ABB – Q4 2025 results

Strong Q4 orders, improved operational performance with good cash flow completes a new record year

Ad hoc Announcement pursuant to Art. 53 Listing Rules of SIX Swiss Exchange

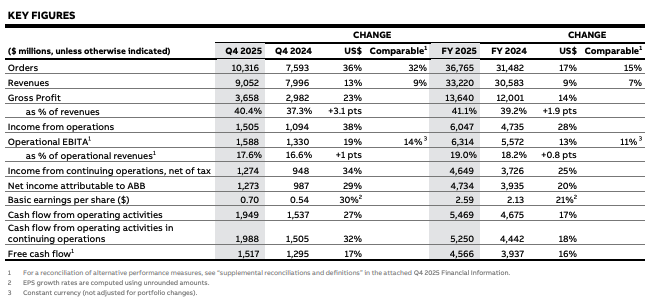

Q4 2025

- Orders $10.3 billion, +36%; comparable1 +32%

- Revenues $9.1 billion, +13%; comparable +9%

- Income from operations $1,505 million; margin 16.6%

- Operational EBITA1 $1,588 million; margin1 17.6%

- Basic EPS $0.70, +30%2

- Cash flow from operating activities $1,949 million; +27%

FY 2025

- Orders $36.8 billion, +17%; comparable1 +15%

- Revenues $33.2 billion, +9%; comparable +7%

- Income from operations $6,047 million; margin 18.2%

- Operational EBITA1 $6,314 million; margin1 19.0%

- Basic EPS $2.59, +21%2

- Cash flow from operating activities $5,469 million; +17%

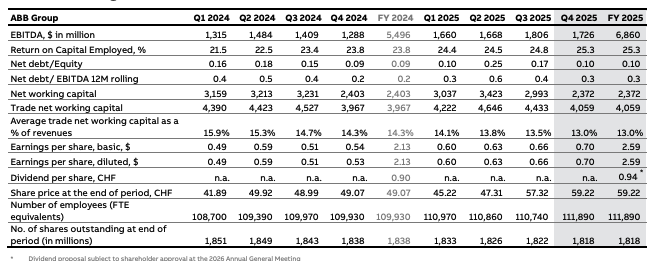

- Return on Capital Employed 25.3%

- Dividend proposal of CHF 0.94 per share

“Q4 was a strong finish to a record year for ABB. We lead in markets with strong secular trends and we will further build on our ABB Way operating model, which gives me confidence in our updated financial targets and that 2026 will be yet another all-time-high result.” Morten Wierod, CEO

CEO Summary

We ended the year on a high note and delivered the strongest annual performance yet for ABB. The fourth quarter was a landmark quarter as we for the first time exceeded the $10 billion order level, at $10.3 billion. In addition to a strong development in the base business, orders were positively impacted by timing of large project bookings. Overall, it was reassuring that the strong order development was broad-based with double-digit growth across all three business areas. So, while we delivered the highest quarterly revenues on record, orders were even higher, resulting in a book-to-bill of 1.14.

In my view, we perform well in overall favorable market conditions. In addition to leveraging on strong comparable growth, we generate internal efficiency gains which successfully mitigate for example tariff and rising material inflation. We grew operational EBITA by 19% and expanded margins by 100 basis points

I was pleased with the strong free cash flow of $1.5 billion in the quarter. This led to us achieving our ambition to improve annual free cash flow, which reached the record level of $4.6 billion. It was also good to see our strong return on capital employed at 25.3%.

In the Electrification business area, demand increased in all customer segments, led by data centers which recorded a very strong double-digit growth. Our medium voltage power technology is at the forefront of the industry. One example of how it puts us in a front-row position for future data center architecture is the extended partnership with Applied Digital where we introduce innovative power designs for large-scale AI-ready data centers. Another future potential demand driver is our cutting-edge direct current (DC) and solid-state electronics technology. This sits at the heart of our collaboration with NVIDIA where ABB will support their 800 VDC architecture to accelerate the development of gigawatt scale next-generation data centers.

In the Motion business area, the strong order growth was supported by continued high demand for rail projects, as well as in the recently formed High Power division, along with positive developments in the short-cycle demand for both low voltage motors and drives. In the Automation business area, we saw persistently strong activity related to marine and ports, and the large Rotterdam port order is yet another proof point of the unique customer value we generate when combining know-how from across our three business areas. Our solution will feature combined shore power systems expected to be the world’s largest to date, able to charge up to 32 container ships simultaneously during loading and unloading operations. We also provide a SCADA system to monitor and control the shore power system while tracking energy usage for precise customer billing.

We have also updated our financial targets, aiming for strong growth, a higher profitability range and strong EPS expansion with a good cash conversion. We raised our ROCE ambition even as we pursue a higher pace of acquired growth. In my view, these new targets are both ambitious and realistic.

To achieve these updated long-term targets, we will further enhance our operational accountability and speed as we continue to build on the ABB Way operating model. Couple this with overall strong external markets where we will capitalize on our position within global trends of energy expansion, the need for energy efficiency and the transition to cleaner energy sources. I am confident in our market position, our leading technology and our ability to help customers become more productive and energy efficient. I expect these factors to support our operational performance in 2026 and long-term.

