Honeywell – Honeywell announces filing of form 10 registration statement and upcoming investor day for planned spin-off of Solstice Advanced Materials

- Solstice Advanced Materials will be a pure-play specialty materials company with leading market positions in refrigerants, semiconductor materials, protective fibers, and healthcare packaging solutions

- Filing marks latest milestone as Solstice prepares to become a standalone public company in the fourth quarter of 2025

- Investor Day scheduled for October 8, 2025, in New York City to provide details on Solstice’s business and value creation strategy

CHARLOTTE, N.C., Aug. 21, 2025 /PRNewswire/ — Honeywell (NASDAQ: HON) today announced the filing of its Form 10 registration statement (“Form 10”) with the U.S. Securities and Exchange Commission (“SEC”) for the planned spin-off of Solstice Advanced Materials (“Solstice”). A copy of the Form 10 is available on the SEC website as well as Honeywell’s Investor Relations website.

“This Form 10 filing marks a pivotal step toward the exciting launch of Solstice Advanced Materials as an innovation-led independent company. With Honeywell’s legacy and a purpose-built management team and Board, Solstice is set up for a very bright future,” said Vimal Kapur, Chairman and CEO of Honeywell. “Today’s announcement also demonstrates the consistent progress our team is making toward forming three industry-leading public companies, each uniquely equipped to deliver exceptional customer service, expand opportunities for employees, and unlock shareholder value.”

“Today is a milestone that underscores Solstice’s tremendous momentum as we prepare for our next chapter as a public company,” said David Sewell, President and CEO of the Solstice Advanced Materials business. “The end markets we serve are underpinned by attractive secular growth trends, including regulatory-driven sustainability transitions in cooling and building solutions and the proliferation of artificial intelligence and advanced computing. We look to harness these trends by focusing on customer-partnered innovation and high-return opportunities that strengthen our ability to serve customers, establish new differentiated technology platforms, and enhance our resilience through market cycles. We believe Solstice is well-positioned to unleash growth and unlock substantial long-term value for all stakeholders.”

Highlights from the Form 10

The Form 10 introduces Solstice Advanced Materials, which will be:

- A differentiated advanced materials company that is a leading global provider of refrigerants, semiconductor materials, protective fibers, and healthcare packaging, and generated net sales of $3.8 billion, net income of $0.6 billion1, and adjusted EBITDA2 of $1.1 billion1 in 2024;

- Home to well-known brands, such as Solstice®, Genetron®, Aclar®, Spectra®, Fluka®, and Hydranal®, supported by more than 3,900 employees, 21 manufacturing sites, and four R&D sites; and

- Built to create value for stakeholders by partnering with its customers to capitalize on secular growth trends, making targeted investments into innovation and manufacturing capabilities while maintaining a strong balance sheet, and supporting resilient, industry-leading margins through disciplined use of the Solstice Accelerator operating model.

Solstice Advanced Materials will be organized into two operating segments:

- Refrigerants & Applied Solutions (“RAS”): A leading portfolio of low-global-warming-potential (LGWP) refrigerants, blowing agents, solvents, and aerosol materials, distributed and sold through the Solstice®, Genetron®, and Aclar® brands. This segment generated net sales of $2.7 billion in 2024.

- Electronic & Specialty Materials (“ESM”): A leading portfolio of electronic materials, industrial-grade fibers, laboratory life sciences materials, and specialty chemicals, distributed and sold through the Spectra®, Fluka®, and Hydranal® brands. This segment generated net sales of $1.0 billion in 2024.

Solstice Investor Day

Solstice will host an Investor Day during the afternoon of October 8, 2025, in New York City. Over the course of the event, members of the leadership team will provide details on Solstice’s specialized businesses, future growth prospects, and compelling financial model.

The event will also highlight Solstice’s differentiated product portfolio, including Solstice® low-global-warming-potential refrigerants, Spectra® high-performance fibers, Hydranal® analytical reagents, and Aclar® pharmaceutical packaging solutions.

A live webcast of the event, along with related presentation materials, will be available through the Investor Relations section of Honeywell’s website at www.honeywell.com/investor. A replay will remain accessible for 30 days following the event.

Additional Information

Solstice’s common stock is expected to be listed on the Nasdaq Stock Exchange under the ticker symbol “SOLS.” The planned spin-off of Solstice is expected to be tax-free for Honeywell shareholders for U.S. federal income tax purposes (other than any cash that Honeywell shareowners receive in lieu of fractional shares). Investors, media, and the general public are invited to learn more about the pending spin-off at Honeywell’s Investor Relations website. Future updates to the Form 10 will be filed with the SEC and may be viewed at www.sec.gov filings under Solstice Advanced Materials’ current name, Solstice Advanced Materials, LLC. The Form 10 filed on August 21, 2025, is subject to change and will be made final prior to the effective date.

