Honeywell – Honeywell provides supplemental financial information for planned segment realignment; adjusts outlook to exclude Advanced Materials

CHARLOTTE, N.C., Dec. 22, 2025 /PRNewswire/ — Honeywell (NASDAQ: HON) today released supplemental 2024 and year-to-date 2025 financial information to reflect its updated business segment structure expected to become effective for the first quarter of 2026, which it previously announced on October 22, 2025.

The company also announced today that it will report its Advanced Materials business unit as discontinued operations beginning the fourth quarter of 2025, following the successful spin of Solstice Advanced Materials (NASDAQ: SOLS) on October 30, 2025. As a result, the company adjusts its full-year and fourth quarter 2025 guidance, and otherwise re-affirms its expectations for fourth quarter performance.

In addition, Honeywell is providing an update on its previously disclosed Flexjet-related litigation matters, which it expects will result in a one-time charge in the fourth quarter. This charge will not impact the company’s non-GAAP financial metrics or guidance. Any potential settlements of these litigation matters are anticipated to include one-time cash payments totaling approximately $470 million in the aggregate to the involved parties.

Supplemental Financial Information

In the attached supplemental financial information, Honeywell provides historical financial information consistent with its previously announced new business segment structure (anticipated to begin in the first quarter of 2026) and reports its Advanced Materials business unit, previously part of Energy and Sustainability Solutions, as discontinued operations beginning in the fourth quarter of 2025. Corporate expenses previously allocated to Advanced Materials will be included as part of Corporate and All Other segment profit of Honeywell.

The new business segment structure aligns to the company’s go-forward strategy for its automation business ahead of the planned spin-off of its Aerospace business in the second half of 2026. The structure will consist of four reportable business segments: Aerospace Technologies, Building Automation, Process Automation and Technology, and Industrial Automation. The three automation segments will each further report two business units aligned to the business models through which the company delivers value for its customers. Reporting for Aerospace Technologies is unchanged.

Honeywell Adjusts 2025 Outlook

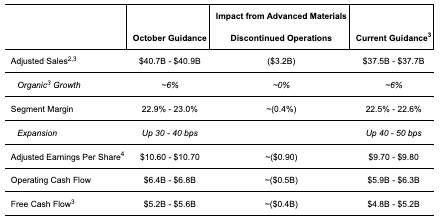

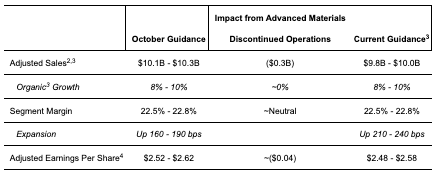

As a result of the reclassification of Advanced Materials to discontinued operations, Honeywell adjusts its full-year and fourth quarter adjusted sales, segment margin, adjusted earnings per share, and free cash flow guidance. Excluding the reclassification, there is no change to the company’s expectations for its fourth quarter non-GAAP financial guidance. A summary of the change in guidance is provided in tables 1 and 2 below.

TABLE 1: FULL-YEAR 2025 GUIDANCE RECONCILIATION1

TABLE 2: FOURTH QUARTER GUIDANCE RECONCILIATION1

Flexjet-Related Litigation Matters Update

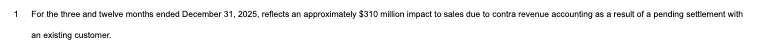

Honeywell is providing an update with respect to the previously disclosed Flexjet-related litigation matters. The company is in ongoing settlement negotiations with Flexjet and the other parties to the litigation matters. Based on negotiations to date, Honeywell expects to record a one-time charge within its Aerospace Technologies segment in the fourth quarter of 2025 that will reduce GAAP sales (due to contra-revenue accounting) and operating income by approximately $310 million and $370 million, respectively. However, this charge will not impact Honeywell’s non-GAAP financial metrics. The company further expects that any settlements will include one-time cash payments to the parties to the Flexjet-related litigation matters totaling approximately $470 million in the aggregate. There can be no assurance that any settlements will be reached, and the foregoing financial impacts are subject to change based on the final terms of any such settlements.

For additional information, please see our Current Report on Form 8-K, filed with the SEC on December 22, 2025, available at http://www.sec.gov.

Additional Information

Honeywell uses our Investor Relations website, www.honeywell.com/investor, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our Investor Relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media.

