Eaton – Eaton reports record third quarter 2025 results, with accelerating orders and continued backlog growth

- Twelve-month rolling average order acceleration in Electrical Americas to up 7%, driven by data center momentum, with strong Aerospace order growth, up 11%

- Strong year-over-year backlog growth of 18% in Electrical sector and 15% in Aerospace segment

- Total book-to-bill ratio of 1.1 for both the Electrical sector and Aerospace segment on a rolling twelve-month basis

- Record segment margins of 25.0%, above the high end of guidance

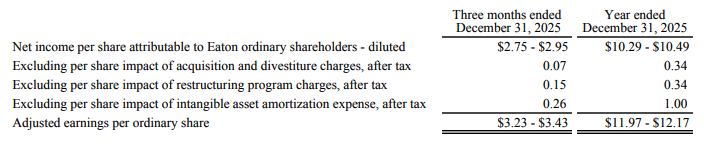

- For full year 2025, earnings per share expected to be between $10.29 and $10.49, and adjusted earnings per share expected to be between $11.97 and $12.17

DUBLIN – Intelligent power management company Eaton Corporation plc (NYSE:ETN) today announced that third quarter 2025 earnings per share were $2.59. Excluding charges of $0.11 per share related to acquisitions and divestitures, $0.26 per share related to intangible amortization, and $0.11 per share related to a multi-year restructuring program, adjusted earnings per share of $3.07 were a quarterly record.

Sales in the quarter were $7.0 billion, a third quarter record and up 10% from the third quarter of 2024. The sales increase consisted of 7% growth in organic sales and 3% growth from acquisitions.

Segment margins were 25.0%, a quarterly record and a 70-basis point improvement over the third quarter of 2024.

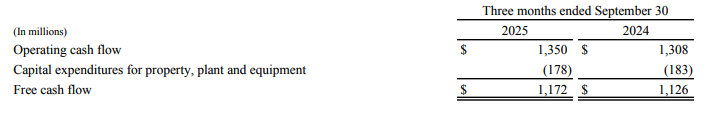

Operating cash flow was $1.4 billion and free cash flow was $1.2 billion, both third quarter records and up 3% and 4%, respectively, over the same period in 2024.

Paulo Ruiz, Eaton chief executive officer, said, “We continued to see strong demand in the quarter with order acceleration, as well as sustained growth in our backlog and positive book-to-bill ratio, driven primarily by our Electrical Americas and Aerospace businesses. While we continue to ramp-up significant capacity investment projects, we remain confident in our ability to deliver our commitments for the year and achieve our 2030 targets. Looking ahead, our strategy to lead, invest and execute for growth will continue to position us well to capitalize on the generational growth opportunities driven by digitalization and AI, reindustrialization, infrastructure spending and more.”

Guidance

For the full year 2025, the company anticipates:

- Organic growth of 8.5-9.5%

- Segment margins of 24.1-24.5%

- Earnings per share between $10.29 and $10.49

- Adjusted earnings per share between $11.97 and $12.17

For the fourth quarter of 2025, the company anticipates:

- Organic growth of 10-12%

- Segment margins of 24.2-24.6%

- Earnings per share between $2.75 and $2.95

- Adjusted earnings per share between $3.23 and $3.43

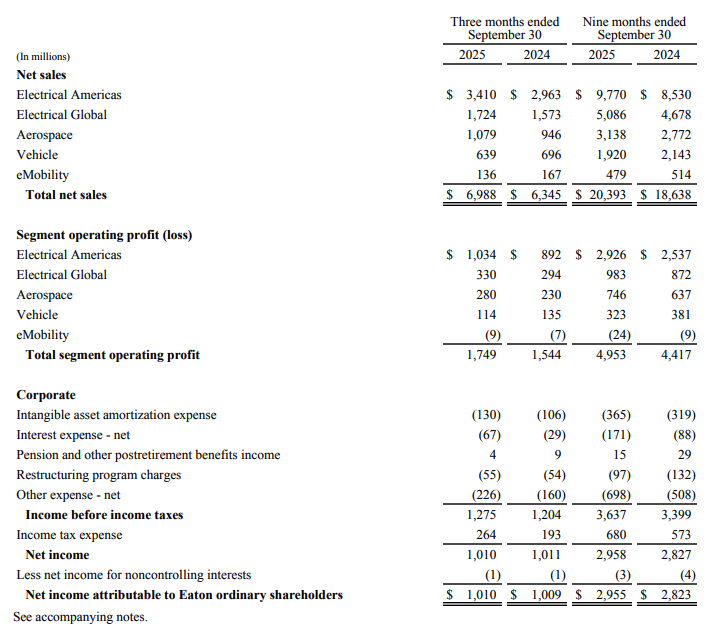

Business Segment Results

Sales for the Electrical Americas segment were a record $3.4 billion, up 15% from the third quarter of 2024. The sales increase consisted of 9% growth in organic sales and 6% growth from acquisitions. Operating profits were a record $1.0 billion, up 16% over the third quarter of 2024. Operating margins of 30.3% were a third quarter record, up 20 basis points over the third quarter of 2024.