Additional Information

Honeywell uses our Investor Relations website, www.honeywell.com/investor, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our Investor Relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media.

Forward-looking Statements

We describe many of the trends and other factors that drive our business and future results in this release. Such discussions contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are those that address activities, events, or developments that management intends, expects, projects, believes, or anticipates will or may occur in the future. They are based on management’s assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments, and other relevant factors, many of which are difficult to predict and outside of our control. They are not guarantees of future performance, and actual results, developments and business decisions may differ significantly from those envisaged by our forward-looking statements. We do not undertake to update or revise any of our forward-looking statements, except as required by applicable securities law. Our forward-looking statements are also subject to material risks and uncertainties, including ongoing macroeconomic and geopolitical risks, such as changes in or application of trade and tax laws and policies, including the impacts of tariffs and other trade barriers and restrictions, lower GDP growth or recession in the U.S. or globally, supply chain disruptions, capital markets volatility, inflation, and certain regional conflicts, that can affect our performance in both the near- and long-term. In addition, no assurance can be given that any plan, initiative, projection, goal, commitment, expectation, or prospect set forth in this release can or will be achieved. Some of the important factors that could cause Honeywell’s actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) the ability of Honeywell to effect the spin-off transaction described above and to meet the conditions related thereto; (ii) the possibility that the spin-off transaction will not be completed within the anticipated time period or at all; (iii) the possibility that the spin-off transaction will not achieve its intended benefits; (iv) the impact of the spin-off transaction on Honeywell’s businesses and the risk that the spin-off transaction may be more difficult, time-consuming or costly than expected, including the impact on Honeywell’s resources, systems, procedures and controls, diversion of management’s attention and the impact and possible disruption of existing relationships with regulators, customers, suppliers, employees and other business counterparties; (v) the possibility of disruption, including disputes, litigation or unanticipated costs, in connection with the spin-off transaction; (vi) the uncertainty of the expected financial performance of Honeywell or Solstice following completion of the spin-off transaction; (vii) negative effects of the announcement or pendency of the spin-off transaction on the market price of Honeywell’s securities and/or on the financial performance of Honeywell; (viii) the ability to achieve anticipated capital structures in connection with the spin-off transaction, including the future availability of credit and factors that may affect such availability; (ix) the ability to achieve anticipated credit ratings in connection with the spin-off transaction; (x) the ability to achieve anticipated tax treatments in connection with the spin-off transaction and future, if any, divestitures, mergers, acquisitions and other portfolio changes and the impact of changes in relevant tax and other laws; and (xi) the failure to realize expected benefits and effectively manage and achieve anticipated synergies and operational efficiencies in connection with the spin-off transaction and completed and future, if any, divestitures, mergers, acquisitions, and other portfolio management, productivity and infrastructure actions. These forward-looking statements should be considered in light of the information included in this release, our Form 10-K and other filings with the SEC. Any forward-looking plans described herein are not final and may be modified or abandoned at any time.

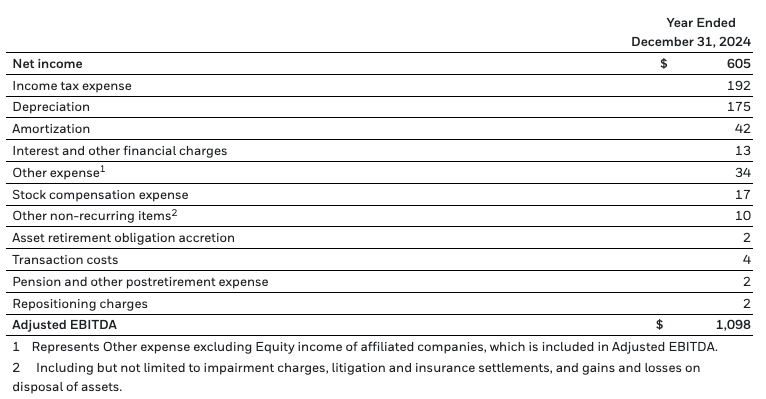

This release contains Adjusted EBITDA, a financial measure presented on a non-GAAP basis.

Management believes that, when considered together with reported amounts, this measure is useful to investors and management in understanding Solstice Advanced Materials’ ongoing operations and in the analysis of ongoing operating trends. This measure should be considered in addition to, and not as a replacement for, the most comparable GAAP measure. Refer to the Appendix attached to this release for a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP measure.

