Siemens – Earnings release and financial results Q1 FY 2026: strong start to fiscal 2026 – Outlook raised

Earnings Release Q1 FY 2026 October 1 to December 31, 2025

Strong start to fiscal 2026 – Outlook raised

“Our strong first-quarter performance shows that we’re delivering on our strategy. Siemens is very well positioned in its growth markets. Artificial intelligence is a strong growth driver for our businesses. We’re scaling industrial AI in our core industries together with world-class partners. By integrating AI deeply into design, development, products and operations, we’re adding measurable value for our customers,” said Roland Busch, President and Chief Executive Officer of Siemens AG. “After a strong start to the fiscal year, we raise our outlook.”

“Our strong operating performance translated into high profitability in the first quarter. We are continuing to rigorously execute our strategy, and our accelerated share buyback program is consistently creating value for shareholders,” said Ralf P. Thomas, Chief Financial Officer of Siemens AG.

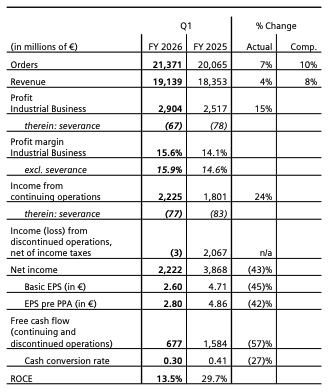

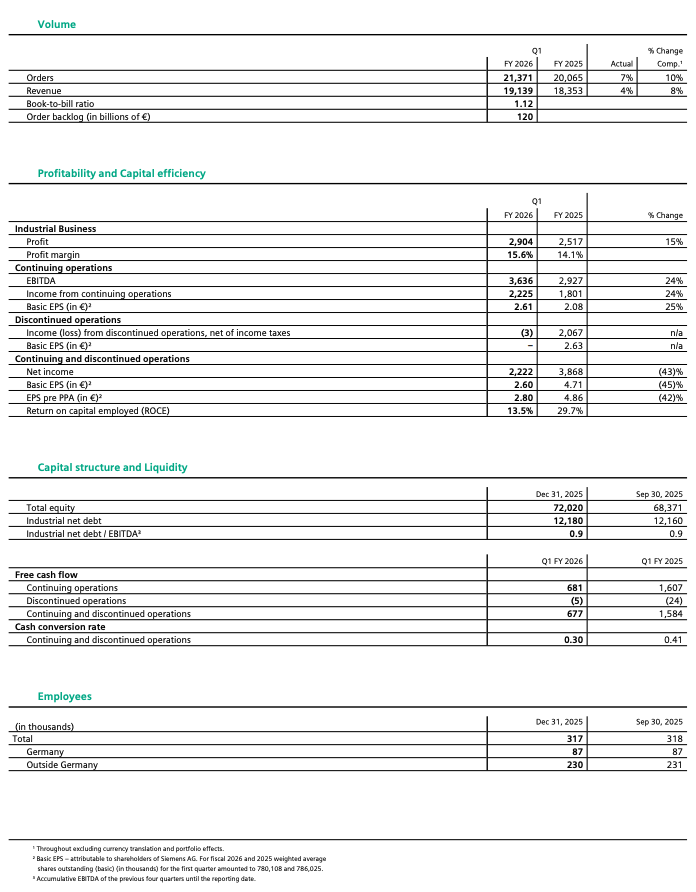

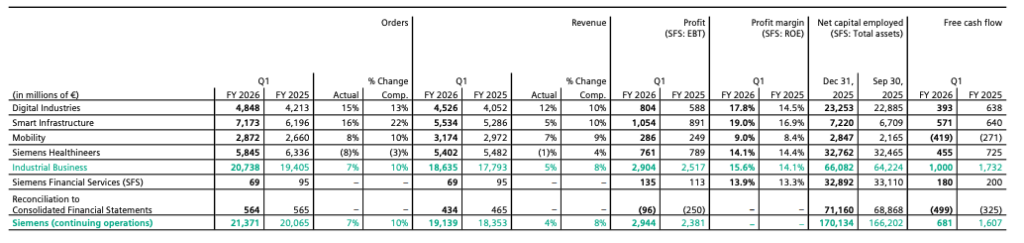

- First quarter orders were up 10% on a comparable basis, excluding currency translation and portfolio effects, with double-digit increases in most industrial businesses; comparable revenue rose 8%, including growth in all industrial businesses