The twelve-month rolling average of orders in the third quarter was up 7% organically. Backlog at the end of September remained strong and was up 20% over September 2024.

Sales for the Electrical Global segment were a third quarter record $1.7 billion, up 10% from the third quarter of 2024. Organic sales were up 8%, and positive currency translation added 2%. Operating profits were a third quarter record $330 million, up 12% over the third quarter of 2024. Operating margins in the quarter were 19.1%, up 40 basis points over the third quarter of 2024.

The twelve-month rolling average of orders in the third quarter was up 2% organically. Backlog at the end of September was up 7% over September 2024.

On a rolling twelve-month basis, the book-to-bill ratio for the Electrical businesses increased to 1.1.

Aerospace segment sales were a third quarter record $1.1 billion, up 14% from the third quarter of 2024. Organic sales were up 13%, and positive currency translation added 1%. Operating profits were a quarterly record $280 million, up 22% over the third quarter of 2024. Operating margins of 25.9% were a quarterly record, up 150 basis points over the third quarter of 2024.

The twelve-month rolling average of orders in the third quarter was up 11% organically. The backlog at the end of September was up 15% over September 2024. On a rolling twelve-month basis, the book-to-bill ratio for the Aerospace segment remained strong at 1.1.

The Vehicle segment posted sales of $639 million, down 8% from the third quarter of 2024. Organic sales declined 9%, which was partially offset by 1% from positive currency translation. Operating profits were $114 million and operating margins in the quarter were 17.8%.

eMobility segment sales were $136 million, down 19% from the third quarter of 2024. Organic sales declined 20%, which was partially offset by 1% from positive currency translation. The segment recorded an operating loss of $9 million.

Notice of conference call: Eaton’s conference call to discuss its third quarter results is available to all interested parties today as a live audio webcast at 11 a.m. United States Eastern time via a link on Eaton’s home page. This news release can be accessed under its headline on the home page. Also available on the website before the call will be a presentation on third quarter results, which will be covered during the call.

This news release contains forward-looking statements concerning fourth quarter and full year 2025 earnings per share, adjusted earnings per share, organic growth and segment margins; anticipated capital deployment; as well as anticipated multi-year restructuring program charges and savings. These statements should be used with caution and are subject to various risks and uncertainties, many of which are outside the company’s control. The following factors could cause actual results to differ materially from those in the forward-looking statements: a global pandemic; geopolitical tensions or war, unanticipated changes in the markets for the company’s business segments; unanticipated downturns in business relationships with customers or their purchases from us; competitive pressures on sales and pricing; supply chain disruptions, unanticipated changes in the cost of material, labor, and other production costs, or unexpected costs that cannot be recouped in product pricing; the introduction of competing technologies; unexpected technical or marketing difficulties; unexpected claims, charges, litigation or dispute resolutions; strikes or other labor unrest at Eaton or at our customers or suppliers; natural disasters; the performance of recent acquisitions; unanticipated difficulties completing or integrating acquisitions; new laws and governmental regulations; interest rate changes; changes in tax laws or tax regulations; stock market and currency fluctuations; and unanticipated deterioration of economic and financial conditions in the United States and around the world. We do not assume any obligation to update these forward-looking statements.