Appendix

Non-GAAP Financial Measure

The following information provides the definition and reconciliation of the non-GAAP financial measure presented in this press release to which this reconciliation is attached to the most directly comparable financial measure calculated and presented in accordance with generally accepted accounting principles (GAAP).

Management believes that, when considered together with reported amounts, this measure is useful to investors and management in understanding Solstice Advanced Materials’ ongoing operations and in the analysis of ongoing operating trends. This measure should be considered in addition to, and not as a replacement for, the most comparable GAAP measure. Other companies may calculate this non-GAAP measure differently, limiting the usefulness of this measure for comparative purposes.

Management does not consider this non-GAAP measure in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitations of this non-GAAP financial measure is that it excludes significant expenses and income that are required by GAAP to be recognized in the combined financial statements. In addition, it is subject to inherent limitations as it reflects the exercise of judgments by management about which expenses and income are excluded or included in determining this non-GAAP financial measure. Investors are urged to review the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measures and not to rely on any single financial measure to evaluate Solstice Advanced Materials’ business.

Solstice Advanced Materials

Reconciliation of Net Income to Adjusted EBITDA

(Unaudited)

(Dollars in millions)

We define adjusted EBITDA as net income excluding income taxes, depreciation, amortization, interest and other financial charges, other expense, stock compensation expense, pension and other postretirement income (expense), transaction-related costs, repositioning charges, asset retirement obligation accretion, and certain other items that are otherwise of an unusual or non-recurring nature (including but not limited to impairment charges, litigation and insurance settlements, and gains and losses on disposal of assets). We believe this measure is useful to investors as it provides greater transparency with respect to supplemental information used by management in its financial and operational decision making, as well as understanding ongoing operating trends.

1 Net income and adjusted EBITDA in 2024 exclude standalone and public company costs of $0.2 billion and $0.1 billion, respectively.

2 See additional information at the end of this release regarding this non-GAAP financial measure.

SourceHoneywell

EMR Analysis

More information on Honeywell: See the full profile on EMR Executive Services

More information on Vimal Kapur (Chairman and Chief Executive Officer, Honeywell): See the full profile on EMR Executive Services

More information on Michal Stepniak (Senior Vice President and Chief Financial Officer, Honeywell): See the full profile on EMR Executive Services

More information on Honeywell Advanced Materials by Honeywell Energy and Sustainability Solutions Segment (ESS) by Honeywell (to be named Solstice Advanced Materials on completion of the spin): https://advancedmaterials.honeywell.com/us/en + Honeywell Advanced Materials plays a crucial role in advancing industries worldwide through diverse applications, revolutionary inventions, and pioneering technologies. Our science and technology experts create solutions that help solve our customers’ needs today and in the future. Our solutions span across industries, including Retail, Pharma, Buildings, Manufacturing and Hi-tech. In each of these verticals we bring deep materials and engineering knowledge, which leads to our customers achieving reduction in energy consumption, cutting down their carbon emissions and improving their operational efficiencies.

Solstice Advanced Materials will be a publicly traded, sustainability-focused, specialty chemicals and materials pure play. With nearly $4 billion in revenue last year, Solstice Advanced Materials will offer leading technologies with premier brands, including the Solstice® hydrofluoroolefin technology.

In addition to its headquarters in Morris Plains, New Jersey, Solstice Advanced Materials will have teams located in Charlotte, Houston, Dublin, Shanghai, Tokyo, Bangalore, Bucharest and Mexico City. The independent company will maintain its global manufacturing footprint along with additional R&D sites. With a large-scale domestic manufacturing base, Solstice Advanced Materials will be positioned to benefit from a compelling investment profile and a more flexible and optimized capital allocation strategy.

Solstice Advanced Materials, to become a standalone public company in the fourth quarter of 2025, will be a pure-play specialty materials company with leading market positions in refrigerants, semiconductor materials, protective fibers, and healthcare packaging solutions.

Solstice Advanced Materials, which will be:

- A differentiated advanced materials company that is a leading global provider of refrigerants, semiconductor materials, protective fibers, and healthcare packaging, and generated net sales of $3.8 billion, net income of $0.6 billion, and adjusted EBITDA of $1.1 billion in 2024;

- Home to well-known brands, such as Solstice®, Genetron®, Aclar®, Spectra®, Fluka®, and Hydranal®, supported by more than 3,900 employees, 21 manufacturing sites, and four R&D sites; and

- Built to create value for stakeholders by partnering with its customers to capitalize on secular growth trends, making targeted investments into innovation and manufacturing capabilities while maintaining a strong balance sheet, and supporting resilient, industry-leading margins through disciplined use of the Solstice Accelerator operating model.