Based on our strong performance, the Board of Directors has decided to propose an ordinary dividend of CHF0.94 per share, up from CHF0.90 in the previous year. We also intend to launch a new share buyback program of up to $2.0 billion, running until January 27, 2027.

Morten Wierod CEO

Outlook

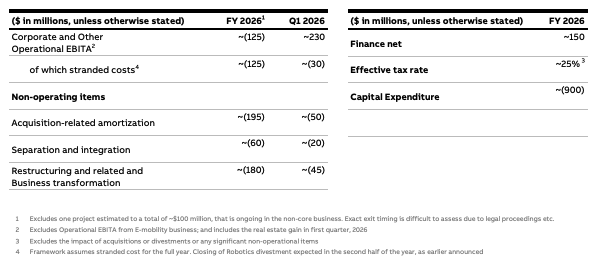

In the first quarter of 2026, we anticipate comparable revenue growth in the 7% – 10% range. The operational EBITA margin should increase year-on-year, excluding the announced real estate gains in the first quarters of 2025 and 2026.

In full-year 2026, we expect a positive book-to-bill, and comparable revenue growth in the range of 6% – 9% year-on-year. The operational EBITA margin should slightly improve year-on-year, even when excluding the announced real estate gain in the first quarter of 2026.

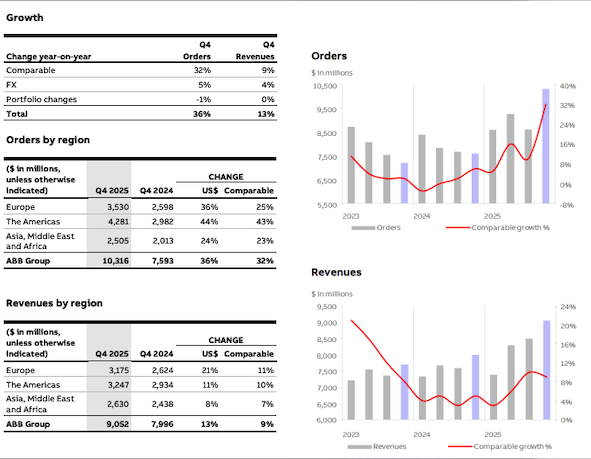

Orders and revenues

Order intake was record-high at $10,316 million, up by 36% (32% comparable). The very strong comparable growth benefited from persistently strong overall market dynamics with the added support from the timing of large project orders. Total growth was additionally supported by changes in foreign exchange rates. All three business areas increased at a comparable double-digit rate, led by exceptional growth of 49% (41% comparable) in Automation and 36% (33% comparable) in Electrification where the timing of several stand-out large orders combined supported order intake by about $600 million in each of the two business areas. In addition to the strong development in the project business, the short-cycle and services businesses both improved at a double-digit rate. The order backlog reached $25,282 million, up by 27% (18% comparable), year-on-year.

Orders in the Americas were up by 44% (43% comparable), up 36% (25% comparable) in Europe and up 24% (23% comparable) in Asia, Middle East and Africa.

Orders increased sharply on continued favourable demand related to the marine, ports and rail segments. Land-based infrastructure demand benefited from upgrades of electrical equipment for such as airports, tunnels etc.

In the industrial space, the utilities segment remains strong. A buoyant data center market supported segment orders to increase at a strong double-digit rate, supported by timing of project orders.

The buildings segment improved, with a stable to positive development in Europe and the United States more than offsetting the general weakness in China.

Orders in the machine builder segment increased sharply from a low comparable, but the absolute level remains subdued in a continued challenging market.

The oil & gas segment remains generally solid, although orders declined in the quarter. There was increased activity among nuclear customers. Mining orders increased in a generally capex-muted market environment.

Quarterly revenues were record-high at $9,052 million and increased by 13%, supported by a strong 9% comparable growth as well as 4% from changes in exchange rates. Comparable growth was primarily due to higher volumes, driven by higher short-cycle and service demand as well as execution of the high order backlog. Additional contribution derived from positive pricing at a low single-digit rate. All three business areas recorded strong revenue growth, with support from virtually all divisions. Revenues increased in all regions, led by Europe at 21% (11% comparable) and the Americas at 11% (10% comparable), with Asia, Middle East and Africa improving by 8% (7% comparable) as a stable comparable trend in China was more than offset by strength in other parts of the region. Quarterly revenues were the highest on record, but orders were even higher, resulting in a book-to-bill of 1.14.