Forward Looking Statements

We describe many of the trends and other factors that drive our business and future results in this release. Such discussions contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including statements related to the proposed separation of Automation and Aerospace Technologies, the realignment of the Company’s reportable business segments, the Company’s full year guidance, the accounting impact of any potential settlements of the Flexjet-related litigation matters, and the evaluation of strategic alternatives for the Productivity Solutions and Services and Warehouse and Workflow Solutions businesses. Forward-looking statements are those that address activities, events, or developments that we or our management intend, expect, project, believe, or anticipate will or may occur in the future. They are based on management’s assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments, and other relevant factors, many of which are difficult to predict and outside of our control, including the Company’s realignment of its reportable business segments, the Company’s current expectations, estimates, and projections regarding the proposed separation of Automation and Aerospace Technologies, the accounting impact of any potential settlements of the Flexjet-related litigation matters, and the evaluation of strategic alternatives for the Productivity Solutions and Services and Warehouse and Workflow Solutions businesses. They are not guarantees of future performance, and actual results, developments, and business decisions may differ significantly from those envisaged by our forward-looking statements. We do not undertake to update or revise any of our forward-looking statements, except as required by applicable securities law. Our forward-looking statements are also subject to material risks and uncertainties, including ongoing macroeconomic and geopolitical risks, such as changes in or application of trade and tax laws and policies, including the impacts of tariffs and other trade barriers and restrictions, lower GDP growth or recession in the U.S. or globally, supply chain disruptions, capital markets volatility, inflation, and certain regional conflicts, that can affect our performance in both the near- and long-term. In addition, no assurance can be given that any plan, initiative, projection, goal, commitment, expectation, or prospect set forth in this release can or will be achieved. These forward-looking statements should be considered in light of the information included in this release, our Form 10-K, and other filings with the SEC. Any forward-looking plans described herein are not final and may be modified or abandoned at any time.

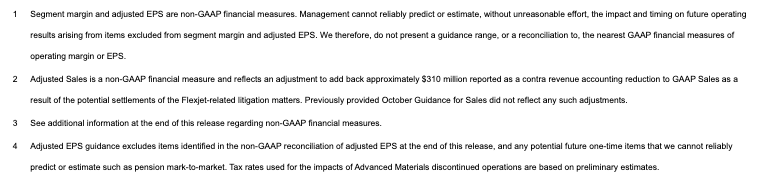

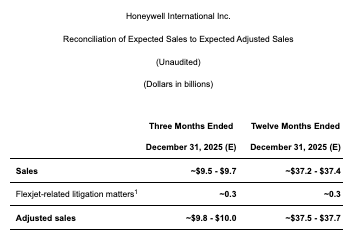

This release contains financial measures presented on a non-GAAP basis. Honeywell’s non-GAAP financial measures used in this release are as follows:

- Segment profit, on an overall Honeywell basis;

- Segment profit margin, on an overall Honeywell basis;

- Organic sales growth;

- Adjusted sales;

- Free cash flow; and

- Adjusted earnings per share.

Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. Certain measures presented on a non-GAAP basis represent the impact of adjusting items net of tax. The tax-effect for adjusting items is determined individually and on a case-by-case basis. Refer to the Appendix attached to this release for reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures.

Appendix

Non-GAAP Financial Measures

The following information provides definitions and reconciliations of certain non-GAAP financial measures presented in this press release to which this reconciliation is attached to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP).

Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. Certain measures presented on a non-GAAP basis represent the impact of adjusting items net of tax. The tax-effect for adjusting items is determined individually and on a case-by-case basis. Other companies may calculate these non-GAAP measures differently, limiting the usefulness of these measures for comparative purposes.

Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitations of these non-GAAP financial measures are that they exclude significant expenses and income that are required by GAAP to be recognized in the consolidated financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. Investors are urged to review the reconciliation of the non-GAAP financial measures to the comparable GAAP financial measures and not to rely on any single financial measure to evaluate Honeywell’s business.

Organic Sales Percent Change

We define organic sales percentage as the year-over-year change in adjusted sales from continuing operations relative to the comparable period, excluding the impact on sales from foreign currency translation, and acquisitions, net of divestitures, for the first 12 months following the transaction date. We believe this measure is useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends.