Solstice Advanced Materials will be organized into two operating segments:

- Refrigerants & Applied Solutions (“RAS”): A leading portfolio of low-global-warming-potential (LGWP) refrigerants, blowing agents, solvents, and aerosol materials, distributed and sold through the Solstice®, Genetron®, and Aclar® brands. This segment generated net sales of $2.7 billion in 2024.

- Electronic & Specialty Materials (“ESM”): A leading portfolio of electronic materials, industrial-grade fibers, laboratory life sciences materials, and specialty chemicals, distributed and sold through the Spectra®, Fluka®, and Hydranal® brands. This segment generated net sales of $1.0 billion in 2024.

Solstice’s common stock is expected to be listed on the Nasdaq Stock Exchange under the ticker symbol “SOLS.”

More information on Dr. Rajeev Gautam (Non-Executive Chairman of the Board of Directors, Solstice Advanced Materials effective on completion of the spin of Honeywell Advanced Materials by Honeywell Energy and Sustainability Solutions Segment (ESS) by Honeywell): See the full profile on EMR Executive Services

More information on David Sewell (President and Chief Executive Officer, Solstice Advanced Materials Business effective on completion of the spin of Honeywell Advanced Materials by Honeywell Energy and Sustainability Solutions Segment (ESS) by Honeywell): See the full profile on EMR Executive Services

More information on SEC (U.S. Securities and Exchange Commission) Regulations: https://www.sec.gov/ + The mission of the SEC is to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. The SEC strives to promote a market environment that is worthy of the public’s trust. The SEC’s regulation of the securities markets facilitates capital formation, which helps entrepreneurs start businesses and companies grow.

EMR Additional Notes:

- Form 10-K:

- A Form 10-K is a comprehensive annual report required by the U.S. Securities and Exchange Commission (SEC) that provides a detailed overview of a publicly traded company’s financial performance and business condition. It is a mandatory filing for companies with publicly traded securities and is distinct from the glossy, more promotional “annual report to shareholders” that a company may also issue.

EMR Additional Financial Notes:

- Major financial KPI’s since 2017 are available on EMR Executive Services under “Financial Results” and comparison with peers under “Market Positioning”

- Companies’ full profile on EMR Executive Services are based on their official press releases, quarterly financial reports, annual reports and other official documents.

- All members of the Executive Committee and of the Board have their full profile on EMR Executive Services

- The 2024 Form 10-K Report of Solstice Advanced Materials be viewed here: https://investor.honeywell.com/static-files/09a8120d-3282-4aad-a63a-280adcb7b6fe

- The 2025 Q2 Earnings Release Presentation can be viewed here: https://investor.honeywell.com/static-files/73f4b895-b09d-4d88-baff-eb7fea1fa125

- The 2025 Q2 Earnings Release Financials can be viewed here: https://www.honeywell.com/content/dam/honeywellbt/en/documents/downloads/press-releases/hon-corp-2q25-financial-release-tables.pdf

- The 2024 Annual Report can be viewed here: https://investor.honeywell.com/static-files/d3fc3f84-56dc-4ba9-bfdc-58ddbab4376f

- The 2024 Q4 Earnings Release can be viewed here: https://investor.honeywell.com/static-files/5b22adeb-4a93-408c-8f77-e1fd0f5ed625

- The 2024 Q4 Earnings and 2025 Outlook Presentation can be viewed here: https://investor.honeywell.com/static-files/f42f398f-d78a-4755-8224-a52c01c0efe5

- The 2023 Annual Report can be viewed here: https://investor.honeywell.com/static-files/98bf174f-edb5-4dfe-8f24-1455590edbcb

- The Honeywell Portfolio Update from October 8, 2024 Presentation can be viewed here: https://investor.honeywell.com/static-files/810b2e87-0899-49ad-8259-388091f0011a

- The Fourth Quarter 2023 Earnings and 2024 Outlook Presentation can be viewed here: https://investor.honeywell.com/static-files/58184017-50e2-433c-9cc8-22a48a5f065c

- The 2022 Q4 Earnings Release can be viewed here: https://investor.honeywell.com/static-files/4826acb7-689b-4dfe-b8cb-d8be7c6a4b52

- The 2022 Annual Report can be viewed here: https://investor.honeywell.com/static-files/bcad5ff0-8046-496c-aea3-af0024981dcc

- The 2021 Annual Report can be viewed here: https://investor.honeywell.com/static-files/0f826f8b-fb20-4adc-a1e0-a841597316f1