiplying these savings and environmental benefits, often delivering a payback in as little as 5 months.

- ABB is enabling faster, safer and more cost-effective rebuilding in areas devastated by the 2025 Southern California wildfires through a collaboration with Cosmic Buildings – a leading construction technology company that uses proprietary mobile robotic microfactories. The microfactory in the Pacific Palisades, California, builds modular structures onsite, offering a glimpse into the future of affordable housing construction. ABB’s robots and digital twin technologies are being integrated into Cosmic’s AIpowered mobile microfactory that reduces construction time by up to 70% and lowers total building costs by approximately 30% compared to conventional methods. Homes can be delivered in just 12 weeks. The process also minimizes waste and improves build quality, easing the burden on homeowners facing underinsurance and inflated rebuilding costs.

- ABB will deliver 1,500 NINVA™ non-invasive temperature sensors approved for marine use to eMarine, a Swedish company dedicated to enabling efficiency and sustainability in the maritime industry. NINVA will complement eMarine’s advanced energy management solutions already deployed on major cruise and cargo vessels worldwide. The data collected by the innovative NINVA temperature sensors will play a key role in optimizing heat recovery as well as the management of cooling water and ventilation systems onboard. The insights will enable lower fuel consumption, measurable energy savings, and reduced CO₂ emissions. With enhanced vibration resistance up to 4g, the sensors meet the demanding conditions of marine operations while maintaining the same accuracy as invasive thermowells – without the need to perforate pipe walls.

Significant events

After Q3 2025

- On October 8, 2025, ABB announced it had signed an agreement to divest its Robotics division to SoftBank Group for an enterprise value of $5.375 billion, and therefore was not pursuing its earlier intention to spin-off the business as a separately listed company. The transaction is subject to regulatory approvals and further customary closing conditions and is expected to close in mid-to-late 2026.

- On October 8, 2025, ABB announced that Sami Atiya, President Robotics & Discrete Automation business area and Member of the Executive Committee, will step down from the Executive Committee at the end of 2025 and leave ABB by the end of 2026 in line with the announced divestment of the Robotics division.

- On October 16, 2025, ABB announced that CFO, Timo Ihamuotila, will step down from the Executive Committee effective February 1, 2026, and leave ABB at the end of 2026. Timo will be succeeded by the internal candidate Christian Nilsson who joined ABB in 2017 as CFO of the Electrification business area

First nine months of 2025

In the first nine months of 2025, order intake increased 10% (9% comparable) year-on-year to $28,141 million, supported by all four business areas.

Revenues improved by 7% (6% comparable) to $25,918 million on execution of the large order backlog and a positive development in the short-cycle businesses. Overall, book-to-bill reached 1.09.

Income from operations amounted to $4,802 million, significantly up 23% year-on-year, resulting in a margin of 18.5%. The earnings increase was mainly driven by improved operational business performance, with additional support from Certain other fair value changes as well as from impacts from Foreign exchange/commodity timing differences.

Operational EBITA increased by 11% to $5,043 million. Improvements in the Electrification, Motion and Process Automation business areas, as well as lower losses in the E-mobility business more than offset the earnings decline in Robotics & Discrete Automation. Moreover, an operational net gain of approximately $140 million relating to a real estate sale in Corporate and Other had a positive impact.

The Operational EBITA margin improved by 90 basis points to 19.5% with the main drivers being operating leverage on higher volumes, positive pricing and improved operational efficiency. Corporate and Other Operational EBITA amounted to -$208 million. This includes a loss of $115 million attributed to the E-mobility business, which was negatively affected by low volumes.

Net finance contributed to results with $45 million, below last year’s income of $55 million. Income tax expense was $1,347 million reflecting a tax rate of 27.6%.

Net income attributable to ABB was $3,461 million, up from $2,948 million in the prior year period. Basic earnings per share was $1.89, representing an increase of 18%.