Earnings

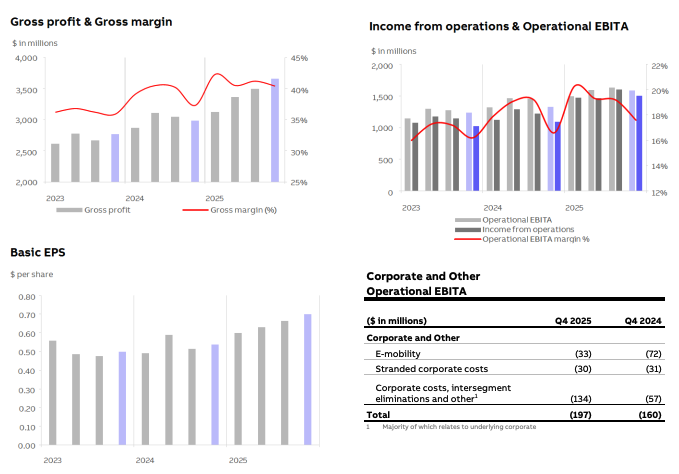

Gross profit

Gross profit increased by 23% (17% constant currency) year-on-year to $3,658 million, reflecting a gross margin of 40.4%, up 310 basis points. Gross margin improved in all business areas

Income from operations

Income from operations amounted to $1,505 million and increased by 38% year-on-year. The increase was mainly driven by the positive impacts from improved operational business performance and Foreign exchange timing differences, while the prior year was also negatively impacted by fair value adjustments of equity investments. The Income from operations margin was 16.6% and improved by 290 basis points.

Operational EBITA

Operational EBITA increased by 19% year-on-year to $1,588 million, reflecting a 100 basis points margin improvement to 17.6%. Higher profitability was primarily due to operational leverage on higher volumes. The impacts from positive pricing and improved operational efficiency more than offset the increase in expenses related to commodities and tariffs, Research and Development (R&D), Selling, general & administrative (SG&A) as well as Corporate expenses. SG&A decreased slightly in relation to revenues to 19.5% from last year’s 19.6%. Operational EBITA in Corporate and other amounted to -$197 million compared with last year’s -$160 million. This is the total of Underlying corporate costs of $164 million which includes Stranded costs of $30 million, and a loss of $33 million in the E-mobility business.

Finance net

Net finance income contributed to results with a positive $48 million, representing a lower income compared with last year’s $56 million.

Income tax

Income tax expense was $292 million and the effective tax rate was 18.6%, in line with the historical pattern of a low tax rate in the fourth quarter.

Net income and earnings per share

Net income attributable to ABB was $1,273 million, representing an increase of 29% year-on-year, driven by the impact from improved business performance more than compensating for a slightly lower contribution from net finance and lower net income in discontinued operations. Basic earnings per share increased by 30% to $0.70, up from $0.54 in the previous year period.

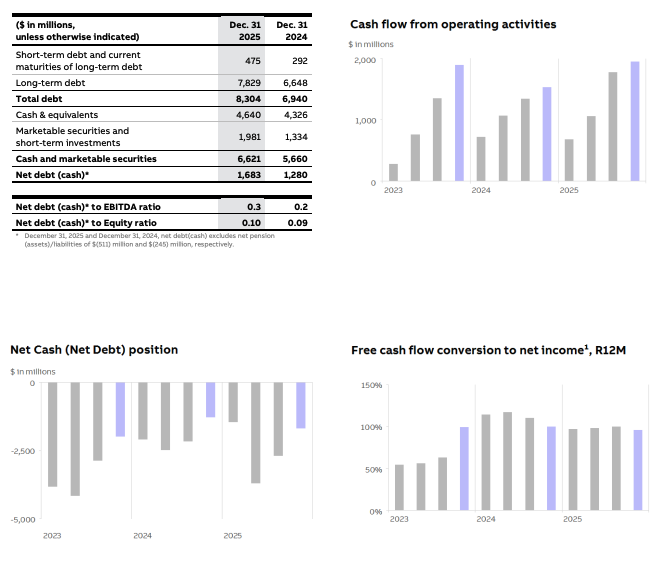

Balance sheet & Cash flow

Trade net working capital1

Trade net working capital amounted to $4,059 million, up slightly year-on-year from $3,967 million. The increase was primarily driven by impacts from changes in foreign exchange rates which more than offset the reduction of inventories and higher trade payables, in local currencies. The average trade net working capital as a percentage of revenues1 was 13.0%, a reduction from 14.3% one year ago.

Capital expenditures

Purchases of property, plant and equipment and intangible assets for continuing operations during the fourth quarter amounted to $409 million, higher than last year’s $271 million. For ABB Group, the total cash outflow on a combined basis amounted to $451 million, higher than last year’s $283 million.

Net debt

Net debt1 amounted to $1,683 million at the end of the quarter and increased from $1,280 million, with the yearon-year increase mainly due to impacts of changes in exchange rates. The sequential decrease from $2,690 million in the third quarter was mainly due to the strong cash generation in operations which more than offset the adverse impact from higher spend on acquisitions.

Cash flows

Cash flow from operating activities during the fourth quarter was $1,949 million, an increase of 27% from last year’s $1,537 million. Contribution to the strong cash flow derived from stronger earnings as well as a reduction in Net working capital, mainly linked to contribution from inventories and trade payables and timing of accrued expenses. Free cash flow amounted to $1,517 million, and improved from last year’s $1,295 million, despite the higher capex spend.

Share buyback program

A share buyback program of up to $1.5 billion was launched on February 10, 2025. During the fourth quarter, ABB repurchased a total of 3,099,590 shares for a total amount of approximately $224 million. At the end of the fourth quarter, ABB’s total number of issued shares, including shares held in treasury, amounts to 1,843,899,204.

