Pipelife – Prefabricated electrical solutions beat 14-week deadline at landmark project

The ambitious SPOT Amsterdam is more than just a residential complex — it’s a bold vision for urban living, offering over 1,000 new homes, alongside work, commercial and leisure areas.

To meet a particularly tight construction target, the project contractor, BLOM Elektrotechniek, relied on Pipelife’s ready-to-install electrical solutions, turning a 14-week deadline into a record-breaking achievement that showcases new speed and efficiency opportunities for large-scale urban developments.

The new hot spot of Amsterdam

SPOT Amsterdam is a state-of-the-art residential project taking shape in Hondsrugpark, a vibrant, park-like district that offers all modern amenities at your doorstep. A total of seven high-rise towers are being built here, with more than 1,000 residential units planned, alongside 17,000 m² of space for offices, shops, restaurants and sports facilities.

Energy efficiency and sustainability are integral to the ambitious project — for example, all units in SPOT towers will be gas-free and supplied by solar panels. The experienced contractor BLOM Elektrotechniek was commissioned to handle most of the electrical installations at SPOT. From power supply to data networks, Wi-Fi, fire alarm systems, solar panels, vide intercoms and parking management — everything was planned in line with the most modern energy and sustainability requirements.

Meeting a pressing construction schedule

One of the most significant project challenges came with Tower B2, also known as Coral, which features 131 apartments. The 11-floor structure had to be completed within just 14 weeks due to utility works scheduled in the area, limiting hoisting operations afterward.

High construction speed and accuracy were therefore critical. The stakeholders decided to explore prefabricated solutions to keep Coral development on schedule. Seeking a reliable prefab partner, BLOM Elektrotechniek turned to Pipelife Netherlands. Both companies immediately found a common ground due to their shared commitment to construction quality, efficiency and innovation.

Fast-track construction with prefabricated electrical solutions

Jan van Meegdenburg, Prefab Manager at Pipelife Netherlands, was responsible for the project on behalf of Pipelife.

“We currently offer prefabricated solutions for virtually any project,” he explains. “Many installers in the Netherlands and beyond are already familiar with Spider, our fully tailored, prewired conduit system that makes electrical installations considerably faster and easier.”

Each Spider system is individually designed to the project’s exact specifications and prefabricated under strict factory conditions. Before delivery, all components and connections are carefully tested and individually labelled to ensure reliable, error-free installation. Once delivered, the Spider system simply has to be rolled out and secured in place.

“We relied on the prefabricated Spider system, along with custom conduit lengths for power, data, switch wires, thermostats, alarm systems and more,” says Remco Lighthart, Project Manager at BLOM Elektrotechniek. Thanks to careful planning and these smart prefab solutions, we were able to complete electrical installations in up to three apartments per day!”

Setting the stage for high-speed installation

Careful preparation and precise engineering were crucial for the project’s success. All connection points were modeled in detail using BIM, and thanks to the close cooperation between BLOM and Pipelife engineers.

Every prefabricated component was tested and certified before being shipped to the site. Furthermore, each part was assigned a unique code, ensuring its installation at the correct location. The prefabricated systems were carefully packaged in crates, labeled per apartment, and hoisted directly to the corresponding floor. As a result, no time was lost moving materials through elevators and across the site.

The tailored components for an entire floor were delivered weekly in line with the construction plan. Jan van Meegdenburg was closely involved in the production process, overseeing each stage.

“Everything was prepared digitally in advance at our office. From there, we produced ready-to-use elements and delivered them according to the schedule agreed with our customer,” he sums up. “Our prefabricated solutions made the installation easier, reduced construction costs, and saved an enormous amount of time.”

A record-breaking success

During the first installations, Pipelife’s specialists were on-site to support the BLOM team through the process. Their guidance and continued involvement ensured the construction process went smoothly.

“It really is a different way of working,” acknowledges Lighthart. “Yes, the preparation stage was longer, but we more than made up for it during installation. Thanks to prefabrication, we managed to complete a new floor every week. It was a true team effort.”

After completing the tower structure, the construction process was evaluated with all stakeholders present, from contractor to installer. The conclusion was unanimous: even less experienced installers found the prefabricated systems simple and intuitive to work with.

Prefabrication was seen as key in securing a successful project outcome, setting a new standard for fast-paced, high-quality construction. The newly built Coral tower is expected to be commissioned by the end of October.

As for the feedback to Pipelife?

“We have nothing but praise,” states Lighthart. “Their efforts were invaluable in delivering Coral on time. Looking forward to our next joint project!”