- On a nominal basis, orders rose 7% to €21.4 billion, and revenue was up 4% to €19.1 billion; the book-to-bill ratio was 1.12

- Profit Industrial Business increased to €2.9 billion, with a profit margin of 15.6%, driven by considerable improvements at Digital Industries and Smart Infrastructure

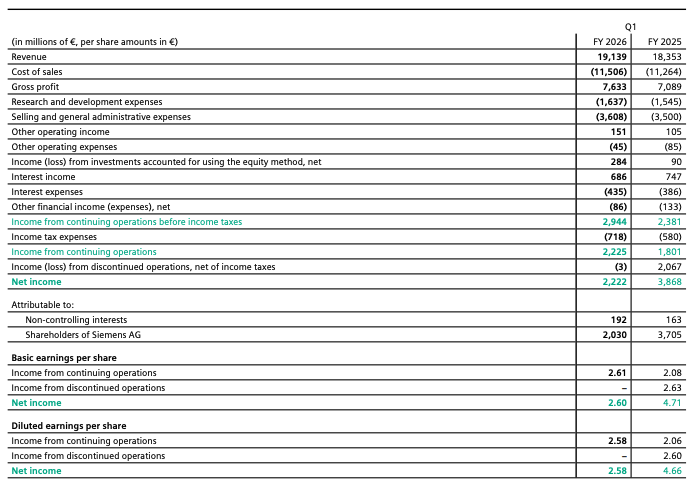

- Net income came in strong at €2.2 billion; in Q1 FY 2025, net income of €3.9 billion had benefited from a €2.1 billion gain (after tax) from the sale of Innomotics; for the current quarter, basic earnings per share (EPS) were €2.60, and EPS before purchase price allocation accounting (EPS pre PPA) were €2.80

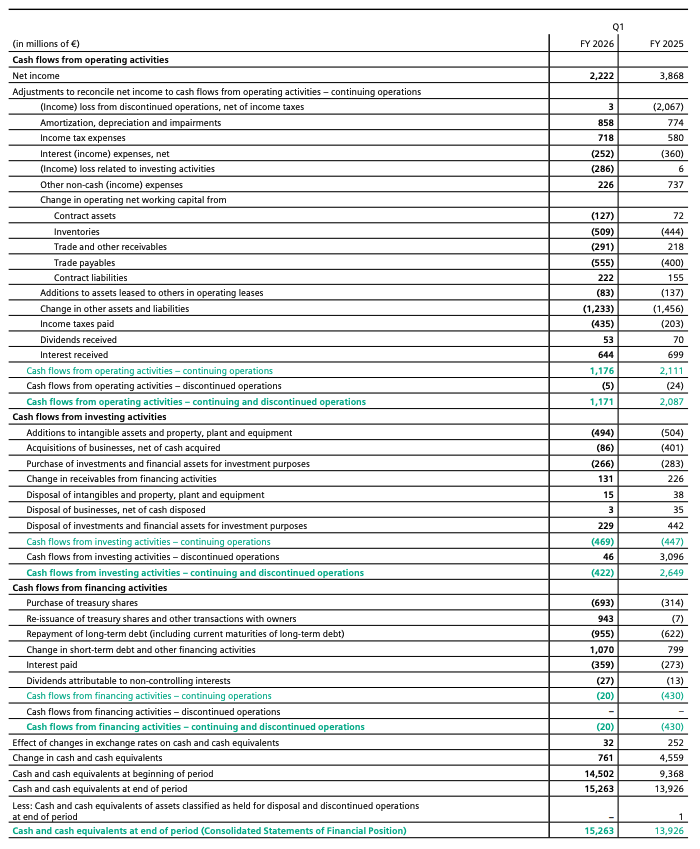

- Free cash flow from continuing and discontinued operations was €0.7 billion

Siemens

- Order growth was led by Smart Infrastructure, which posted record-high order intake, and was supported by significant growth at Digital Industries and clear growth at Mobility

- Broad-based revenue growth across industrial businesses, including a double-digit increase at Digital Industries, with strong growth contributions from both its software and its automation business