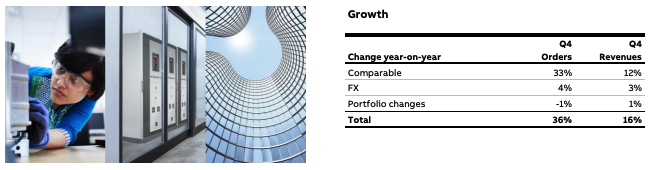

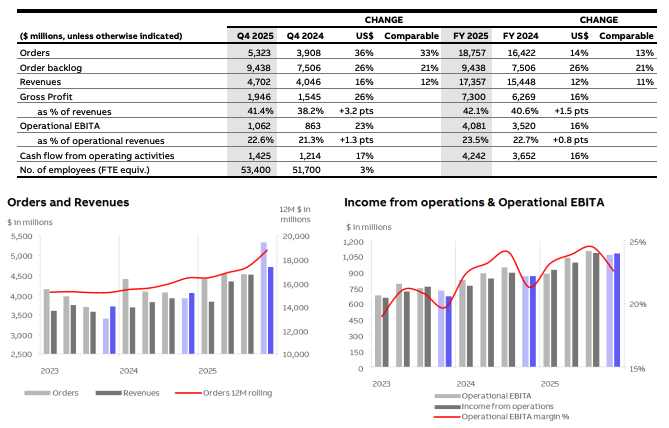

Electrification

Orders and revenues

For the first time, quarterly order intake exceeded the $5 billion mark. This was achieved through a strong performance in a buoyant market environment, with additional benefit from timing of large project bookings. In total, orders increased by 36% (33% comparable) to $5,323 million.

- Several large data center project orders, each exceeding the $100 million mark, boosted orders by approximately $600 million combined.

- Double-digit order growth across the project, service and short-cycle businesses. Strong orders outpaced record-high revenues, resulting in a book-to-bill of 1.13, increasing the order backlog by 26% (21% comparable) to $9.4 billion.

- All customer segments improved, led by exceptional growth in data centers. The increase in buildings was driven by the commercial segment where the US improved, Europe remained stable and China declined. Other areas of strength were utilities and land transport infrastructure such as airports, rail, tunnels.

- The Americas increased by 55% (55% comparable) with particular support from the timing of large orders in the United States. Europe was up by 17% (7% comparable). Asia, Middle East and Africa improved by 22% (19% comparable) with improvements in countries like India and Australia more than offsetting weakness in China.

- Revenues exceeded expectations and increased 16% (12% comparable) with a positive development in all divisions. Strong comparable revenues were primarily driven by higher volumes across short-cycle, service, and project businesses. Total growth was further supported by favorable changes in exchange rates of 3%, with a slight added contribution from portfolio changes.

Profit

Operational EBITA reached $1,062 million and increased sharply by 23%, representing a 130 basis points expansion in margin, year-on-year.

- Profit increased primarily due to operational leverage on higher volumes and improved productivity in operations. These combined benefits more than offset higher spend on raw materials – mainly linked to rising copper and silver prices as well as tariffs, SG&A and higher investments in R&D.

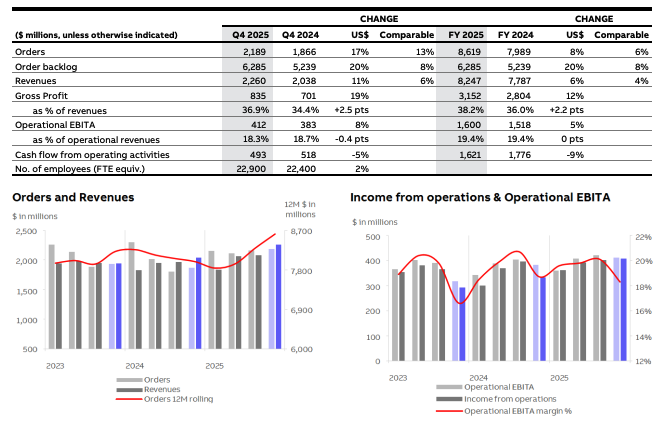

Motion

Orders and revenues

Order intake totaled $2,189 million, up 17% (13% comparable) year-on-year, sustaining the high order levels achieved in recent quarters. Comparable growth was broadbased across all divisions and regions, with additional growth contribution from favourable changes in exchange rates.

- The rail segment showed persistently strong customer activity with increased orders. HVAC linked to commercial buildings also improved. Power generation made strong progress, supported by grid modernization and distributed energy systems. Food & beverage, marine and mining showed positive development. Chemicals contributed positively in the quarter, in an otherwise muted market environment. Oil & gas and pulp & paper weighed on order intake.

- The Americas was up 26% (25% comparable), with strong improvement of 30% (29% comparable) in the United States. Europe increased 16% (6% comparable) and Asia, Middle East and Africa was up by 9% (9% comparable), with China at 16% (14% comparable).

- All-time-high revenues totaled $2,260 million, up by 11% (6% comparable). The main driver to comparable growth was higher volumes, further supported by positive pricing. Additional contribution derived from changes in exchange rates as well as from portfolio changes, including the acquisition of Gamesa Electric in Spain, completed in early December.