Find out more about

SourcePipelife

EMR Analysis

More information on wienerberger AG: https://www.wienerberger.com/en.html + wienerberger is a leading international provider of innovative, ecological solutions for the entire building envelope, in the fields of new build and renovation, as well as infrastructure in water and energy management.

With more than 20,000 employees worldwide, wienerberger’s solutions enable energy-efficient, healthy, climate-friendly, and affordable living. wienerberger is the world’s largest producer of bricks and the market leader in clay roof tiles in Europe as well as concrete pavers in Eastern Europe. In pipe systems (ceramic and plastic pipes), the company is one of the leading suppliers in Europe and a leading supplier of facade products in North America.

At the beginning of 2024, wienerberger successfully completed the acquisition of Terreal, becoming the leading European provider of innovative all-in roofing and solar solutions, as well as solutions for the entire building envelope in Europe and North America.

With its more than 200 production sites, wienerberger generated revenues of approx. € 4.5 billion and an operating EBITDA of € 760 million in 2024.

wienerberger AG is a public company on the Vienna Stock Exchange. There is no single, main shareholder, as all shares are free float shares. The majority of shares are held by institutional investors, with less than 15% owned by private investors.

wienerberger’s brands are: wienerberger (Clay Blocks, Facing Bricks and Clay Toof Tiles), Pipelife (Plastic Pipes for transporting energy, water and data) Steinzeug-Keramo (Solutions for Sewer Systems, Pipes for open and sealed designs), Semmelrock (Concrete pavements in Central and Eastern Europe) and General Shale (Facing Bricks in the USA and Canada).

More information on Heimo Scheuch (Chairman of the Managing Board and Chief Executive Officer, wienerberger AG): See the full profile on EMR Executive Services

More information on Pipelife by wienerberger: https://www.pipelife.com + Pipelife is a leading supplier of piping system solutions for infrastructure, buildings and agriculture. Based in 24 countries, we provide communities around the world with safe, healthy and carefree living for current and future generations.

Pipelife was founded in 1989, as a joint venture of Solvay (Belgium) and Wienerberger (Austria). Since 2012, Pipelife is fully owned by Wienerberger, with our headquarters based in Vienna, Austria. We are actively present in 24 countries with 2,979 employees. In 2024, 674,661 km of our pipes have been installed.

More information on Harald Schwarzmayr (Chief Executive Officer, Pipelife, wienerberger AG + Chief Operating Officer, wienerberger AG Europe West, wienerberger AG): See the full profile on EMR Executive Services

More information on Jan van Meegdenburg (Prefab Manager, Pipelife Netherlands, Pipelife, wienerberger AG): See the full profile on EMR Executive Services

More information on Spider by Pipelife by wienerberger: https://www.pipelife.com/buildings/electrical-installations/prefabricated-electrical-systems.html + The Spider is our prefabricated electrical solution, designed to streamline installation and ensure error-free wiring. Delivered fully preassembled, you can simply roll out and install on-site — no handling of heavy pipe coils, cutting, branching, stripping or wire pulling necessary.

Suitable for both new builds and renovation projects, the Spider is compatible with various structures — including wooden frames, metal studs, prefab concrete, and brick. All connections are pre-assembled under strict factory conditions and thoroughly safety tested for your peace of mind.

More information on SPOT Amsterdam: https://spotamsterdam.nl/ + SPOT: living in the heart of Amsterdam’s renewal.

SPOT Amsterdam opens the door to a unique living experience in a vibrant neighborhood, right in the heart of Amsterdam. Located on the green Hondsrugpark, SPOT will soon feature seven energy-efficient residential buildings with a mix of stylish City Apartments, spacious Grand Apartments, and luxurious Penthouses. Here, you’ll live surrounded by everything you need: inviting restaurants and cafes, various shops, sports facilities, and even a school and daycare center. SPOT also features modern offices, allowing you to combine living and working. With the perfect balance between urban dynamism and green living, SPOT is the perfect place to come home.

More information on BLOM Elektrotechniek: https://www.blomelektrotechniek.nl/ + Blom Elektrotechniek BV is located in Warmenhuizen and Beverwijk. Our family business has been in business for over 50 years. We currently have approximately 150 permanent employees. We work on technically interesting and exciting projects, including new construction, conversions, and renovations.

Our clients want certainty. From the initial concept through to completion, service, and maintenance. They engage us as consultants and co-creators. This also saves time in design and implementation, and increases quality! LEAN thinking and approach are the hallmarks of our approach. No matter how complex or extensive, we can handle any project within our field. We design and supervise with advanced and reliable techniques. For example, we’re also a leader in 3D BIM. And another thing… we’re proud of our remarkably low absenteeism rate. We have a positive work and learning environment. Also check out Blom Opleidingen and Blom Online Academy Soofos. And of course, we’re an accredited training company!