A quantitative reconciliation of reported sales percent change to organic sales percent change has not been provided for the forward-looking measure of organic sales percent change because management cannot reliably predict or estimate, without unreasonable effort, the fluctuations in global currency markets that impact foreign currency translation, nor is it reasonable for management to predict the timing, occurrence and impact of acquisition and divestiture transactions, all of which could significantly impact our reported sales percent change.

We define adjusted sales as sales from continuing operations less the sales impact of the Flexjet-related litigation matters. Management considers the nature and significance of these litigation matters to be unusual and not indicative of the Company’s ongoing performance.

We believe that adjusted sales is a non-GAAP measure that is useful to investors and management as a measure of ongoing operations and in analysis of ongoing operating trends.

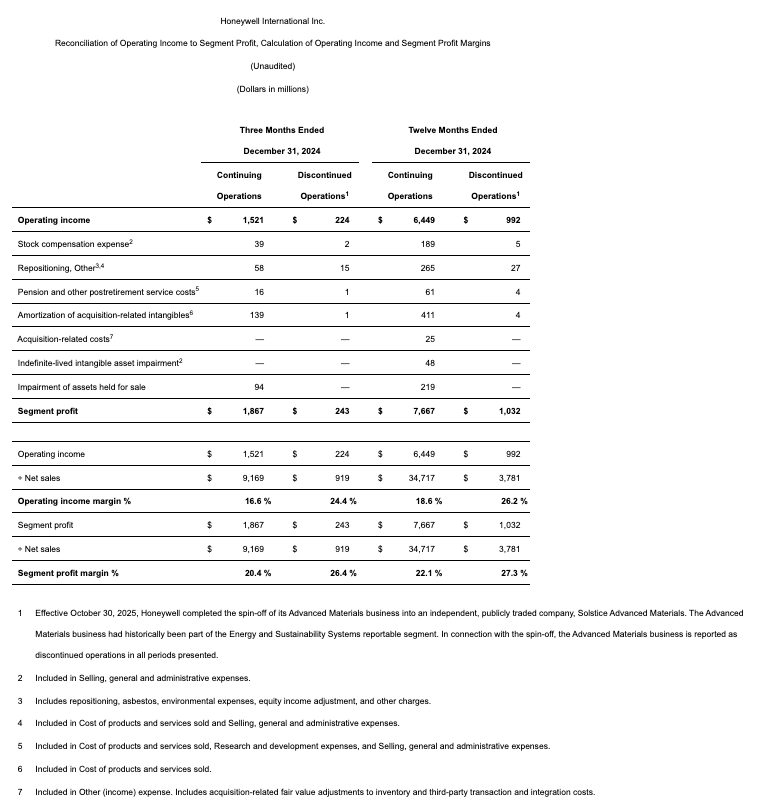

We define operating income as net sales less total cost of products and services sold, research and development expenses, impairment of assets held for sale, and selling, general and administrative expenses. We define segment profit, on an overall Honeywell basis, as operating income, excluding stock compensation expense, pension and other postretirement service costs, amortization of acquisition-related intangibles, certain acquisition- and divestiture-related costs and impairments, and repositioning and other charges. We define segment profit margin, on an overall Honeywell basis, as segment profit divided by net sales. We believe these measures are useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends.

A quantitative reconciliation of operating income to segment profit, on an overall Honeywell basis, has not been provided for all forward-looking measures of segment profit and segment profit margin included herein. Management cannot reliably predict or estimate, without unreasonable effort, the impact and timing on future operating results arising from items excluded from segment profit, particularly pension mark-to-market expense as it is dependent on macroeconomic factors, such as interest rates and the return generated on invested pension plan assets. The information that is unavailable to provide a quantitative reconciliation could have a significant impact on our reported financial results. To the extent quantitative information becomes available without unreasonable effort in the future, and closer to the period to which the forward-looking measures pertain, a reconciliation of operating income to segment profit will be included within future filings.

Acquisition amortization and acquisition- and divestiture-related costs are significantly impacted by the timing, size, and number of acquisitions or divestitures we complete and are not on a predictable cycle and we make no comment as to when or whether any future acquisitions or divestitures may occur. We believe excluding these costs provides investors with a more meaningful comparison of operating performance over time and with both acquisitive and other peer companies.