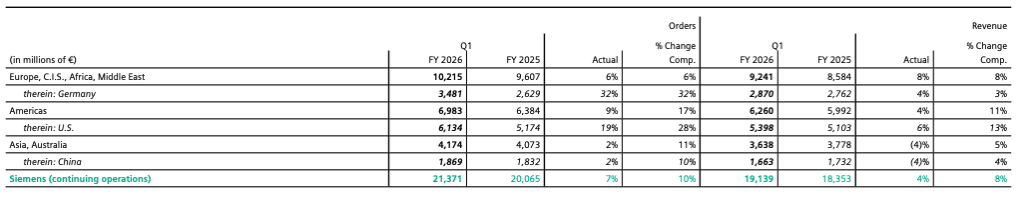

- Currency translation effects took five percentage points each from order and revenue growth; portfolio transactions added one percentage point to order and revenue growth

- Profit Industrial Business: Digital Industries recorded a substantial profit increase, mainly driven by the automation business; Smart Infrastructure continued to perform excellently, with significantly higher profit; profit margin Industrial Business was burdened by currency effects, with Digital Industries being most affected

- Strong net income; Q1 FY 2025 had benefited from a €2.1 billion gain (after tax) from the sale of Innomotics

- Decrease in Free cash flow was due mainly to Industrial Business, which generated a Free cash flow of €1.0 billion compared to €1.7 billion in Q1 FY 2025; main factor was a build-up of working capital, including effects from timing of payments in Mobility projects; outside Industrial Business, Siemens recorded a cash outflow of €0.4 billion related to settlement of an obligation of final disposal of nuclear waste

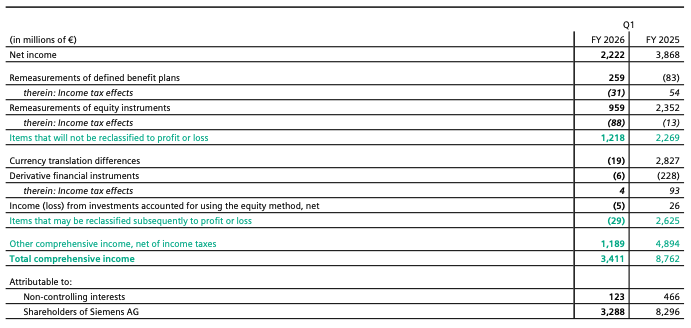

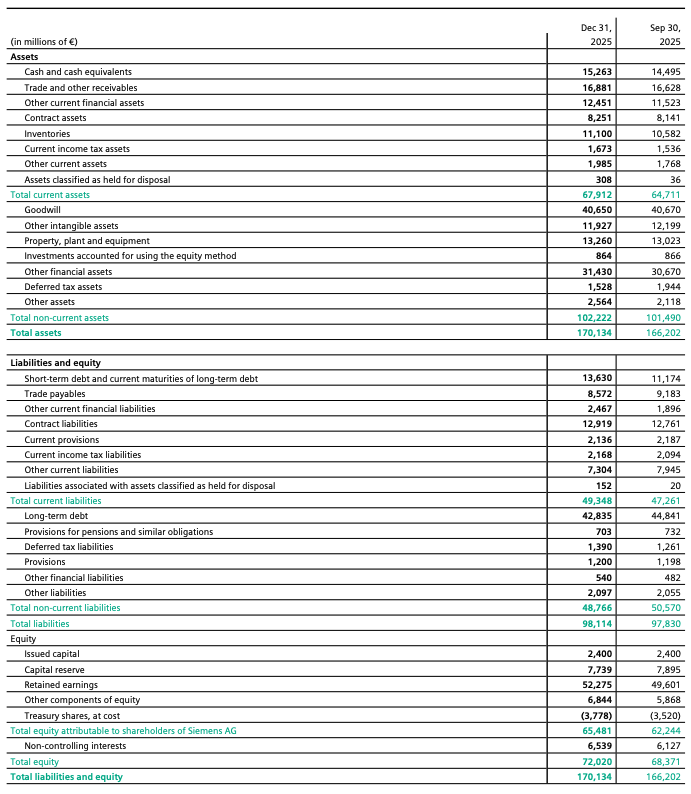

- As of December 31, 2025, provisions for pensions and similar obligations amounted to €0.7 billion, the same low level as of September 30, 2025