Profit

Operational EBITA improved by 8% to $412 million, however the margin of 18.3% softened by 40 basis points year-on-year, with broadly similar impacts from:

- Lower profitability in the recently formed High Power division where some operational inefficiencies hampered margin.

- The acquired business Gamesa Electric is currently making a slight loss and diluted the Motion Operational EBITA margin by approximately 20 basis points, with one month included in results. It is expected to be dilutive for the full year 2026.

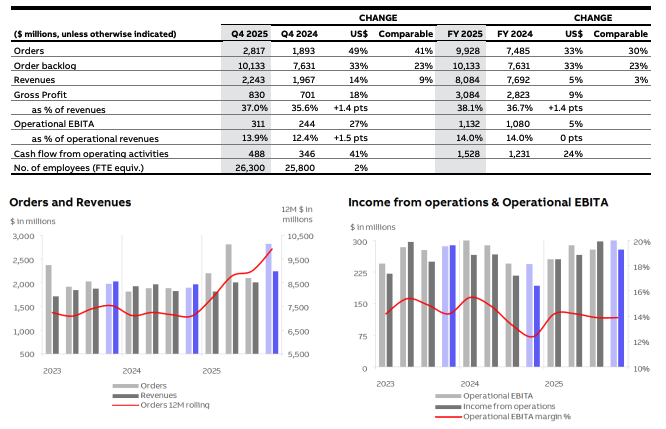

Automation

Orders and revenues

Strong comparable order growth was driven by an overall robust market environment outside of the discrete segment, with the added contribution from timing of project orders. Total growth was further supported by favorable changes in exchange rates and increased by 49% (41% comparable) to the new record order level of $2,817 million.

- Several large project orders linked to the marine and ports segment, each valued at the $100+ million mark, boosted orders by close to $600 million combined. On a strong book-to-bill of 1.26, the order backlog reached $10.1 billion, up by 33% (23% comparable).

- Persistently high customer activity was linked to marine and port automation and electrification. Orders from machine builders also increased sharply from a very low comparable, albeit the absolute level remains subdued. Customer activity in the oil & gas segment is solid, although quarterly orders declined. Mining orders increased in an otherwise capex muted market environment. Activity among nuclear customers increased.

- The strong revenue growth of 14% was generated by a positive year-on-year development across divisions. Comparable growth of 9% was mainly due to higher volumes with added support from changes in exchanges rates, as well as a favorable price impact. The volume increase derived from execution of the strong order backlog and a positive development in both the service and the short-cycle product businesses.

As earlier announced, this was the first quarter the financial results of the Machine Automation division were presented as part of the Automation business area.

Profit

Strong gross margin improvement with added support from stringent SG&A cost management drove Operational EBITA margin up by 150 basis points to 13.9%. This represents an earnings increase of 27% to $311 million.

- Key levers to the gross margin increase of 140 basis points were operational benefits from higher volumes with some positive pricing, as well as productivity enhancements.

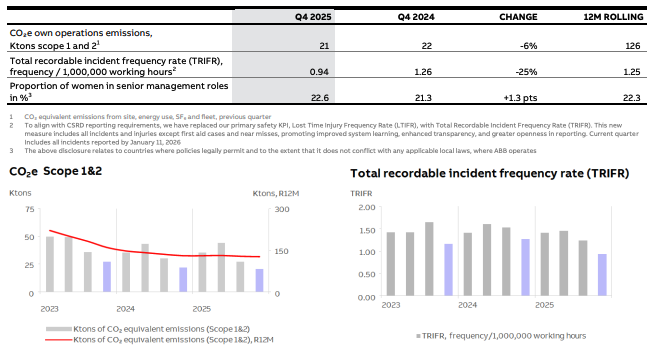

Sustainability

Events from the Quarter

- ABB has achieved A scores for climate and water in non-profit organization CDP’s 2025 rankings, earning a place on the annual A List for both climate change and for the first time, water stewardship. ABB joins the top 1 percent of the 20,000 companies scored that achieved a double A rating. Achieving an A rating for Water for the first time is testament to the company’s focus on water-related risks exposure, water stewardship, governance, as well as its enhanced supplier engagement on the topic of water risk. ABB improved its water security score from a B in 2023, to an A- in 2024 and now an A in 2025.

- ABB launched ABB Ability™ BuildingPro, a cybersecure integration platform designed to connect, manage, and optimize building operations. Available across more than 40 countries worldwide, the solution supports key sectors including commercial real estate, education, healthcare, hospitality, and government – helping organizations accelerate decarbonization and digital transformation. Acting as a central intelligence hub, it unifies data from building systems to improve performance, reduce energy use, and enhance occupant experience.

- With a strategic investment in OctaiPipe, a UK-based innovator in AI-driven software for optimizing data center cooling systems, ABB will partner to equip data center operators with intelligent tools to achieve substantial energy savings, strengthen operational resilience, and meet the growing demands for sustainability and transparency. The transaction consists of ABB taking a minority stake in OctaiPipe and will bring a major advancement: an on-premises AI solution that enables up to 30 percent energy savings in cooling, with very short payback periods and rapid deployment – without the need for new hardware.