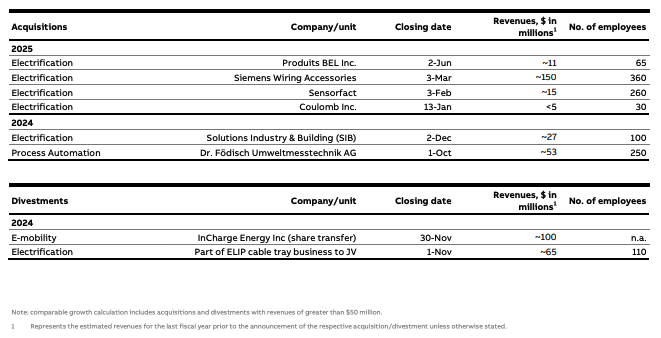

Acquisitions and divestments, last twelve months

Additional figures

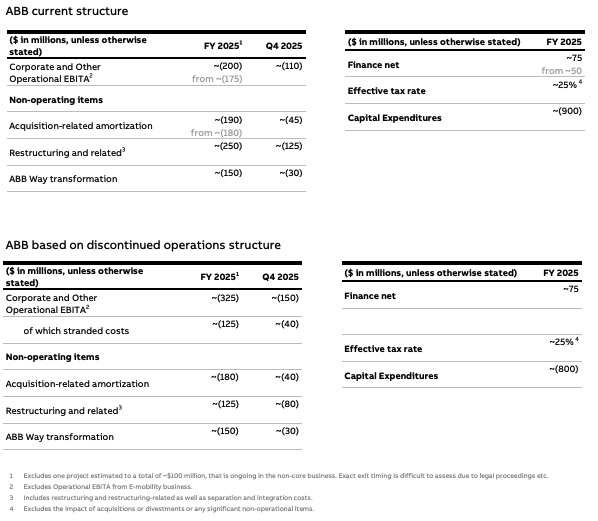

Additional 2025 guidance

Important notice about forward-looking information

This press release includes forward-looking information and statements as well as other statements concerning the outlook for our business, including those in the sections of this release titled “CEO summary,” “Outlook,” “Sustainability” “Significant events” and “Additional 2025 guidance”. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions and the economic conditions of the regions and industries that are major markets for ABB. These expectations, estimates and projections are generally identifiable by statements containing words such as “anticipates,” “expects,” “estimates,” “intends,” “plans,” “targets,” “guidance,” or similar expressions. However, there are many risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this press release and which could affect our ability to achieve any or all of our stated targets. These include, among others, business risks associated with the volatile global economic environment and political conditions, market acceptance of new products and services, changes in governmental regulations and currency exchange rates. Although ABB Ltd believes that its expectations reflected in any such forward looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.

Q3 results presentation on October 16, 2025

The Q3 2025 results press release and presentation slides are available on the ABB News Center at www.abb.com/news and on the Investor Relations homepage at www.abb.com/investorrelations.

A conference call and webcast for analysts and investors is scheduled to begin at 10:00 a.m. CET. To pre-register for the conference call or to join the webcast, please refer to the ABB website: www.abb.com/investorrelations.

The recorded session will be available after the event on ABB’s website.

Financial calendar

2025

- November 18 – Capital Markets Day in New Berlin, United States

2026

- January 29 – Q4 2025 results

- February 19 – Planned publication of Annual Reporting Suite

- March 19 – Annual General Meeting

- April 22 – Q1 2026 results

- July 16 – Q2 2026 results

- October 16 – Q3 2026 results

SourceABB

EMR Analysis

More information on ABB: See full profile on EMR Executive Services

More information on Morten Wierod (Chief Executive Officer and Member of the Group Executive Committee, ABB): See full profile on EMR Executive Services

More information on Timo Ihamuotila (Chief Financial Officer, ABB till end of 2026 + Member of the Executive Committee, ABB till February 1, 2026): See full profile on EMR Executive Services

More information on Christian Nilsson (Chief Financial Officer, Electrification Business Area, ABB till February 1, 2026 + Chief Financial Officer and Member of the Executive Committee, ABB as from February 1, 2026): See full profile on EMR Executive Services

More information on the Sustainability Strategy and Sustainability Statement 2024 by ABB: See full profile on EMR Executive Services

More information on Karin Lepasoon (Chief Communications and Sustainability Officer and Member of Executive Committee, ABB): See full profile on EMR Executive Services

More information on Electrification Business Area by ABB: See the full profile on EMR Executive Services

More information on Giampiero Frisio (President, Electrification Business Area and Member of the Executive Committee, ABB): See full profile on EMR Executive Services

More information on Motion Business Area by ABB: See the full profile on EMR Executive Services

More information on Brandon Spencer (President, Motion Business Area and Member of the Executive Committee, ABB): See full profile on EMR Executive Services

More information on Process Automation Business Area by ABB: See the full profile on EMR Executive Services

More information on Peter Terwiesch (President, Process Automation Business Area and Member of the Executive Committee, ABB): See full profile on EMR Executive Services

More information on Robotics & Discrete Automation Business Area by ABB: See full profile on EMR Executive Services

More information on Sami Atiya (President, Robotics & Discrete Automation Business Area and Member of the Executive Committee, ABB till end of 2025 + Strategic Advisor, ABB from January 2026 till December 2026): See full profile on EMR Executive Services

More information on SoftBank Group Corp.: https://group.softbank/en + The SoftBank Group is a global technology player that aspires to drive the Information Revolution. The SoftBank Group is comprised of the holding company SoftBank Group Corp. (TOKYO: 9984) and its global portfolio of companies, which includes advanced telecommunications, Internet services, AI, smart robotics, IoT and clean energy technology providers. In September 2016, Arm Limited, the world’s leading semiconductor IP company, joined the SoftBank Group. SoftBank Group Corp. is investing in the SoftBank Vision Fund, which is deploying up to $100 billion in committed capital to support the global businesses and technologies that the SoftBank Vision Fund believes will enable the next stage of the Information Revolution.