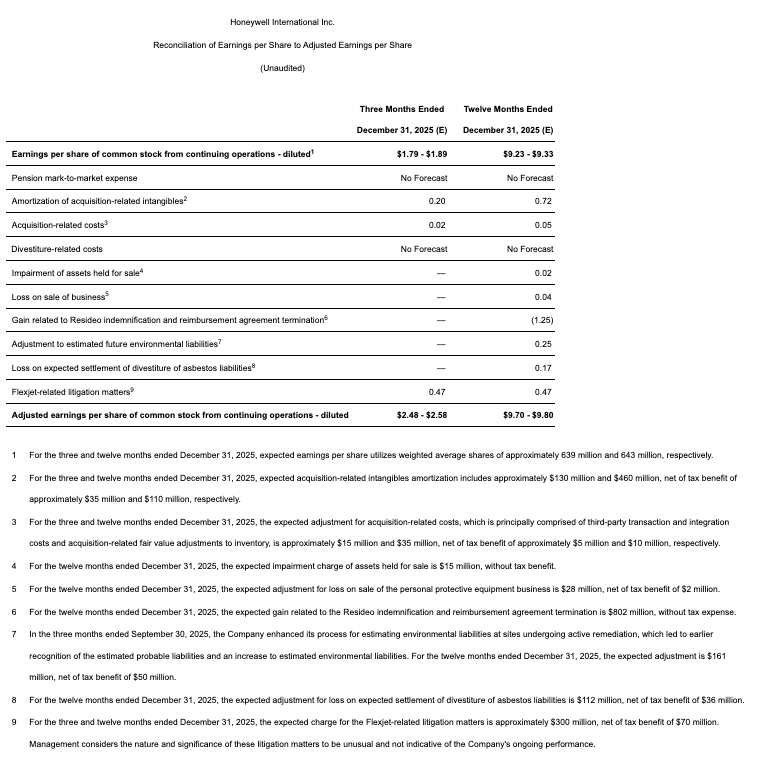

We define adjusted earnings per share as diluted earnings per share from continuing operations adjusted to exclude various charges as listed above. We believe adjusted earnings per share is a measure that is useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends. For forward-looking information, management cannot reliably predict or estimate, without unreasonable effort, the pension mark-to-market expense or the divestiture-related costs. The pension mark-to-market expense is dependent on macroeconomic factors, such as interest rates and the return generated on invested pension plan assets. The divestiture-related costs are subject to detailed development and execution of separation restructuring plans for the announced separation of Automation and Aerospace Technologies. We therefore do not include an estimate for the pension mark-to-market expense or divestiture-related costs. Based on economic and industry conditions, future developments, and other relevant factors, these assumptions are subject to change.

Acquisition amortization and acquisition- and divestiture-related costs are significantly impacted by the timing, size, and number of acquisitions or divestitures we complete and are not on a predictable cycle and we make no comment as to when or whether any future acquisitions or divestitures may occur. We believe excluding these costs provides investors with a more meaningful comparison of operating performance over time and with both acquisitive and other peer companies.

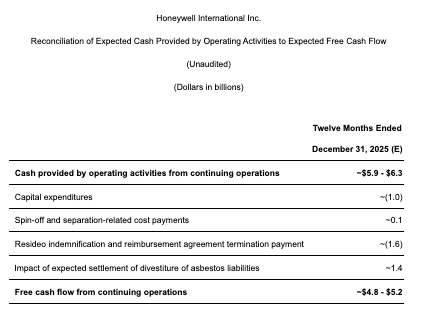

We define free cash flow as cash provided by operating activities from continuing operations less cash for capital expenditures and excluding spin-off and separation-related cost payments, the Resideo indemnification and reimbursement agreement termination payment, and the cash payment for settlement of divestiture of asbestos liabilities.

We believe that free cash flow is a non-GAAP measure that is useful to investors and management as a measure of cash generated by operations that will be used to repay scheduled debt maturities and can be used to invest in future growth through new business development activities or acquisitions, pay dividends, repurchase stock, or repay debt obligations prior to their maturities. This measure can also be used to evaluate our ability to generate cash flow from operations and the impact that this cash flow has on our liquidity.