- The Canadian Space Agency awarded ABB a contract to carry out the conceptual development for a component of the High-altitude Aerosols, Water Vapour and Clouds (HAWC) satellite mission – a Canadian-led initiative focused on advancing climate science and environmental monitoring. In addition, ABB will support further technology development activities to be defined over the course of the project. Through its role, ABB helps to refine global climate monitoring capabilities. The HAWC mission aims to deliver essential data to enhance forecasting of severe and extreme weather events, improve climate modeling, support air quality assessments, and aid in tracking natural disasters such as wildfires, volcanic eruptions and intense rainfall.

- ABB celebrated Abilities, which highlights both visible and invisible disabilities and promotes practical inclusion through webinars, workshops, and panel discussions. From its award-winning Rehab on Wheels initiative – India’s first mobile rehabilitation unit developed with the Association of People with Disability – to “Senti come mi sento” (“Feel How I Feel”) in Italy, activities focus on breaking down barriers to access and understanding. By bringing rehabilitation to underserved communities and immersing teams in the lived experience of multiple sclerosis, the programs foster empathy, awareness, and a more inclusive culture grounded in real human experience.

Significant events

During Q4 2025

- On October 8, 2025, ABB announced it had signed an agreement to divest its Robotics division to SoftBank Group for an enterprise value of $5.375 billion, and therefore was not pursuing its earlier intention to spin-off the business as a separately listed company. The transaction is subject to regulatory approvals and further customary closing conditions and is expected to close in mid-to-late 2026.

- On October 8, 2025, ABB announced that Sami Atiya, President Robotics & Discrete Automation business area and Member of the Executive Committee, will step down from the Executive Committee at the end of 2025 and leave ABB by the end of 2026 in line with the announced divestment of the Robotics division.

- On October 16, 2025, ABB announced that CFO, Timo Ihamuotila, will step down from the Executive Committee effective February 1, 2026, and leave ABB at the end of 2026. Timo will be succeeded by the internal candidate Christian Nilsson who joined ABB in 2017 as CFO of the Electrification business area.

- On November 19, 2025 ABB announced updated financial targets at the Capital Markets Day. This included upgrading Operational EBITA margin target to 18-22 percent with newly introduced targets per business area; ROCE target raised to >20 percent. Organic and acquired revenue growth targets confirmed; Earnings Per Share target confirmed and free cash flow conversion to net income target updated to >95 percent to reflect expected strong growth.

After Q4 2025

- On January 28, 2026, ABB announced that it has completed the sale of a commercial property in Zurich, Switzerland. Consequently, a pre-tax operational gain of ~CHF290 million will be recorded in the first quarter of 2026.

Full year 2025

2025 was a new record year for ABB, with strong orders, increases across most lines of the income statement and all-time-high cash delivery.

Order intake increased 17% (15% comparable) year-onyear to $36,765 million, supported by all three business areas. There was a positive development across most customer segments, led by particular strength in data centers, marine, ports, utilities and land-based infrastructure such as tunnels and airports, which benefited from electrical upgrades. On the muted side, there were the process industry-related areas such as pulp & paper, chemicals and mining.

Revenues improved by 9% (7% comparable) to $33,220 million supported by a positive development across the project, service and short-cycle businesses. Revenues were at an all-time-high, but orders were even higher, resulting in a book-to-bill 1.11. The order backlog amounted to $25.3 billion, up by 27% (18% comparable), year-on-year.

Income from operations amounted to $6,047 million, significantly up 28% year-on-year, resulting in a margin of 18.2%. The increase was mainly driven by the positive impacts from improved operational business performance, with further support from foreign exchange timing differences, while the prior year was also negatively impacted by fair value adjustments of assets and liabilities held for sale and equity investments.

Operational EBITA increased by 13% to $6,314 million. The higher result was due to the improved business performance more than offsetting higher expenses linked to Corporate & other. Moreover, an operational net gain of approximately $140 million relating to a real estate sale in Corporate and Other had a positive impact.

The Operational EBITA margin improved by 80 basis points to 19.0% with the main drivers being operating leverage on higher volumes, positive pricing and improved operational efficiency. Corporate and other Operational EBITA amounted to -$499 million. This includes a loss of $148 million attributed to the E-mobility business and Stranded costs of $123 million linked to the ongoing divestment of the Robotics business.

Net finance contributed to results with $117 million, below last year’s income of $132 million. Income tax expense was $1,570 million reflecting a tax rate of 25.2%.

Net income attributable to ABB was $4,734 million, up from $3,935 million in the prior year period. Basic earnings per share was $2.59, representing an increase of 21%.