More information on Masayoshi Son (Founder, Representative Director, Corporate Officer, Chairman & Chief Executive Officer, SoftBank Group Corp.): https://group.softbank/en/about/officer + https://group.softbank/en/about/officer/son

More information on SoftBank Corp. by SoftBank Group Corp.: https://www.softbank.jp/en/ + Guided by the SoftBank Group’s corporate philosophy, “Information Revolution — Happiness for everyone,” SoftBank Corp. (TOKYO: 9434) operates telecommunications and IT businesses in Japan and globally. Building on its strong business foundation, SoftBank Corp. is expanding into non-telecom fields in line with its “Beyond Carrier” growth strategy while further growing its telecom business by harnessing the power of 5G/6G, IoT, Digital Twin and Non-Terrestrial Network (NTN) solutions, including High Altitude Platform Station (HAPS)-based stratospheric telecommunications. While constructing AI data centers and developing homegrown LLMs specialized for the Japanese language, SoftBank is integrating AI with radio access networks (AI-RAN), with the aim of becoming a provider of next-generation social infrastructure.

More information on Yasuyuki Imai (Director and Chairman, SoftBank Corp., SoftBank Group Corp.): https://www.softbank.jp/en/corp/aboutus/governance/corporate-governance/officer/ + https://www.linkedin.com/in/yasuyuki-imai-76709196/

More information on Junichi Miyakawa (President and Chief Executive Officer, SoftBank Corp., SoftBank Group Corp.): https://www.softbank.jp/en/corp/aboutus/governance/corporate-governance/officer/

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The ABB Q3 2025 Results Presentation can be found here: https://library.e.abb.com/public/21008831e120458797f5b71896bfb98c/ABB-Q3-2025-press-release-English.pdf

- The ABB Q3 2025 Financial Information can be found here: https://library.e.abb.com/public/ad1f406890f44fdd9fbb5c946134a7b5/ABB-Q3-2025-financial-information.pdf

- The ABB Q2 2025 Results Presentation can be found here: https://resources.news.e.abb.com/attachments/published/127767/en-US/15CDC0BE6575/ABB-Q2-2025-Presentation.pdf

- The ABB Q2 2025 Financial Information can be found here: https://library.e.abb.com/public/4ac21ed3c1af4118a5e7115e89205d10/ABB-Q2-2025-financial-information.pdf

- The ABB Integrated Report 2024 can be found here: https://library.e.abb.com/public/6fe759d28f0d4261b6c4a8ab21275fe3/ABB%20Integrated%20Report%202024.pdf

- The ABB Q4 2024 Full Financial Information can be found here: https://library.e.abb.com/public/daae2758e6a546efab24d3967aaa0f37/ABB-Q4-2024-financial-information.pdf

- The ABB Q4 2024 Group Results Presentation can be found here: https://library.e.abb.com/public/4e87bd89e0c541ed857d8085f22e7f61/ABB-Q4-2024-presentation.pdf

- The ABB Integrated Report 2023 can be found here: https://library.e.abb.com/public/8fe35c6a0c3943d5aacc783ce0ffaf3b/ABB%20Integrated%20Report%202023.pdf

- ABB Q4 2023 Full Financial Report can be found here: https://library.e.abb.com/public/9d87fae42fab43c297c4ee385296fd05/ABB-Q4-2023-financial-information.pdf

- ABB Q4 2023 Results Presentation Report can be found here: https://library.e.abb.com/public/0834f841fe5a4829bd9ce21ad23d8f70/ABB-Q4-2023_Group%20presentation.pdf

- ABB Q4 2022 Full Financial Report can be found here: https://library.e.abb.com/public/0c911f20f7cc46848b2e64bde82fb4f5/ABB-Q4-2022-financial-information.pdf

- ABB Q4 2022 Group Results Presentation can be found here: https://library.e.abb.com/public/63461737ba8345e3aa6d2461f06fc72d/ABB%20Q4%202022%20Group%20results%20presentation.pdf

- The ABB Integrated Report 2022 can be found here: https://library.e.abb.com/public/ef5852f1e2e54cad97abcc4fc48d1d58/Annual%20Reporting%20Suite_Integrated%20Report%202022_English.pdf

- The ABB Annual Report 2021 can be found here: https://library.e.abb.com/public/c6dae9af148d4d5fb87efc97bb4b460a/ABB-Group-Annual-Report-2021-English.pdf