- Return on capital employed (ROCE) declined as a result of lower net income and a substantial increase in average capital employed; the latter was largely related to the acquisitions of Altair and Dotmatics

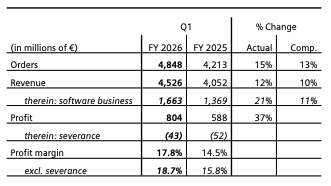

Digital Industries

- Double-digit increases in orders and revenue, with both the software business (which won several larger contracts) and the automation business (driven by the short-cycle business) contributing strongly to growth; new volume from recent acquisitions, in particular from Altair and Dotmatics, more than offset substantial negative currency translation effects

- On a geographic basis, orders and revenue were up in all reporting regions, with strong comparable increases in the U.S. and in China

- Substantial increases in profit and profitability were largely attributable to the automation business; overall, negative currency effects burdened profit and profitability; severance charges held back profit and profitability in both the current and the prior-year quarter; in addition, profit for the current quarter was impacted by €35 million in integration costs related to the acquisitions of Altair and Dotmatics, reducing Digital Industries’ profit margin by 0.7 percentage points

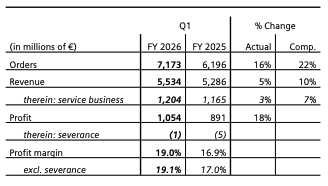

Smart Infrastructure

- Broad-based volume growth despite substantial headwinds from currency translation effects; on a comparable basis, orders and revenue increased in all businesses and all reporting regions

- Orders rose to a quarterly record high; this increase was mainly driven by the electrification and the electrical products businesses and included several larger contract wins from data center customers, predominantly in the U.S.

- Revenue growth was mainly driven by the electrification business, which continued to execute strongly on its large order backlog; on a geographic basis, growth was primarily attributable to the region Europe, C.I.S., Africa, Middle East and to the U.S.

- Smart Infrastructure increased profit and profitability in all its businesses on higher revenue, economies of scale, and ongoing productivity improvements; in addition, profitability benefited from positive commodity-hedging effects, which more than offset adverse currency effects

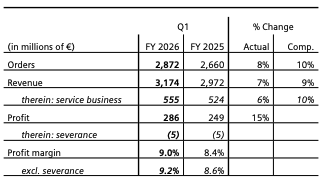

Mobility

- Orders rose due to higher volume from large orders, among them a contract worth €0.6 billion for delivery of battery-powered regional trains in Germany and an extension of an existing contract worth €0.4 billion for delivery of automatic metro trains in France

- Revenue growth was driven by the rolling stock business and the customer services business

- Profit and profitability rose, with the strongest increase coming from the rolling stock business

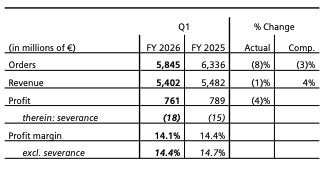

Siemens Healthineers

- Volume development influenced by negative currency translation effects; order intake decreased compared to Q1 FY 2025 which had included several large contract wins; revenue growth on a comparable basis in the precision therapy business and the imaging business was partly offset by a decline in the diagnostics business; this decrease was due mainly to a structural change in the market environment in China

- Profit impacted by increased tariffs and by negative currency effects (in the precision therapy business and the imaging business); in the diagnostics business, it was also impacted by the above-mentioned revenue decline and an unfavorable business mix

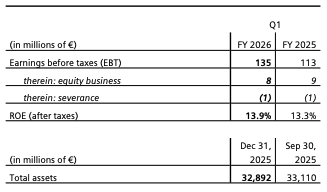

Siemens Financial Services

- Siemens Financial Services recorded a significantly higher earnings contribution from its debt business due mainly to lower expenses for credit risk provisions

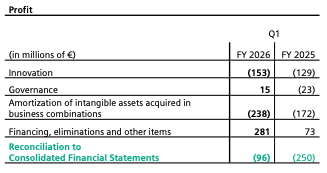

Reconciliation to Consolidated Financial Statements

- Change in result for Governance was due to a combination of higher income from Siemens brand fees and lower governance costs

