Orsted – Completion of rights issue and strong execution of business plan

Today, Ørsted’s Board of Directors approved the interim report for the first nine months of 2025.

Ørsted has taken significant steps in delivering on its strategic priorities during the third quarter. This includes the strengthening of its capital structure through the completion of the rights issue and the divestment of a 50 % equity stake in the 2.9 GW Hornsea 3 Offshore Wind Farm in the UK. The operational performance has remained solid, and Ørsted reiterates its full-year EBITDA guidance.

Rasmus Errboe, Group President and CEO of Ørsted, says in a comment to the interim report for the first nine months of 2025:

“I’m satisfied with the good progress across our entire construction portfolio and our solid operational performance. Despite lower wind speeds in the quarter, we have increased the generation by 8 % compared to Q3 2024 through a combination of higher availability rates for our offshore portfolio and ramping up generation from Gode Wind 3 in Germany.”

“We’ve significantly strengthened Ørsted’s financial robustness with the completion of the rights issue and the agreement to divest a 50 % stake in our Hornsea 3 project in the UK. I’m pleased with the strong support from our shareholders. I see this as a strong indication that our investors see significant potential in Ørsted and in the offshore wind industry. Our key focus is to continue delivering on our business plan, which will enable Ørsted to remain a global leader of offshore wind with a strong foothold in Europe.”

Highlights from the execution of our business plan in Q3

We have significantly strengthened our capital structure with the completion of the rights issue, amounting to DKK 60 billion in gross proceeds. As planned, we have divested a 50 % equity stake of our 2.9 GW Hornsea 3 Offshore Wind Farm in the UK, which supports a further strengthening of our capital structure.

We have made good progress on our 8.1 GW offshore wind construction portfolio, including the completed installation of the remaining offshore substations for the Northeast programme in the US. Once the current construction portfolio is fully commissioned, the projects will contribute with an annual EBITDA run rate of DKK 11 to 12 billion.

We have continued our efforts to improve our competitiveness. We announced an adjustment of our organisation through a reduction of approx. 2,000 positions towards the end of 2027. This is necessary as it increases our competitiveness and is a natural consequence of our strategic focus on offshore wind in Europe and the completion of our construction portfolio during 2026 and 2027.

Guidance

We maintain our full-year EBITDA guidance of DKK 24-27 billion excluding earnings from new partnerships and cancellation fees. Additionally, we maintain our gross investments guidance of DKK 50-54 billion.

Results for 9M 2025

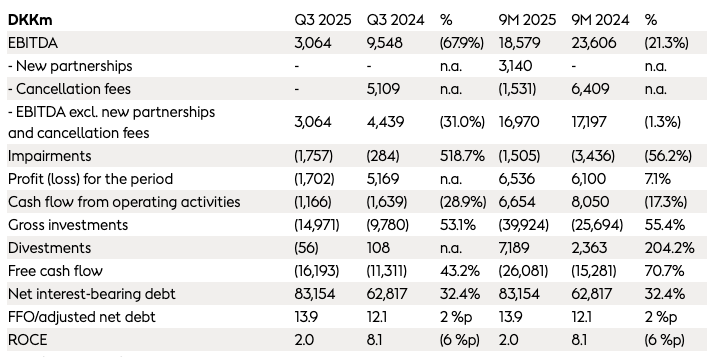

Operating profit (EBITDA) for first the nine months of 2025 amounted to DKK 18.6 billion compared to DKK 23.6 billion in the same period last year, mainly due to the reversal of cancellation fees in 2024 not being repeated in 2025. EBITDA excluding new partnerships and cancellation fees in 9M 2025 amounted to DKK 17.0 billion, roughly in line with the same period last year.

Earnings from our offshore sites amounted to DKK 16.1 billion in 9M 2025, up 5 % compared to the same period last year. The increase was mainly due to higher availability, partly offset by lower wind speeds.

Profit for the period totalled DKK 6.5 billion, DKK 0.4 billion higher than in 9M 2024. Return on capital employed (ROCE) came in at 2.0 %. ROCE adjusted for impairment losses and cancellation fees in 9M 2025 was 10.2 %.