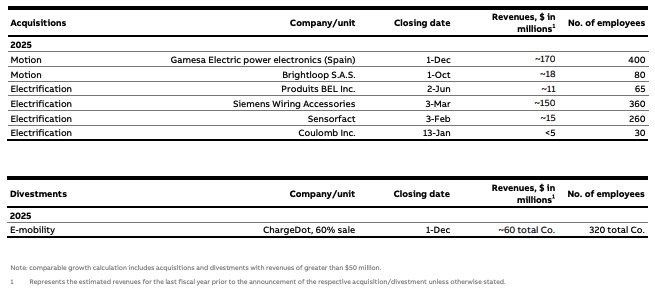

Key acquisitions and divestments, last twelve months

Additional figures

Additional 2026 guidance

ABB based on discontinued operations structure

Important notice about forward-looking information

This press release includes forward-looking information and statements as well as other statements concerning the outlook for our business, including those in the sections of this release titled “CEO summary,” “Outlook,” “Sustainability” “Significant events” and “Additional 2026 guidance”. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions and the economic conditions of the regions and industries that are major markets for ABB. These expectations, estimates and projections are generally identifiable by statements containing words such as “anticipates,” “expects,” “estimates,” “intends,” “plans,” “targets,” “guidance,” or similar expressions. However, there are many risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this press release and which could affect our ability to achieve any or all of our stated targets. These include, among others, business risks associated with the volatile global economic environment and political conditions, market acceptance of new products and services, changes in governmental regulations and currency exchange rates. Although ABB Ltd believes that its expectations reflected in any such forward looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved

Q4 results presentation on January 29, 2026

The Q4 2025 results press release and presentation slides are available on the ABB News Center at www.abb.com/news and on the Investor Relations homepage at www.abb.com/investorrelations.

A conference call and webcast for analysts and investors is scheduled to begin at 10:00 a.m. CET. To join the webcast, please refer to the ABB website: www.abb.com/investorrelations.

The recorded session will be available after the event on ABB’s website.

Financial calendar

2026

- February 19 Planned publication of Annual Reporting Suite

- March 19 Annual General Meeting

- April 22 Q1 2026 results

- July 16 Q2 2026 results

- October 20 Q3 2026 results

SourceABB

EMR Analysis

More information on ABB: See full profile on EMR Executive Services

More information on Morten Wierod (Chief Executive Officer and Member of the Group Executive Committee, ABB): See full profile on EMR Executive Services

More information on Timo Ihamuotila (Chief Financial Officer, ABB till end of 2026 + Member of the Executive Committee, ABB till February 1, 2026): See full profile on EMR Executive Services

More information on Christian Nilsson (Chief Financial Officer, Electrification Business Area, ABB till February 1, 2026 + Chief Financial Officer and Member of the Executive Committee, ABB as from February 1, 2026): See full profile on EMR Executive Services

More information on the ABB Way: See full profile on EMR Executive Services

More information on Electrification Business Area by ABB: See the full profile on EMR Executive Services

More information on Giampiero Frisio (President, Electrification Business Area and Member of the Executive Committee, ABB): See full profile on EMR Executive Services

More information on Motion Business Area by ABB: See the full profile on EMR Executive Services

More information on Brandon Spencer (President, Motion Business Area and Member of the Executive Committee, ABB): See full profile on EMR Executive Services

More information on Gamesa Electric by Motion Business Area by ABB: https://www.gamesaelectric.com/ + Gamesa Electric is a worldwide leader in the design and manufacturing of electrical equipment, with extensive experience in photovoltaics, hydro-electric energy, marine propulsion, wind power and energy storage applications, among others.

In April 2017, Gamesa merged Siemens Wind to form Siemens Gamesa Renewable Energy. Gamesa Electric is a 100% subsidiary of this merged company.

More information on Juan Barandiaran (Managing Director, Gamesa Electric, Renewable Power, Motion High Power Division, Motion Business Area, ABB): See the full profile on EMR Executive Services

More information on Process Automation Business Area by ABB: See the full profile on EMR Executive Services

More information on Peter Terwiesch (President, Process Automation Business Area and Member of the Executive Committee, ABB): See full profile on EMR Executive Services

More information on Robotics & Discrete Automation Business Area by ABB (Robotics Division to be divested to SoftBank Group subject to regulatory approvals and further customary closing conditions and expected to close in mid-to-late 2026 + Machine Automation Division, which together with ABB Robotics currently forms the Robotics & Discrete Automation Business Area, became a part of the Process Automation Business Area as of the fourth quarter 2025): See full profile on EMR Executive Services

More information on Sami Atiya (Strategic Advisor, ABB till December 2026): See full profile on EMR Executive Services

More information on the Sustainability Strategy, the Sustainability Statement 2024 and the Climate Transition Plan by ABB: See full profile on EMR Executive Services

More information on Karin Lepasoon (Chief Communications and Sustainability Officer and Member of Executive Committee, ABB): See full profile on EMR Executive Services

More information on Anke Hampel (Group Head of Sustainability, ABB): See full profile on EMR Executive Services

More information on ABB Ability™ BuildingPro by ABB: https://new.abb.com/low-voltage/products/building-automation/product-range/abb-ability-buildingpro + ABB Ability™ BuildingPro serves as the central hub for integrating and aggregating data from across a building’s diverse operations and technology systems. By orchestrating all components- systems, sensors, controls- within a unified, intelligent framework, BuildingPro enables buildings to function as cohesive, high-performance environments. This holistic approach drives both energy and operational efficiency while enhancing occupant comfort, productivity, and well-being.

More information on OctaiPipe (Minority Stake Investment by ABB Motion Ventures by ABB): https://octaipipe.ai/ + The data centre cooling efficiency experts.