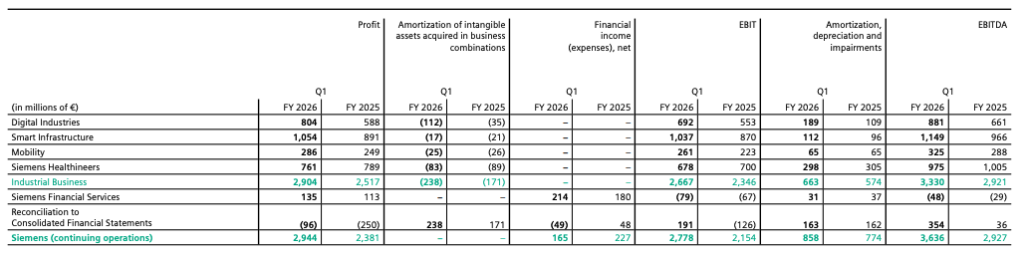

- Amortization of intangible assets acquired in business combinations rose due primarily to the acquisitions of Altair and Dotmatics

- Financing, eliminations and other items included a gain of €0.2 billion from contribution of shares in Fluence Energy, Inc. to the Siemens Pension Trust

- In February 2026, the sale of the airport logistics business in the U.S. was closed

Outlook

After a strong start to the fiscal year, we raise our outlook for basic EPS from net income before purchase price allocation accounting (EPS pre PPA) from a range of €10.40 to €11.00 to a range of €10.70 to €11.10 for fiscal 2026.

Furthermore, we confirm the remaining expectations for fiscal 2026 given in our Earnings Release Q4 FY 2025, which were as follows:

For fiscal 2026, we assume that the global economic environment will stabilize and that global GDP growth will remain near the prior-year level.

We also anticipate that in fiscal 2026 negative currency effects will strongly burden nominal growth rates in volume as well as profit for our industrial businesses and earnings per share (EPS).

For fiscal 2026, Digital Industries expects comparable revenue growth − net of currency translation and portfolio effects − of 5% to 10% and a profit margin of 15% to 19%.

Smart Infrastructure expects for fiscal 2026 comparable revenue growth of 6% to 9% and a profit margin of 18% to 19%.

Mobility expects for fiscal 2026 comparable revenue growth of 8% to 10% and a profit margin of 8% to 10%.

For the Siemens Group, we expect comparable revenue growth in the range of 6% to 8% and a book-to-bill ratio above 1 for fiscal 2026.

This outlook excludes burdens from legal and regulatory matters.

Notes and forward-looking statements

Starting today at 07:30 a.m. CET, the press conference call on Siemens’ first-quarter results for fiscal 2026 will be broadcast live at www.siemens.com/conferencecall.

Starting today at 08:30 a.m. CET, you can also follow the conference call for analysts and investors live at www.siemens.com/analystcall.

Recordings of the press conference call and the conference call for analysts and investors will be made available afterwards.

Starting today at 10:00 a.m. CET, we will also provide a live video webcast of Chairman of the Supervisory Board Jim Hagemann Snabe’s and CEO Roland Busch’s speeches to the Annual Shareholders’ Meeting in Munich, Germany. You can access the webcast at www.siemens.com/press/agm. A video of the speeches will be available after the live webcast.

Financial publications are available for download at: www.siemens.com/ir.

This document contains statements related to our future business and financial performance and future events or developments involving Siemens that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. We may also make forwardlooking statements in other reports, in prospectuses, in presentations, in material delivered to shareholders and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Siemens’ management, of which many are beyond Siemens’ control. These are subject to a number of risks, uncertainties and factors, including, but not limited to those described in disclosures, in particular in the chapter Report on expected developments and associated material opportunities and risks in the Combined Management Report of the Siemens Report (siemens.com/siemensreport), and in the Interim Group Management Report of the Half-year Financial Report (provided that it is already available for the current reporting year), which should be read in conjunction with the Combined Management Report. Should one or more of these risks or uncertainties materialize, should decrees, decisions, assessments or requirements of regulatory or governmental authorities deviate from our expectations, should events of force majeure, such as pandemics, unrest or acts of war, occur or should underlying expectations including future events occur at a later date or not at all or assumptions prove incorrect, actual results, performance or achievements of Siemens may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. Siemens neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Siemens’ net assets and financial positions or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

This document is a Quarterly Statement according to Section 53 of the Exchange Rules for the Frankfurter Wertpapierbörse.