EATON CORPORATION plc CONSOLIDATED STATEMENTS OF INCOME

EATON CORPORATION plc BUSINESS SEGMENT INFORMATION

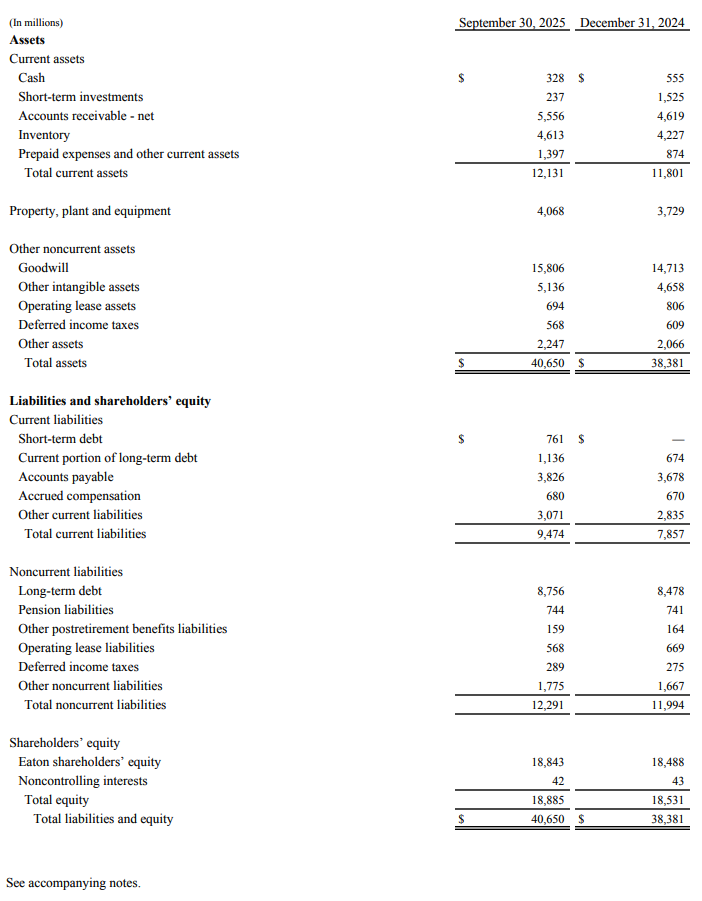

EATON CORPORATION plc CONDENSED CONSOLIDATED BALANCE SHEETS

EATON CORPORATION plc NOTES TO THE THIRD QUARTER 2025 EARNINGS RELEASE

Amounts are in millions of dollars unless indicated otherwise (per share data assume dilution). Columns and rows may not add and the sum of components may not equal total amounts reported due to rounding.

Note 1. NON-GAAP FINANCIAL INFORMATION

This earnings release includes certain non-GAAP financial measures. These financial measures include adjusted earnings, adjusted earnings per ordinary share, and free cash flow, each of which differs from the most directly comparable measure calculated in accordance with generally accepted accounting principles (GAAP). A reconciliation of each of these financial measures to the most directly comparable GAAP measure is included in this earnings release. Management believes that these financial measures are useful to investors because they provide additional meaningful financial information that should be considered when assessing our business performance and trends, and they allow investors to more easily compare Eaton Corporation plc’s (Eaton or the Company) financial performance period to period. Management uses this information in monitoring and evaluating the on-going performance of Eaton and each business segment.

The Company’s fourth quarter and full year net income per ordinary share and adjusted earnings per ordinary share guidance for 2025 is as follows:

A reconciliation of operating cash flow to free cash flow is as follows:

Note 2. ACQUISITIONS OF BUSINESSES

Acquisition of Exertherm

On May 20, 2024, Eaton acquired Exertherm, a U.K.-based provider of thermal monitoring solutions for electrical equipment. Exertherm is reported within the Electrical Americas business segment.

Acquisition of a 49% stake in NordicEPOD AS

On May 31, 2024, Eaton acquired a 49 percent stake in NordicEPOD AS, which designs and assembles standardized power modules for data centers in the Nordic region. Eaton accounts for this investment on the equity method of accounting and it is reported within the Electrical Global business segment.

Acquisition of Fibrebond Corporation

On April 1, 2025, Eaton acquired Fibrebond Corporation (Fibrebond) for $1.45 billion, net of cash acquired. Fibrebond is a U.S. based designer and builder of pre-integrated modular power enclosures for data center, industrial, utility and communications customers. Fibrebond had sales of approximately $378 million for the twelve months ended February 28, 2025, and is reported within the Electrical Americas business segment.

As part of the acquisition, Eaton assumed $240 million of employee transaction and retention awards. Awards vest in six equal annual installments starting in the second quarter of 2025, subject to continued employment with Eaton. Forfeited employee awards are paid to former Fibrebond shareholders annually. Eaton recognizes compensation expense for the awards over the requisite service period and any employee forfeitures owed to former Fibrebond shareholders are expensed immediately in Other expense (income) – net. During the third quarter of 2025, compensation expense of $9 million, $2 million and $5 million were included in Costs of products sold, Selling and administrative expense, and Other expense (income) – net, respectively. During the first nine months of 2025, compensation expense of $43 million, $14 million and $7 million were included in Costs of products sold, Selling and administrative expense, and Other expense (income) – net, respectively.