More information on Arnold Blom (Owner and Chief Executive Officer, BLOM Elektrotechniek): https://www.blomelektrotechniek.nl/contact/ + https://www.linkedin.com/in/arnold-blom-1b116b139/

More information on Remco Lighthart (Project Manager, BLOM Elektrotechniek): https://www.blomelektrotechniek.nl/remco-ligthart/ + https://www.linkedin.com/in/remco-ligthart-05021a18a/

EMR Additional Notes:

- Power Utility – Utilities:

- Also known as an electric utility or power company, is a company or entity responsible for generating, transmitting, and distributing electricity to consumers. They often operate in regulated markets and are major providers of energy in most countries.

- BIM (Building Information Modeling):

- BIM refers to a process that spans the entire life-cycle of a building, from its initial design to its demolition.

- It is an intelligent 3D model-based process that usually requires a BIM execution plan for owners, architects, engineers, and contractors to more efficiently plan, design, construct, and manage buildings and infrastructure.

- BIM is a digital representation of physical and functional characteristics of a facility. A BIM is a shared knowledge resource for information about a facility forming a reliable basis for decisions during its life-cycle; defined as existing from earliest conception to demolition. BIM is used for creating and managing data during the design, construction, and operations process. BIM integrates multi-disciplinary data to create detailed digital representations that are managed in an open cloud platform for real-time collaboration. The ability to share relevant data with all of the project’s participants makes BIM an excellent collaboration tool in general.

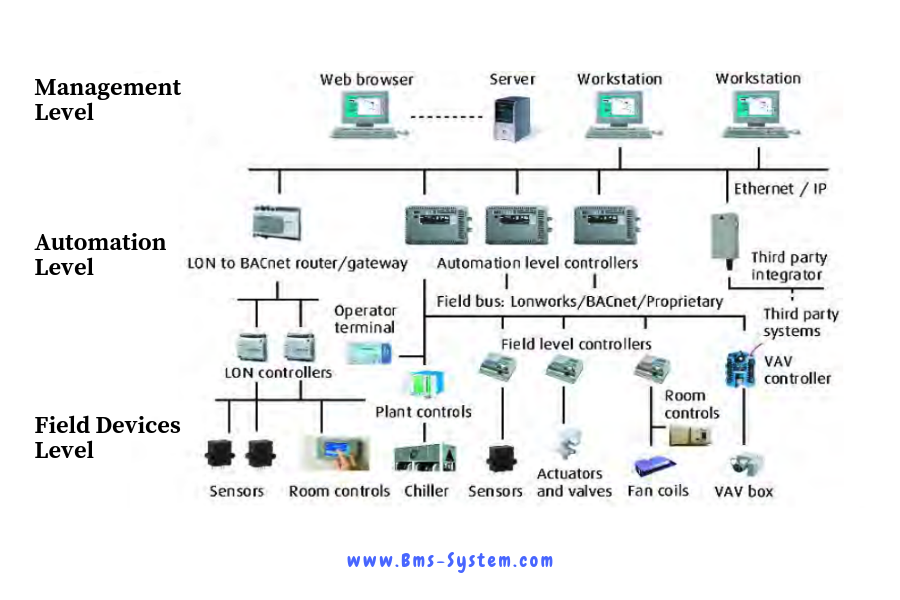

- BMS (Building Management Systems):

- Building Management or Automation Systems (BMS or BAS) is a broad system that controls and monitors various building functions.

- BMS are combinations of hardware and software that allow for automated control and monitoring of various building systems such as HVAC systems, lighting, access control and other security systems.

- The hardware and software technologies of the BMS were created in the 60’s. Over the years, the BMS IT infrastructure grew organically and added layers of communication protocols, networks, and controls.

- BEM (Building Energy Management System):

- BEM is often a core part of a modern BMS, that focuses exclusively on energy efficiency.

- BEM is a computer-based system that monitors and controls a building’s electrical and mechanical equipment such as lighting, power systems, heating, and ventilation. The BEMS is connected to the building’s service plant and back to a central computer to allow control of on/off times for temperatures, lighting, humidity, etc.

- Cables connect various series of hubs around the building to a central supervisory computer where building operators can control the building. The building energy management software provides control functions, monitoring, and alarms, and allows the operators to enhance building performance. They can efficiently control 84 percent of your building energy consumption.

- => BIM vs. BEM: BIM is a comprehensive, digital modeling and management process for a building’s entire lifecycle. BEM is a system used during the operational phase specifically to monitor and manage a building’s energy consumption and systems to optimize energy performance. BEM is often a key part of the data used in the operational phase of a BIM project.