Financial Results

First Quarter of Fiscal 2026

Key figures (in millions of €, except where otherwise stated)

Consolidated Statements of Income

Consolidated Statements of Comprehensive Income

Consolidated Statements of Financial Position

Consolidated Statements of Cash Flows

Overview of Segment figures

EBITDA Reconciliation

Orders & Revenue by region

SourceSiemens

EMR Analysis

More information on Siemens AG: See full profile on EMR Executive Services

More information on Jim Hagemann Snabe (Chairman of the Supervisory Board, Siemens AG): See full profile on EMR Executive Services

More information on Dr. Roland Busch (President and Chief Executive Officer, Siemens AG): See full profile on EMR Executive Services

More information on Prof. Dr. Ralf P. Thomas (Member of the Managing Board and Chief Financial Officer, Siemens AG till May 13, 2026 + Special Advisor to the Supervisory Board and the Managing Board, Siemens AG as from May 13, 2026 till end of 2026 + Chairman of the Supervisory Board, Siemens Healthineers AG, Siemens AG): See full profile on EMR Executive Services

More information on Veronika Bienert (Member of the Managing Board and Chief Financial Officer, Siemens AG as from April 1, 2026): See full profile on EMR Executive Services

More information on “ONE Tech Company” Program by Siemens AG: See full profile on EMR Executive Services

More information on Altair Engineering Inc. by Siemens AG: https://altair.com/ + When data science meets rocket science, incredible things happen. The innovation our world-changing technology enables may feel like magic to users, but it’s the time-tested result of the rigorous application of science, math, and Altair.

Our comprehensive, open-architecture simulation, artificial intelligence (AI), high-performance computing (HPC), and data analytics solutions empower organizations to build better, more efficient, more sustainable products and processes that will usher in the breakthroughs of tomorrow’s world. Welcome to the cutting edge of computational intelligence – no magic necessary.

More information on James R. Scapa (Founder, Chairman and Chief Executive Officer, Altair, Siemens AG): See full profile on EMR Executive Services

More information on Dotmatics by Siemens AG: https://www.dotmatics.com/ + Harmonizing Science & Data to Create a Better Future, Together.

From developing new personalized and preventive patient treatment solutions to revising climate change – Dotmatics solutions are at the core of scientific innovation.

Dotmatics is a leader in R&D scientific software connecting science, data, and decision-making. Its enterprise R&D platform and applications, including GraphPad Prism, SnapGene and Geneious, drive efficiency and accelerate innovation. More than 2 million scientists and 14,000 customers trust Dotmatics to help them create a healthier, cleaner, safer world. Dotmatics is a global team of more than 800 people dedicated to supporting its customers in over 180 countries. The company is headquartered in Boston, with 14 offices and R&D teams located around the world.

More information on Thomas Swalla (Chief Executive Officer, Dotmatics, Siemens AG): See full profile on EMR Executive Services

More information on Fluence Energy, Inc. by Siemens AG & AES Corporation: https://fluenceenergy.com/ + Fluence is enabling the global clean energy transition with market-leading energy storage products and services, and digital applications for renewables and storage.

Fluence Energy, Inc. (“Fluence”) (Nasdaq: FLNC) is a global market leader delivering intelligent energy storage and optimization software for renewables and storage. The Company’s solutions and operational services are helping to create a more resilient grid and unlock the full potential of renewable portfolios. With gigawatts of projects successfully contracted, deployed, and under management across nearly 50 markets, the Company is transforming the way we power our world for a more sustainable future.