Agreement to Acquire Ultra PCS Limited

On June 16, 2025, Eaton signed an agreement to acquire Ultra PCS Limited (Ultra PCS), which is headquartered in the U.K. with operations in the U.K. and the U.S. Ultra PCS produces electronic controls, sensing, stores ejection and data processing solutions, enabling mission success for global aerospace customers in the air and on the ground. Under the terms of the agreement, Eaton will pay $1.55 billion for Ultra PCS. The transaction is subject to customary closing conditions and regulatory approvals and is expected to close in the fourth quarter of 2025. Ultra PCS will be reported within the Aerospace business segment.

Acquisition of Resilient Power Systems Inc.

On August 6, 2025, Eaton acquired Resilient Power Systems Inc. (Resilient), a leading North American developer and manufacturer of innovative energy solutions, including solid-state transformer-based technology. Resilient was acquired for $86 million, including $55 million of cash paid at closing and an initial estimate of $31 million for the fair value of contingent future consideration based on 2025 through 2028 revenue performance and achievement of technology-based milestones. The fair value of contingent consideration liabilities is estimated by discounting contingent payments expected to be made, and may increase or decrease based on changes in revenue estimates and discount rates, with a maximum possible undiscounted value of $45 million. Resilient is reported within the Electrical Americas business segment

As part of the acquisition, Eaton assumed employee incentives with a maximum payout of $50 million contingent upon achievement of the same revenue performance and technology-based milestones, as well as continued employment with Eaton. The incentives will be paid over three years, starting in 2026 and concluding in 2028. As of September 30, 2025, the Company expects to pay $38 million of employee incentives based on the estimated probability of the milestones being achieved. Compensation expense will be recognized over the requisite service period. During the third quarter of 2025, compensation expense of $4 million was included in Selling and administrative expense.

Agreement to Acquire Boyd Thermal

On November 2, 2025, Eaton signed an agreement to acquire Boyd Thermal, a U.S. based global leader in thermal components, systems, and ruggedized solutions for data center, aerospace and other end-markets. Boyd Thermal employs more than 5,000 people with manufacturing sites across North America, Asia, and Europe. Under the terms of the agreement, Eaton will pay $9.5 billion for Boyd Thermal. The transaction is subject to customary closing conditions and regulatory approvals and is expected to close in the second quarter of 2026.

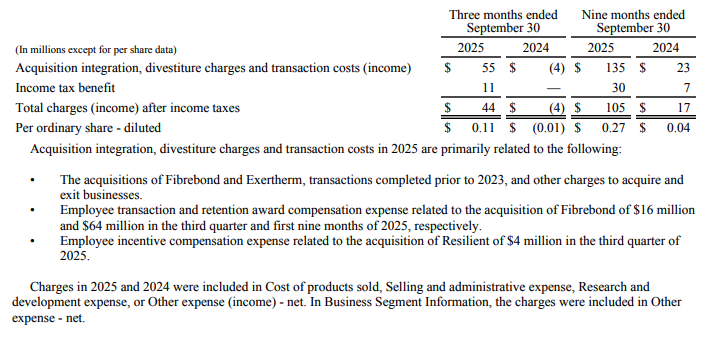

Note 3. ACQUISITION AND DIVESTITURE CHARGES

Eaton incurs integration charges and transaction costs to acquire and integrate businesses, and transaction, separation and other costs to divest and exit businesses. Eaton also recognizes gains and losses on the sale of businesses. A summary of these Corporate items is as follows:

Note 4. RESTRUCTURING CHARGES

During the first quarter of 2024, Eaton implemented a multi-year restructuring program to accelerate opportunities to optimize its operations and global support structure. These actions will better align the Company’s functions to support anticipated growth and drive greater effectiveness throughout the Company. Since the inception of the program, the Company has incurred charges of $300 million. This restructuring program is expected to be completed in 2026 and is expected to incur additional expenses related to workforce reductions of $118 million and plant closing and other costs of $57 million, resulting in total estimated charges of $475 million for the entire program. The Company expects mature year benefits of $375 million when the multi-year program is fully implemented.