OctaiPipe is a deep-tech company pioneering the development and use of artificial intelligence to improve the value, efficiency, and sustainability of data centre energy management. Our vision is to build the future of AI infrastructure for safe, secure, scalable, and sustainable data centres.

OctaiPipe’s collaborative AI software platform has been designed to increase the performance of data centres. OctaiPipe is the performance optimisation expert your team has been missing, providing data centre managers and operatives with recommendations and explanations in plain English to help optimise energy usage and improve sustainability reporting.

More information on Eric Topham (Co-founder and Chief Executive Officer, OctaiPipe): https://www.linkedin.com/in/eric-topham-79a59114/

More information on Applied Digital: https://www.applieddigital.com/ + Applied Digital (Nasdaq: APLD) — named Best Data Center in the Americas 2025 by Datacloud — designs, builds, and operates high-performance, sustainably engineered data centers and colocation services for artificial intelligence, cloud, networking, and blockchain workloads. Headquartered in Dallas, TX, and founded in 2021, the Company combines hyperscale expertise, proprietary waterless cooling, and rapid deployment capabilities to deliver secure, scalable compute at industry-leading speed and efficiency, while creating economic opportunities in underserved communities through its award-winning Polaris Forge AI Factory model.

More information on Wes Cummins (Founder, Chairman and Chief Executive Officer, Applied Digital): https://www.applieddigital.com/leadership + https://www.linkedin.com/in/wes-cummins-63114481/

More information on NVIDIA: https://www.nvidia.com/en-us/ + NVIDIA pioneered accelerated computing to tackle challenges no one else can solve. Our work in AI and digital twins is transforming the world’s largest industries and profoundly impacting society.

Founded in 1993, NVIDIA is the world leader in accelerated computing. Our invention of the GPU in 1999 sparked the growth of the PC gaming market, redefined computer graphics, revolutionized accelerated computing, ignited the era of modern AI, and is fueling industrial digitalization across markets. NVIDIA is now a full-stack computing infrastructure company with data-center-scale offerings that are reshaping industry.

More information on Jensen Huang (Chief Executive Officer, NVIDIA): https://nvidianews.nvidia.com/bios + https://www.linkedin.com/in/jenhsunhuang/

More information on Canadian Space Agency (CSA): https://www.asc-csa.gc.ca/eng/ + We promote the peaceful use and development of space, advance the knowledge of space through science, and ensure that space science and technology provide social and economic benefits for Canadians.

More information on Lisa Campbell (President, Canadian Space Agency): https://www.asc-csa.gc.ca/eng/about/minister-senior-leaders.asp + https://www.linkedin.com/in/lisa-campbell-b754a3335/

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The ABB Q4 2025 Full Year Results Presentation can be found here: https://library.e.abb.com/public/17c5f84dedb946478c22ba1e00f5673e/ABB-Q4-2025-press-release-English.pdf

- The ABB Q4 2025 Full Year Financial Information can be found here: https://library.e.abb.com/public/efa424a5e55545ef99275bfafc6ff638/ABB-Q4-2025-financial-information.pdf

- The ABB Integrated Report 2024 can be found here: https://library.e.abb.com/public/6fe759d28f0d4261b6c4a8ab21275fe3/ABB%20Integrated%20Report%202024.pdf

- The ABB Q4 2024 Full Financial Information can be found here: https://library.e.abb.com/public/daae2758e6a546efab24d3967aaa0f37/ABB-Q4-2024-financial-information.pdf

- The ABB Q4 2024 Group Results Presentation can be found here: https://library.e.abb.com/public/4e87bd89e0c541ed857d8085f22e7f61/ABB-Q4-2024-presentation.pdf

- The ABB Integrated Report 2023 can be found here: https://library.e.abb.com/public/8fe35c6a0c3943d5aacc783ce0ffaf3b/ABB%20Integrated%20Report%202023.pdf

- ABB Q4 2023 Full Financial Report can be found here: https://library.e.abb.com/public/9d87fae42fab43c297c4ee385296fd05/ABB-Q4-2023-financial-information.pdf

- ABB Q4 2023 Results Presentation Report can be found here: https://library.e.abb.com/public/0834f841fe5a4829bd9ce21ad23d8f70/ABB-Q4-2023_Group%20presentation.pdf

- ABB Q4 2022 Full Financial Report can be found here: https://library.e.abb.com/public/0c911f20f7cc46848b2e64bde82fb4f5/ABB-Q4-2022-financial-information.pdf

- ABB Q4 2022 Group Results Presentation can be found here: https://library.e.abb.com/public/63461737ba8345e3aa6d2461f06fc72d/ABB%20Q4%202022%20Group%20results%20presentation.pdf

- The ABB Integrated Report 2022 can be found here: https://library.e.abb.com/public/ef5852f1e2e54cad97abcc4fc48d1d58/Annual%20Reporting%20Suite_Integrated%20Report%202022_English.pdf

- The ABB Annual Report 2021 can be found here: https://library.e.abb.com/public/c6dae9af148d4d5fb87efc97bb4b460a/ABB-Group-Annual-Report-2021-English.pdf