More information on Julian Nebreda (President and Chief Executive Officer, Fluence Energy, Inc., Siemens AG): https://fluenceenergy.com/about/leadership/ + https://www.linkedin.com/in/julian-nebreda/

More information on Innomotics (previously Siemens Large Drives Applications) by KPS Capital Partners: https://www.innomotics.com/hub/en/ + Innomotics GmbH is a globally leading provider of electric motors and large drive systems that combines deep technical expertise and leading innovation in electrical solutions across industries and regions. With its more than 150 years of experience in developing electric motors, the company is the backbone for reliable drive technology in industry and infrastructure worldwide. Innomotics is a thought leader in the areas of industrial efficiency, electrification, sustainability, and digitalization. The company is headquartered in Nuremberg (Germany) and employs around 15,000 people worldwide. Annual revenue exceeds 3 billion euros. With 17 production sites and a comprehensive sales and service network in 49 countries, Innomotics has a wellbalanced global presence in a growing market.

More information on Michael Reichle (Chief Executive Officer, Innomotics, KPS Capital Partners): https://www.innomotics.com/hub/en/company/about-innomotics + https://www.linkedin.com/in/michael-reichle/

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents like the Universal Registration Document.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- Siemens Energy Q1 FY 2026 Earnings Release and Financial Results: https://assets.new.siemens.com/siemens/assets/api/uuid:958b35dc-9844-4e7f-b30e-eb795d9e74da/HQPR202602097341EN.pdf

- Siemens Energy Q1 FY 2026 Earnings Presentation: https://assets.new.siemens.com/siemens/assets/api/uuid:7928be7d-266d-40ba-a814-64248e7a9bb7/Q1-FY2026-Presentation.pdf

- Siemens Energy Annual Report 2025: https://www.siemens.com/global/en/company/investor-relations/events-publications-ad-hoc/annualreports.html

- Siemens Energy Q4 FY 2025 Earnings Release and Financial Results: https://p3.aprimocdn.net/siemensenergy/b17980ef-1d11-4d4a-8c24-b394012dd9f4/2025-11-13_Earnings-Release-Q4-FY25-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2025 Earnings Presentation: https://p3.aprimocdn.net/siemensenergy/4aa07956-ca76-49a5-a17d-b394012dd927/2025-11-13_Q4-Analyst-presentation-final_print-pdf_Original%20file.pdf

- Siemens Energy Annual Report 2024: https://p3.aprimocdn.net/siemensenergy/6974f976-432a-4ed9-ba61-b24301167dc8/A-Siemens-Energy-Annual-Report-2024-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2024 Earnings Release and Financial Results: https://p3.aprimocdn.net/siemensenergy/ed099e7a-c429-46b9-8e57-b2260127e834/Earnings-Release-Q4_EN_final-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2024 Earnings Presentation: https://p3.aprimocdn.net/siemensenergy/d516ea4c-b219-4259-94f3-b2260132e5cd/2024-11-13_Q4_Analyst-presentation_final-pdf_Original%20file.pdf

- Siemens Energy Annual Report 2023: https://p3.aprimocdn.net/siemensenergy/41a02640-9d16-4610-af08-b0ce00e67556/2023-12-06-Siemens-Energy-AG-Annual-Report-2023-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2023 Earnings Release and Financial Results: https://p3.aprimocdn.net/siemensenergy/e0872591-2bff-46a9-833f-b0ba015a476c/2023-11-15-Earnings-Release-Q4-FY23-EN-pdf_Original%20file.pdf

- Siemens Energy Q4 FY 2023 Presentation Analyst Call: https://p3.aprimocdn.net/siemensenergy/e0c4db0b-48d4-49fc-b421-b0bb0057e5a1/2023-11-15-Analyst-Presentation-Q4-FY23-EN-pdf_Original%20file.pdf

- Siemens Energy Annual Report 2022: https://assets.siemens-energy.com/siemens/assets/api/uuid:2c6beb5b-85ef-4200-a361-6a4550a31b9b/2022-12-12-siemens-energy-ag-annual-report-2022.pdf

- Siemens Energy Comparable key Figures FY2022: https://assets.siemens-energy.com/siemens/assets/api/uuid:76569361-381b-40d7-9542-d6216f6f1482/2023-02-07-siemens-energy-comparable-key-figures-fy2022.pdf?ste_sid=81e549b0261e3412a9eecb9842be8982

- Siemens Energy Annual Report 2021: https://assets.siemens-energy.com/siemens/assets/api/uuid:a400bf27-8ce4-4f48-8f2b-e89a9bd44b64/2021-12-07-siemens-energy-ag-annual-report-2021.pdf