A summary of restructuring program charges is as follows:

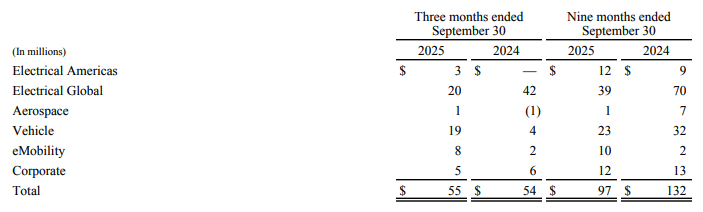

Restructuring program charges (income) related to the following segments:

These restructuring program charges were included in Cost of products sold, Selling and administrative expense, Research and development expense, or Other expense (income) – net, as appropriate. In Business Segment Information, these restructuring program charges are treated as Corporate items.

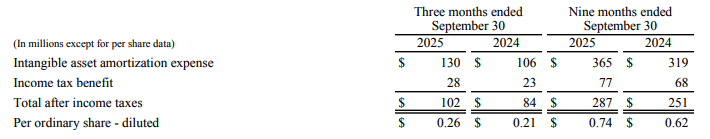

Note 5. INTANGIBLE ASSET AMORTIZATION EXPENSE

Intangible asset amortization expense is as follows:

SourceEaton

EMR Analysis

More information on Eaton: See full profile on EMR Executive Services

More information on Paulo Ruiz Sternadt (Chief Executive Officer, Eaton): See the full profile on EMR Executive Services

More information on Olivier Leonetti (Senior Leadership Team – Executive Vice President and Chief Financial Officer, Eaton): See full profile on EMR Executive Services

More information on Boyd Corporation: https://www.boydcorp.com/ +Boyd is the world’s leading innovator in sustainable engineered material and thermal solutions that make our customers’ products better, safer, faster, and more reliable. We develop and combine technologies to solve ambitious performance targets in our customers’ most critical applications. By implementing technologies and material science in novel ways to seal, protect, cool, and interface, Boyd has continually redefined the possible and championed customer success for over 90 years.

More information on Doug Britt (Chief Executive Officer, Boyd Corporation): https://www.boydcorp.com/about-boyd/leadership.html + https://www.linkedin.com/in/doug-britt-3b361b5/

More information on Boyd Thermal by Eaton: https://www.boydcorp.com/ + https://www.boydcorp.com/thermal.html +

Boyd Thermal Management: Boyd has a long history of developing, designing, testing, optimizing, and fabricating reliable high-performance thermal management solutions across all industries. Through consistent innovation in engineering and manufacturing, Boyd provides optimized, cost-efficient cooling solutions and systems utilizing the largest range of traditional and advanced cooling technologies.

Boyd Thermal has forecasted sales of $1.7 billion for 2026, of which $1.5 billion is in liquid cooling.

Boyd Thermal is a global business based in the U.S., with more than 5,000 employees and manufacturing sites across North America, Asia and Europe. With its decades-long history starting as an aerospace thermal management supplier, today Boyd’s thermal business serves data center, industrial, aerospace and other markets.

More information on David Huang (Chief Executive Officer, Boyd Thermal, Eaton): https://www.boydcorp.com/about-boyd/leadership.html + https://www.linkedin.com/in/david-huang-31960b7/

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- Eaton Q3 2025 Presentation can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/quarterly-earnings/filings/2025/q3/3Q-2025-analyst-presentation.pdf

- Eaton Q2 2025 Presentation can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/quarterly-earnings/filings/2025/q2/2Q-2025-analyst-presentation.pdf

- Eaton Annual Report 2024 can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/annual-report/eaton-2024-annual-report.pdf

- Eaton Q4 2024 Earnings Release can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/quarterly-earnings/filings/2024/q4/4Q-2024-earnings-complete.pdf

- Eaton Q4 2024 Presentation can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/quarterly-earnings/filings/2024/q4/4Q-2024-analyst-presentation.pdf

- Eaton Annual Report 2023 can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/annual-report/eaton-2023-annual-report.pdf

- Eaton Q4 2023 Earnings Release can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/quarterly-earnings/filings/2023/q4/4Q-2023-earnings-complete.pdf

- Eaton Annual Report 2022 can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/annual-report/Eaton_AnnualReport22_Digital_FINAL.pdf

- Eaton 2022 Annual Investor Conference Presentations can be found here: https://www.eaton.com/us/en-us/company/investor-relations/investor-toolkit/financial-reports/annual-investor-conference.html

- Eaton Annual Report 2021 can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/annual-report/Eaton-annual-report-2021-web.pdf

- Eaton Q4 2021 Earning Release can be found here: https://www.eaton.com/content/dam/eaton/company/investor-relations/quarterly-earnings/filings/4Q-2021-earnings-complete.pdf