SourceHoneywell

EMR Analysis

More information on Honeywell: See the full profile on EMR Executive Services

More information on Vimal Kapur (Chairman and Chief Executive Officer, Honeywell): See the full profile on EMR Executive Services

More information on Michal Stepniak (Senior Vice President and Chief Financial Officer, Honeywell): See the full profile on EMR Executive Services

More information on Honeywell Aerospace Technologies Segment (AT) by Honeywell: https://aerospace.honeywell.com/ + Products and services from Honeywell Aerospace Technologies are found on virtually every commercial, defense and space aircraft. The Aerospace Technologies business unit builds aircraft engines, cockpit and cabin electronics, wireless connectivity systems, mechanical components and more. Its hardware and software solutions create more fuel-efficient aircraft, more direct and on-time flights and safer skies and airports.

As a standalone company, Honeywell Aerospace will be one of the largest publicly listed pure-play aerospace suppliers, with more than $15 billion in 2024 sales1. With leading positions in propulsion, cockpit and navigation systems and auxiliary power, Honeywell Aerospace’s technology is featured on virtually every commercial and defense aircraft platform worldwide, making it uniquely positioned to capitalize on long-term growth trends. The independent company will be headquartered in Phoenix, Arizona.

The Aerospace Technologies business will continue to report results as a Honeywell business segment until the completion of its separation, which is on track for the second half of 2026.

More information on Craig Arnold (Member of the Board of Directors, Honeywell till spin-off expected to be completed in the second half of 2026 + Non-Executive Chairman of the Board, Honeywell Aerospace as from spin-off expected to be completed in the second half of 2026): See the full profile on EMR Executive Services

More information on Jim Currier (President and Chief Executive Officer, Aerospace Technologies Segment (AT), Honeywell till spin-off expected to be completed in the second half of 2026 + President and Chief Executive Officer, Honeywell Aerospace as from spin-off expected to be completed in the second half of 2026): See the full profile on EMR Executive Services

More information on Sean Meakim (Vice President, Investor Relations and Strategic Finance, Honeywell till February 2, 2026 + Vice President, Investor Relations, Honeywell Aerospace as from February 2, 2026): See the full profile on EMR Executive Services

More information on Honeywell Building Automation Segment (BA) by Honeywell: https://buildings.honeywell.com/us/en/home + Through hardware, software, sensors, and analytics, Honeywell helps customers convert buildings into integrated, safe, and more sustainable assets. With solutions and services used in more than 10 million buildings worldwide, Building Automation will continue to strengthen Honeywell’s position in attractive end markets like hospitals, airports, education, and data centers.

More information on Billal Hammoud (President and Chief Executive Officer, Building Automation Segment (BA), Honeywell): See the full profile on EMR Executive Services

More information on Honeywell Industrial Automation Segment (IA) by Honeywell: https://automation.honeywell.com/us/en + With a deep history in industrial automation that spans more than five decades, Honeywell enables process industry operations, creates world-class sensor technologies, automates supply chains, makes warehouses smarter, and improves worker safety. This combination build on our core strengths in controls and automation technologies, deliver better commercial outcomes for our customers, and enhance our growth.

More information on Peter Lau (President and Chief Executive Officer, Industrial Automation Segment (IA), Honeywell): See the full profile on EMR Executive Services

More information on Honeywell Process Solutions by Honeywell Industrial Automation Segment (IA) by Honeywell (to be named Process Automation by Process Automation and Technology (PA&T) Segment as from January 1, 2026): https://process.honeywell.com/us/en/about-us + Honeywell Process Solutions is a pioneer in automation control, instrumentation and services for the oil and gas; refining; energy; pulp and paper; industrial power generation; chemicals and petrochemicals; biofuels; life sciences; and metals, minerals, and mining industries.

Honeywell plays a critical role across the entire lifecycle of an industrial facility, including:

- Project design and engineering

- Technology licensing

- Technical services

- Ongoing operations

- Cybersecurity

- Continuous modernization.

A leader in digitization, Honeywell delivers software and services that help customers overcome competitive pressures and uncertain market conditions to achieve game-changing business outcomes. Honeywell’s comprehensive portfolio in process control, monitoring, and safety systems and instrumentation provides optimized operations and maintenance efficiencies to meet diverse automation needs.