Earnings call

In connection with the presentation of the interim report for the first nine months of 2025, an earnings call for investors and analysts will be held on Wednesday, 5 November 2025 at 14:00 CET.

The earnings call can be followed live at:

https://getvisualtv.net/stream/?orsted-q3-2025

The interim report is available for download at:

https://orsted.com/financial-reports

SourceOrsted

EMR Analysis

More information on Ørsted: See the full profile on EMR Executive Services

More information on Lene Skole (Chairwoman of the Board of Directors, Ørsted): See the full profile on EMR Executive Services

More information on Rasmus Errboe (Group President and Chief Executive Officer, Ørsted): See the full profile on EMR Executive Services

More information on Trond Westlie (Group Executive Team – Executive Vice President, Chief Financial Officer, Ørsted): See the full profile on EMR Executive Services

More information on the Ørsted Hornsea 3 Offshore Wind Farm by Ørsted and Apollo: https://hornseaproject3.co.uk/ + Hornsea Three offshore wind farm could meet the average daily needs of well over 3 million UK homes.

In August 2015, Ørsted acquired the rights to develop the Hornsea Zone from SMart Wind Ltd, who were originally awarded the zone in The Crown Estate Round 3 bid process. To date, Hornsea One and Hornsea Two have both received planning consent, with Hornsea One now operational and Hornsea Two currently under construction.

On 14 May 2018, we submitted a Development Consent Order (DCO) application for a third project in the zone, Hornsea Project Three Offshore Wind Farm.

The application was accepted by the Planning Inspectorate in June 2018 and was granted consent by the Secretary of State for the Department for Business, Energy and Industrial Strategy on 31 December 2020.

- Location:

- Hornsea Three will be located in the North Sea, approximately 120 km off the Norfolk coast and 160 km off the Yorkshire coast.

- Size:

- Up to 231 offshore wind turbines will be located within a 696 km2 area.

- Power output:

- The wind farm will be capable of generating at least 2.85 GW of green electricity, enough to meet the average daily needs of well over 3 million homes.

More information on Apollo: https://www.apollo.com/ + Since our founding in 1990, we have believed that adhering to our values is integral to our success. This has allowed us to build an innovative and collaborative culture that can support great businesses and generate attractive returns for our clients.

Apollo is a high-growth, global alternative asset manager. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade credit to private equity. For more than three decades, our investing expertise across our fully integrated platform has served the financial return needs of our clients and provided businesses with innovative capital solutions for growth. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes. As of June 30, 2025, Apollo had approximately $840 billion of assets under management.

More information on Marc Rowan (Chief Executive Officer and Chair of the Board, Apollo Global Management, Apollo): https://www.apollo.com/aboutus/leadership-and-people

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents like the Universal Registration Document.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- Ørsted First Nine Months 2025 Interim Report can be found here: https://cdn.orsted.com/-/media/q32025/interim-financial-report-9m-2025.pdf

- Ørsted Q3 2025 Investor Presentation can be found here: https://cdn.orsted.com/-/media/q32025/orsted-q3-2025-investor-presentation.pdf

- Ørsted 2024 Annual Report can be found here: https://via.ritzau.dk/ir-files/13560592/14250895/14986/Orsted%20Annual%20Report%202024_WEB.pdf

- Ørsted Q4 & FY 2024 Investor Presentation can be found here: https://via.ritzau.dk/ir-files/13560592/14250895/14987/%C3%98rsted%20Investor%20Presentation%20-%20Q4%202024.pdf

- Ørsted 2023 Annual Report can be found here: https://via.ritzau.dk/ir-files/13560592/8204/12529/%C3%98rsted%20annual%20report%202023.pdf

- Ørsted FY 2023 Investor Presentation can be found here: https://orstedcdn.azureedge.net/-/media/annual-report-2023/orsted-fy-2023-results–capital-markets-update.pdf

- Ørsted 2022 Annual Report can be found here: https://via.ritzau.dk/ir-files/13560592/6237/9071/%C3%98rsted%20annual%20report%202022.pdf

- Ørsted 2021 Annual Report can be found here: https://orstedcdn.azureedge.net/-/media/annual2021/annual-report-2021.ashx