More information on Jim Masso (President and Chief Executive Officer, Honeywell Process Solutions, Honeywell Industrial Automation Segment (IA), Honeywell till January 1, 2026 + President and Chief Executive Officer, Honeywell Process Automation, Process Automation and Technology (PA&T) Segment as from January 1, 2026): See the full profile on EMR Executive Services

More information on Solstice Advanced Materials: See full profile on EMR Executive Services

More information on David Sewell (President and Chief Executive Officer, Solstice Advanced Materials): See full profile on EMR Executive Services

More information on Flexjet: https://flexjet.com/ + Flexjet, a global leader in private aviation, first entered the fractional jet ownership market in 1995 and is celebrating its 30th anniversary. Flexjet offers fractional jet ownership and leasing and is the first in the world to be recognized as achieving the Air Charter Safety Foundation’s Industry Audit Standard, is the first and only company to be honored with 26 FAA Diamond Awards for Excellence, upholds an ARG/US Platinum Safety Rating, a 4AIR Bronze Sustainable Rating and is certified at Stage 2 with IS-BAO. Flexjet Technical Services, a fully integrated maintenance and product support infrastructure, has operations in the U.S., Canada and Europe and its primary mission is to support the maintenance of the Flexjet fleet. Red Label by Flexjet, a market differentiator, features an ultra-modern fleet, flight crews assigned to a single aircraft and the LXi Cabin Collection of interiors. To date there are more than 50 different interior designs across its fleet, which includes the Embraer Phenom 300, Praetor 500 and 600, Bombardier Challenger 350/3500 and the Gulfstream G450, G650 and G700. Flexjet’s European fleet includes the Embraer Praetor 600 and the Gulfstream G650. Flexjet’s helicopter division offers leases, helicopter cards and convenient interchange access for its aircraft Owners. Flexjet owns, operates and maintains its global fleet of Sikorsky S-76 helicopters which boast 55,000 hours of safe flying certified by Wyvern and ARG/US and serving locations throughout the northeastern United States, Florida, United Kingdom and Italy. Flexjet is a member of the Directional Aviation family of companies.

More information on Michael J. Silvestro (Chief Executive Officer, Flexjet): https://flexjet.com/wp-content/uploads/2023/12/Flexjet-LLC-Executive-Biographies.pdf

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The Honeywell 2025 Q3 Earnings Release Presentation can be viewed here: https://investor.honeywell.com/static-files/93ab586f-f906-4487-a881-e82cabba2561

- The Honeywell 2025 Q3 Earnings Release Financials can be viewed here: https://www.honeywell.com/content/dam/honeywellbt/en/documents/downloads/press-releases/hon-corp-3q25-financial-release-tables.pdf

- The Honeywell 2025 Q2 Earnings Release Presentation can be viewed here: https://investor.honeywell.com/static-files/73f4b895-b09d-4d88-baff-eb7fea1fa125

- The Honeywell 2025 Q2 Earnings Release Financials can be viewed here: https://www.honeywell.com/content/dam/honeywellbt/en/documents/downloads/press-releases/hon-corp-2q25-financial-release-tables.pdf

- The Honeywell 2024 Annual Report can be viewed here: https://investor.honeywell.com/static-files/d3fc3f84-56dc-4ba9-bfdc-58ddbab4376f

- The Honeywell 2024 Q4 Earnings Release can be viewed here: https://investor.honeywell.com/static-files/5b22adeb-4a93-408c-8f77-e1fd0f5ed625

- The Honeywell 2024 Q4 Earnings and 2025 Outlook Presentation can be viewed here: https://investor.honeywell.com/static-files/f42f398f-d78a-4755-8224-a52c01c0efe5

- The Honeywell 2023 Annual Report can be viewed here: https://investor.honeywell.com/static-files/98bf174f-edb5-4dfe-8f24-1455590edbcb

- The Honeywell Portfolio Update from October 8, 2024 Presentation can be viewed here: https://investor.honeywell.com/static-files/810b2e87-0899-49ad-8259-388091f0011a

- The Honeywell Fourth Quarter 2023 Earnings and 2024 Outlook Presentation can be viewed here: https://investor.honeywell.com/static-files/58184017-50e2-433c-9cc8-22a48a5f065c

- The Honeywell 2022 Q4 Earnings Release can be viewed here: https://investor.honeywell.com/static-files/4826acb7-689b-4dfe-b8cb-d8be7c6a4b52

- The Honeywell 2022 Annual Report can be viewed here: https://investor.honeywell.com/static-files/bcad5ff0-8046-496c-aea3-af0024981dcc

- The Honeywell 2021 Annual Report can be viewed here: https://investor.honeywell.com/static-files/0f826f8b-fb20-4adc-a1e0-a841597316f1